Berkshire Hathaway 2011 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

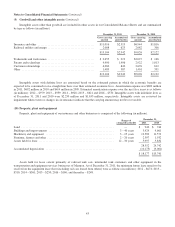

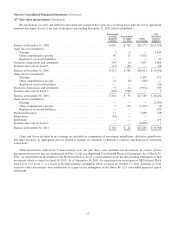

(10) Property, plant and equipment (Continued)

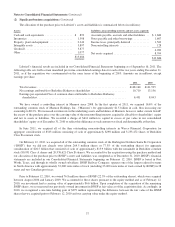

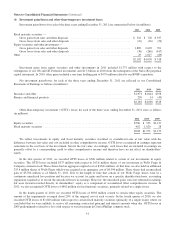

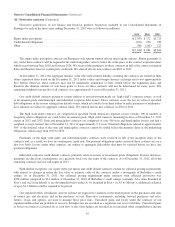

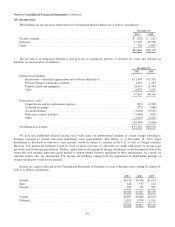

Property, plant and equipment of our railroad, utilities and energy businesses is comprised of the following (in millions).

Ranges of

estimated useful life

December 31,

2011 2010

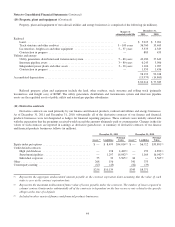

Railroad:

Land ............................................................. — $ 5,925 $ 5,901

Track structure and other roadway ..................................... 5–100years 36,760 35,463

Locomotives, freight cars and other equipment ........................... 5–37years 5,533 4,329

Construction in progress ............................................. — 885 453

Utilities and energy:

Utility generation, distribution and transmission system .................... 5–80years 40,180 37,643

Interstate pipeline assets ............................................. 3–80years 6,245 5,906

Independent power plants and other assets ............................... 3–30years 1,106 1,097

Construction in progress ............................................. — 1,559 1,456

98,193 92,248

Accumulated depreciation ................................................ (15,979) (14,863)

$ 82,214 $ 77,385

Railroad property, plant and equipment include the land, other roadway, track structure and rolling stock (primarily

locomotives and freight cars) of BNSF. The utility generation, distribution and transmission system and interstate pipeline

assets are the regulated assets of public utility and natural gas pipeline subsidiaries.

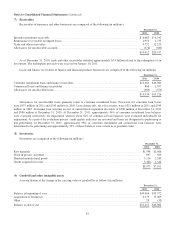

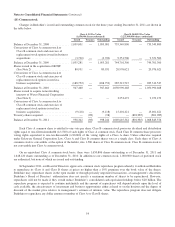

(11) Derivative contracts

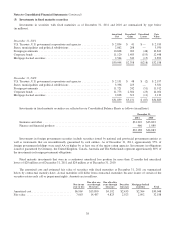

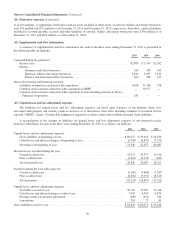

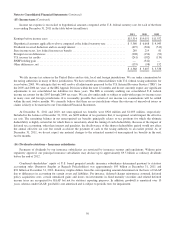

Derivative contracts are used primarily by our finance and financial products, railroad and utilities and energy businesses.

As of December 31, 2011 and December 31, 2010, substantially all of the derivative contracts of our finance and financial

products businesses were not designated as hedges for financial reporting purposes. These contracts were initially entered into

with the expectation that the premiums received would exceed the amounts ultimately paid to counterparties. Changes in the fair

values of such contracts are reported in earnings as derivative gains/losses. A summary of derivative contracts of our finance

and financial products businesses follows (in millions).

December 31, 2011 December 31, 2010

Assets (3) Liabilities

Notional

Value Assets (3) Liabilities

Notional

Value

Equity index put options ................................. $ — $ 8,499 $34,014(1) $ — $6,712 $33,891(1)

Credit default contracts:

High yield indexes ................................. — 198 4,489(2) — 159 4,893(2)

States/municipalities ................................ — 1,297 16,042(2) — 1,164 16,042(2)

Individual corporate ................................ 55 32 3,565(2) 84 — 3,565(2)

Other ................................................ 268 156 341 375

Counterparty netting .................................... (67) (43) (82) (39)

$256 $10,139 $343 $8,371

(1) Represents the aggregate undiscounted amount payable at the contract expiration dates assuming that the value of each

index is zero at the contract expiration date.

(2) Represents the maximum undiscounted future value of losses payable under the contracts. The number of losses required to

exhaust contract limits under substantially all of the contracts is dependent on the loss recovery rate related to the specific

obligor at the time of a default.

(3) Included in other assets of finance and financial products businesses.

44