Berkshire Hathaway 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion (Continued)

Insurance—Underwriting (Continued)

Berkshire Hathaway Reinsurance Group (Continued)

In the fourth quarter of 2011, we recorded a pre-tax underwriting loss of $581 million ($642 million for the full year) with

respect to the SRLHA contract. Since the inception of the SRLHA contract, mortality rates have continued to exceed the

assumptions we made at the inception of the contract. During the fourth quarter of 2011, after considerable internal actuarial

analysis, our management concluded that future mortality rates are expected to be greater than our original assumptions. As a

result we increased our estimated liabilities for future policyholder benefits to reflect the new assumptions. The liabilities

established in connection with the SRLHA contract reflect our best estimates for expected mortality, lapse rates, future

premiums on the underlying policies and discount rates. We believe that our revised estimates for policyholder benefits are now

adequate. However, under certain scenarios considered only remotely possible, additional increases in these liabilities and net

underwriting losses of up to $300 million may occur. We do not currently believe significant additional net underwriting losses

under this contract are likely.

The underwriting results of the life and annuity business also include a portfolio of annuity contracts, most of which were

written several years ago. These contracts generated underwriting losses of $118 million, $114 million, and $99 million in 2011,

2010 and 2009, respectively, primarily related to periodic interest that accretes with respect to the related liabilities. At

December 31, 2011, annuity liabilities were approximately $2.1 billion.

Berkshire Hathaway Primary Group

Our primary insurance group consists of a wide variety of independently managed insurance businesses that principally

write liability coverages for commercial accounts. These businesses include: Medical Protective Corporation (“MedPro”) and

Princeton Insurance Company (acquired as of December 30, 2011), providers of professional liability insurance to physicians,

dentists and other healthcare providers; National Indemnity Company’s primary group (“NICO Primary Group”), writers of

commercial motor vehicle and general liability coverages; U.S. Investment Corporation, whose subsidiaries underwrite specialty

insurance coverages; a group of companies referred to internally as “Berkshire Hathaway Homestate Companies,” providers of

standard commercial multi-line insurance; Central States Indemnity Company, a provider of credit and disability insurance to

individuals nationwide through financial institutions; Applied Underwriters, a provider of integrated workers’ compensation

solutions; and BoatU.S., a writer of insurance for owners of boats and small watercraft.

Earned premiums by our primary insurance businesses were approximately $1.7 billion in each of the last three years. In

recent years, premium volume of our primary insurers, in general, has been constrained by soft market conditions. We have the

capacity and desire to write substantially more volume if market conditions improve. Underwriting gains as percentages of

premiums earned were 14% in 2011, 16% in 2010 and 5% in 2009. The underwriting gain in 2011 reflects favorable loss

experience at MedPro and Applied Underwriters, including overall reductions of estimated liabilities for prior years’ losses,

partially offset by increased underwriting losses of the Berkshire Hathaway Homestate Companies. The improvement in

underwriting results in 2010 was primarily due to reductions of MedPro’s estimated prior years’ loss reserves and reduced

underwriting loss ratios of the Berkshire Hathaway Homestate Companies.

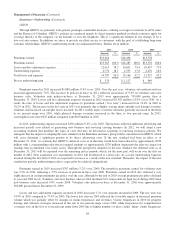

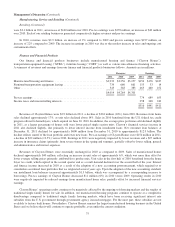

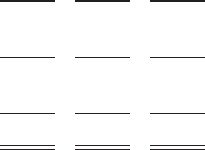

Insurance—Investment Income

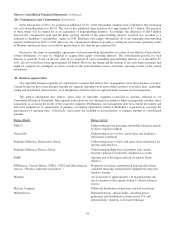

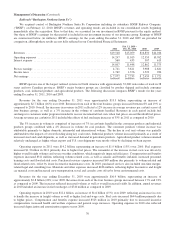

A summary of net investment income of our insurance operations follows. Amounts are in millions.

2011 2010 2009

Investment income before taxes, noncontrolling interests and equity method earnings ............ $4,725 $5,145 $5,459

Income taxes and noncontrolling interests ............................................... 1,170 1,335 1,615

Net investment income before equity method earnings ..................................... 3,555 3,810 3,844

Equity method earnings ............................................................. — 50 427

Net investment income .............................................................. $3,555 $3,860 $4,271

Investment income consists of interest and dividends earned on cash equivalents and investments of our insurance

businesses. Pre-tax investment income in 2011 declined $420 million (8%) compared to 2010. Investment income in 2011 was

negatively impacted by redemptions at the end of 2010 and in 2011 of certain investments we made in 2008 and 2009,

68