Berkshire Hathaway 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

(15) Income taxes (Continued)

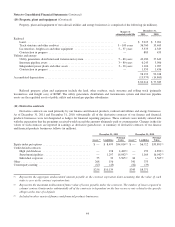

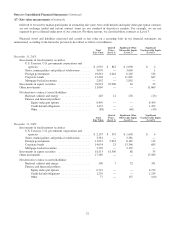

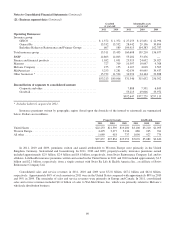

Income tax expense is reconciled to hypothetical amounts computed at the U.S. federal statutory rate for each of the three

years ending December 31, 2011 in the table below (in millions).

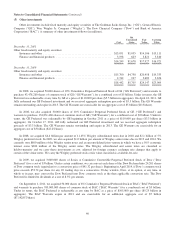

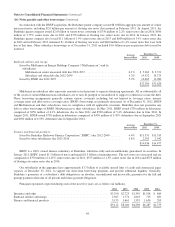

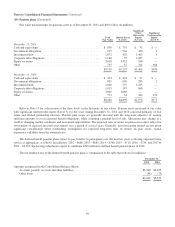

2011 2010 2009

Earnings before income taxes ..................................................... $15,314 $19,051 $11,552

Hypothetical amounts applicable to above computed at the federal statutory rate ............. $ 5,360 $ 6,668 $ 4,043

Dividends received deduction and tax exempt interest .................................. (497) (504) (512)

State income taxes, less federal income tax benefit ..................................... 289 219 81

Foreign tax rate differences ....................................................... (208) (154) (92)

U.S. income tax credits .......................................................... (241) (182) (134)

BNSF holding gain .............................................................. — (342) —

Other differences, net ............................................................ (135) (98) 152

$ 4,568 $ 5,607 $ 3,538

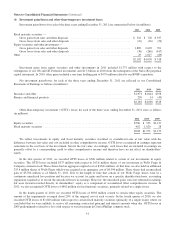

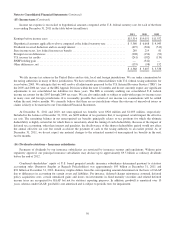

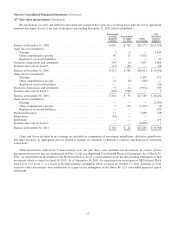

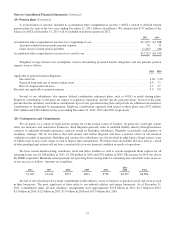

We file income tax returns in the United States and in state, local and foreign jurisdictions. We are under examination by

the taxing authorities in many of these jurisdictions. We have settled tax return liabilities with U.S. federal taxing authorities for

years before 2005. We anticipate that we will resolve all adjustments proposed by the U.S. Internal Revenue Service (“IRS”) for

the 2005 and 2006 tax years at the IRS Appeals Division within the next 12 months and do not currently expect any significant

adjustments to our consolidated tax liabilities for those years. The IRS is currently auditing our consolidated U.S. federal

income tax returns for the 2007 through 2009 tax years. We are also under audit or subject to audit with respect to income taxes

in many state and foreign jurisdictions. It is reasonably possible that certain of our income tax examinations will be settled

within the next twelve months. We currently believe that there are no jurisdictions where the outcome of unresolved issues or

claims is likely to be material to our Consolidated Financial Statements.

At December 31, 2011 and 2010, net unrecognized tax benefits were $928 million and $1,005 million, respectively.

Included in the balance at December 31, 2011, are $698 million of tax positions that, if recognized, would impact the effective

tax rate. The remaining balance in net unrecognized tax benefits principally relates to tax positions for which the ultimate

deductibility is highly certain but for which there is uncertainty about the timing of such deductibility. Because of the impact of

deferred tax accounting, other than interest and penalties, the disallowance of the shorter deductibility period would not affect

the annual effective tax rate but would accelerate the payment of cash to the taxing authority to an earlier period. As of

December 31, 2011, we do not expect any material changes to the estimated amount of unrecognized tax benefits in the next

twelve months.

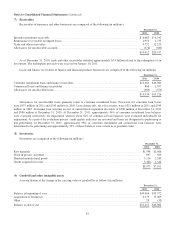

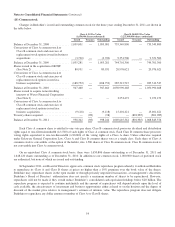

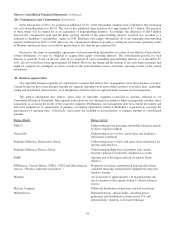

(16) Dividend restrictions – Insurance subsidiaries

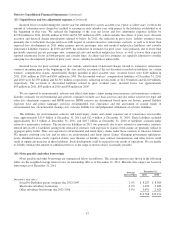

Payments of dividends by our insurance subsidiaries are restricted by insurance statutes and regulations. Without prior

regulatory approval, our principal insurance subsidiaries may declare up to approximately $9.5 billion as ordinary dividends

before the end of 2012.

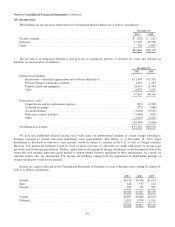

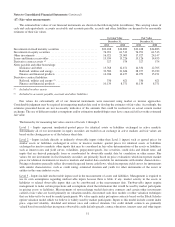

Combined shareholders’ equity of U.S. based property/casualty insurance subsidiaries determined pursuant to statutory

accounting rules (Statutory Surplus as Regards Policyholders) was approximately $95 billion at December 31, 2011 and

$94 billion at December 31, 2010. Statutory surplus differs from the corresponding amount determined on the basis of GAAP

due to differences in accounting for certain assets and liabilities. For instance, deferred charges reinsurance assumed, deferred

policy acquisition costs, certain unrealized gains and losses on investments in fixed maturity securities and related deferred

income taxes are recognized for GAAP but not for statutory reporting purposes. In addition, goodwill is amortized over 10

years, whereas under GAAP, goodwill is not amortized and is subject to periodic tests for impairment.

50