Berkshire Hathaway 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BERKSHIRE HATHAWAY INC.

and Subsidiaries

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

Results of Operations

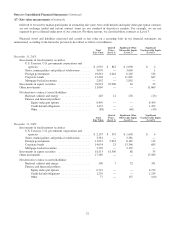

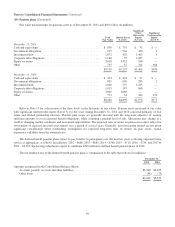

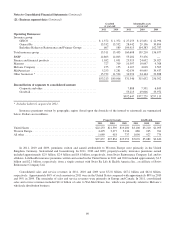

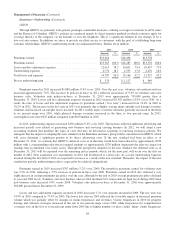

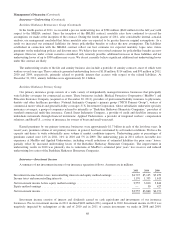

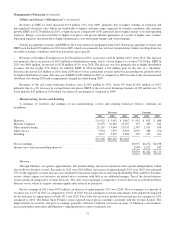

Net earnings attributable to Berkshire for each of the past three years are disaggregated in the table that follows. Amounts

are after deducting income taxes and exclude earnings attributable to noncontrolling interests. Amounts are in millions.

2011 2010 2009

Insurance – underwriting .......................................................... $ 154 $ 1,301 $ 949

Insurance – investment income ..................................................... 3,555 3,860 4,271

Railroad ....................................................................... 2,972 2,235(1) —

Utilities and energy .............................................................. 1,204 1,131 1,071

Manufacturing, service and retailing ................................................. 3,039(2) 2,462 1,113

Finance and financial products ...................................................... 516 441 411

Other .......................................................................... (665) (337) (246)

Investment and derivative gains/losses ............................................... (521) 1,874 486

Net earnings attributable to Berkshire ............................................ $10,254 $12,967 $8,055

(1) Includes earnings of BNSF from February 12.

(2) Includes earnings of Lubrizol from September 16.

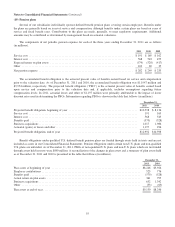

Through our subsidiaries, we engage in a number of diverse business activities. Our operating businesses are managed on

an unusually decentralized basis. There are essentially no centralized or integrated business functions (such as sales, marketing,

purchasing, legal or human resources) and there is minimal involvement by our corporate headquarters in the day-to-day

business activities of the operating businesses. Our senior corporate management team participates in and is ultimately

responsible for significant capital allocation decisions, investment activities and the selection of the Chief Executive to head

each of the operating businesses. It also is responsible for establishing and monitoring Berkshire’s corporate governance efforts,

including, but not limited to, communicating the appropriate “tone at the top” messages to its employees and associates,

monitoring governance efforts, including those at the operating businesses, and participating in the resolution of governance-

related issues as needed. The business segment data (Note 21 to the Consolidated Financial Statements) should be read in

conjunction with this discussion.

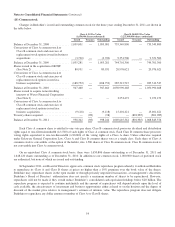

On February 12, 2010, BNSF became a wholly-owned subsidiary when we completed the acquisition of the 77.5% of

BNSF common stock that we did not already own. As a result, beginning at that date, BNSF’s results and net earnings are

included fully in our consolidated results. Prior to February 12, 2010, our share of BNSF’s net earnings determined under the

equity method is reflected in the preceeding table as a component of insurance investment income. We completed the

acquisition of The Lubrizol Corporation on September 16, 2011 and included its results as a component of manufacturing,

service and retailing businesses in the table above.

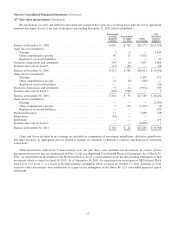

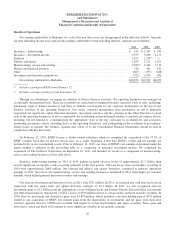

Insurance underwriting earnings in 2011 of $154 million included after-tax losses of approximately $1.7 billion from

several significant catastrophe events occurring primarily in the first quarter. After-tax losses from catastrophes occurring in

2010 were approximately $600 million. Our railroad and utilities and energy businesses continued to generate significant

earnings in 2011. Several of our manufacturing, service and retailing businesses benefitted in 2011 from improved customer

demand, which helped generate increased revenues and earnings.

Our after-tax investment and derivative losses in 2011 were $521 million. In 2011, we incurred non-cash after-tax losses in

connection with our equity index put option derivative contracts of $1.2 billion. In 2011, we also recognized after-tax

investment gains of $1.2 billion from the redemptions of our Goldman Sachs and General Electric Preferred Stock investments

and other-than-temporary impairment (“OTTI”) losses of $590 million related to certain equity and fixed maturity securities. In

2010, after-tax investment and derivatives gains were $1,874 million, which included a one-time holding gain of $979 million

related to our acquisition of BNSF, net realized gains from the dispositions of investments and net gains from derivative

contracts, partially offset by OTTI losses recorded with respect to certain fixed maturity and equity securities. These gains and

losses have caused and likely will continue to cause significant volatility in our periodic earnings.

62