Berkshire Hathaway 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion (Continued)

Insurance—Underwriting (Continued)

GEICO (Continued)

increased in the two to four percent range versus 2009. Claim severities in 2010 for physical damage coverages rose in the two

to four percent range compared to 2009, while injury severities increased in the three to seven percent range. Incurred losses

from catastrophe events in 2010 were $109 million compared to $83 million in 2009. Underwriting expenses incurred in 2010

increased 2.6% versus 2009 and primarily reflected increased advertising costs.

General Re

Through General Re, we conduct a reinsurance business offering property and casualty and life and health coverages to

clients worldwide. We write property and casualty reinsurance in North America on a direct basis through General Reinsurance

Corporation and internationally through Germany-based General Reinsurance AG and other wholly-owned affiliates. Property

and casualty reinsurance is also written through brokers with respect to Faraday in London. Life and health reinsurance is

written in North America through General Re Life Corporation and internationally through General Reinsurance AG. General

Re strives to generate underwriting profits in essentially all of its product lines. Our management does not evaluate underwriting

performance based upon market share and our underwriters are instructed to reject inadequately priced risks. General Re’s

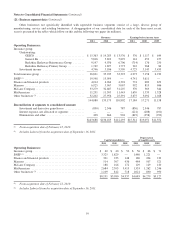

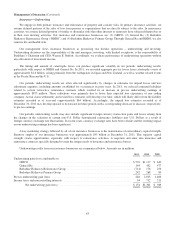

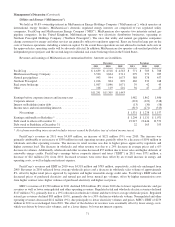

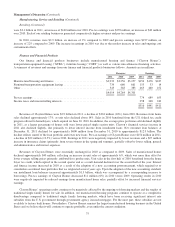

underwriting results are summarized in the following table. Amounts are in millions.

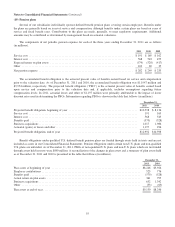

Premiums written Premiums earned Pre-tax underwriting gain

2011 2010 2009 2011 2010 2009 2011 2010 2009

Property/casualty ................. $2,910 $2,923 $3,091 $2,941 $2,979 $3,203 $ 7 $289 $300

Life/health ...................... 2,909 2,709 2,630 2,875 2,714 2,626 137 163 177

$5,819 $5,632 $5,721 $5,816 $5,693 $5,829 $144 $452 $477

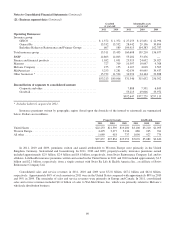

Property/casualty

Premiums written in 2011 were relatively unchanged from 2010, while premiums earned in 2011 declined $38 million

(1.3%) from 2010. Excluding the effects of foreign currency exchange rate changes, premiums written and earned in 2011

declined $94 million (3.2%) and $132 million (4.4%), respectively, compared with 2010. The declines in premiums written and

earned reflected lower premium volume in North American property treaty business, substantially offset by higher premiums in

European property lines and broker market motor liability. Price competition in most property and casualty lines persists. Our

underwriters continue to exercise discipline by not accepting offers to write business where prices are deemed inadequate. We

remain prepared to increase premium volumes should market conditions improve.

Underwriting gains were $7 million in 2011 and consisted of a net underwriting gain of $127 million from casualty/workers’

compensation business substantially offset by a net underwriting loss of $120 million from property business. Our property

results in 2011 included $861 million of catastrophe losses for events occurring in 2011. The catastrophe losses in 2011 were

primarily attributable to the earthquakes in New Zealand and Japan, as well as to weather related loss events in the United States,

Europe and Australia. The timing and magnitude of catastrophe and large individual losses has produced and is expected to

continue to produce significant volatility in periodic underwriting results. The underwriting gain in 2011 of $127 million from

casualty/workers’ compensation business reflected overall reductions in prior years’ loss reserve estimates, due generally to lower

than expected claim reports from cedants, which was partially offset by $111 million of recurring accretion of discounted

workers’ compensation liabilities and amortization of deferred charges on retroactive reinsurance contracts written many years

ago.

Premiums written in 2010 declined $168 million (5.4%) from 2009, while premiums earned in 2010 declined $224 million

(7.0%) from 2009. Excluding the effects of foreign currency exchange rate changes, premiums written and earned in 2010

declined $202 million (6.5%) and $169 million (5.3%), respectively, compared with 2009. Premiums written and earned in 2010

reflected decreased volume due to price competition in most property and casualty lines.

Underwriting gains were $289 million in 2010 and consisted of gains of $236 million from property business and $53

million from casualty/workers’ compensation business. The property results in 2010 included $339 million of catastrophe losses

incurred primarily from the Chilean and New Zealand earthquakes and weather related losses in Europe, Australia and

New England, offset by reductions in liability estimates for prior years’ losses. The underwriting gains of $53 million from

casualty/workers’ compensation business reflected overall reductions in estimated prior years’ loss reserves, offset in part by

$125 million of accretion of discounted workers’ compensation liabilities and amortization of deferred charges.

65