Berkshire Hathaway 2011 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

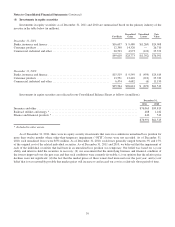

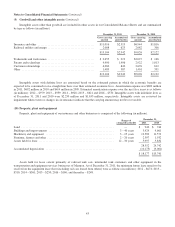

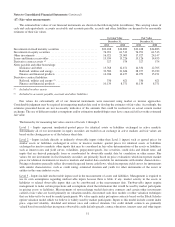

(7) Receivables

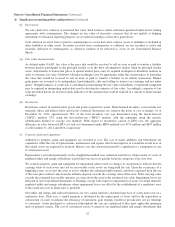

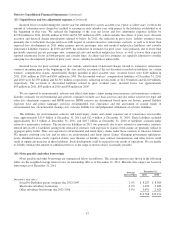

Receivables of insurance and other businesses are comprised of the following (in millions).

December 31,

2011 2010

Insurance premiums receivable ............................................................. $ 6,663 $ 6,342

Reinsurance recoverable on unpaid losses .................................................... 2,953 2,735

Trade and other receivables ................................................................ 9,772 12,223

Allowances for uncollectible accounts ....................................................... (376) (383)

$19,012 $20,917

As of December 31, 2010, trade and other receivables included approximately $3.9 billion related to the redemption of an

investment. The redemption proceeds were received on January 10, 2011.

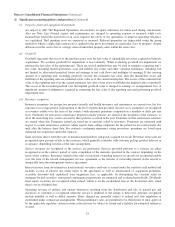

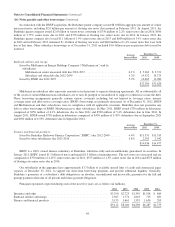

Loans and finance receivables of finance and financial products businesses are comprised of the following (in millions).

December 31,

2011 2010

Consumer installment loans and finance receivables ............................................ $13,463 $14,042

Commercial loans and finance receivables .................................................... 860 1,557

Allowances for uncollectible loans .......................................................... (389) (373)

$13,934 $15,226

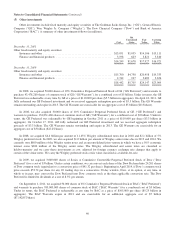

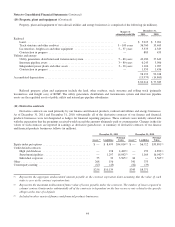

Allowances for uncollectible loans primarily relate to consumer installment loans. Provisions for consumer loan losses

were $337 million in 2011 and $343 million in 2010. Loan charge-offs, net of recoveries, were $321 million in 2011 and $349

million in 2010. Consumer loan amounts are net of unamortized acquisition discounts of $500 million at December 31, 2011

and $580 million at December 31, 2010. At December 31, 2011, approximately 96% of consumer installment loan balances

were evaluated collectively for impairment whereas about 82% of commercial loan balances were evaluated individually for

impairment. As a part of the evaluation process, credit quality indicators are reviewed and loans are designated as performing or

non-performing. At December 31, 2011, approximately 98% of consumer installment and commercial loan balances were

determined to be performing and approximately 92% of those balances were current as to payment status.

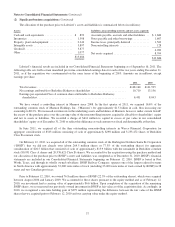

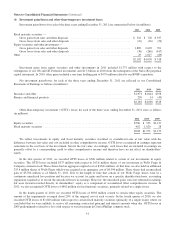

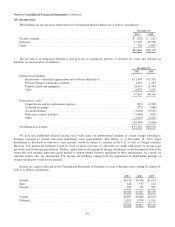

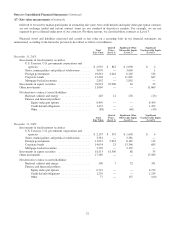

(8) Inventories

Inventories are comprised of the following (in millions).

December 31,

2011 2010

Raw materials ............................................................................ $1,598 $1,066

Work in process and other ................................................................... 897 509

Finished manufactured goods ................................................................ 3,114 2,180

Goods acquired for resale ................................................................... 3,366 3,346

$8,975 $7,101

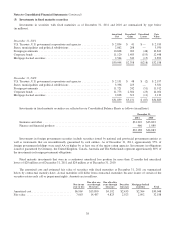

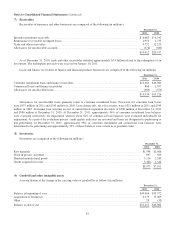

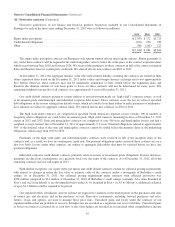

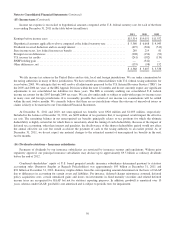

(9) Goodwill and other intangible assets

A reconciliation of the change in the carrying value of goodwill is as follows (in millions).

December 31,

2011 2010

Balance at beginning of year ............................................................... $49,006 $33,972

Acquisition of businesses ................................................................. 4,179 15,069

Other ................................................................................. 28 (35)

Balance at end of year .................................................................... $53,213 $49,006

42