Berkshire Hathaway 2011 Annual Report Download - page 21

Download and view the complete annual report

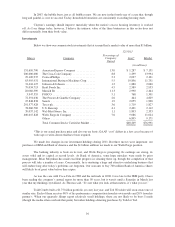

Please find page 21 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Today the world’s gold stock is about 170,000 metric tons. If all of this gold were melded together, it

would form a cube of about 68 feet per side. (Picture it fitting comfortably within a baseball infield.) At

$1,750 per ounce – gold’s price as I write this – its value would be $9.6 trillion. Call this cube pile A.

Let’s now create a pile B costing an equal amount. For that, we could buy all U.S. cropland (400

million acres with output of about $200 billion annually), plus 16 Exxon Mobils (the world’s most

profitable company, one earning more than $40 billion annually). After these purchases, we would

have about $1 trillion left over for walking-around money (no sense feeling strapped after this buying

binge). Can you imagine an investor with $9.6 trillion selecting pile A over pile B?

Beyond the staggering valuation given the existing stock of gold, current prices make today’s annual

production of gold command about $160 billion. Buyers – whether jewelry and industrial users,

frightened individuals, or speculators – must continually absorb this additional supply to merely

maintain an equilibrium at present prices.

A century from now the 400 million acres of farmland will have produced staggering amounts of corn,

wheat, cotton, and other crops – and will continue to produce that valuable bounty, whatever the

currency may be. Exxon Mobil will probably have delivered trillions of dollars in dividends to its

owners and will also hold assets worth many more trillions (and, remember, you get 16 Exxons). The

170,000 tons of gold will be unchanged in size and still incapable of producing anything. You can

fondle the cube, but it will not respond.

Admittedly, when people a century from now are fearful, it’s likely many will still rush to gold. I’m

confident, however, that the $9.6 trillion current valuation of pile A will compound over the century at

a rate far inferior to that achieved by pile B.

• Our first two categories enjoy maximum popularity at peaks of fear: Terror over economic collapse

drives individuals to currency-based assets, most particularly U.S. obligations, and fear of currency

collapse fosters movement to sterile assets such as gold. We heard “cash is king” in late 2008, just

when cash should have been deployed rather than held. Similarly, we heard “cash is trash” in the early

1980s just when fixed-dollar investments were at their most attractive level in memory. On those

occasions, investors who required a supportive crowd paid dearly for that comfort.

My own preference – and you knew this was coming – is our third category: investment in productive

assets, whether businesses, farms, or real estate. Ideally, these assets should have the ability in

inflationary times to deliver output that will retain its purchasing-power value while requiring a

minimum of new capital investment. Farms, real estate, and many businesses such as Coca-Cola, IBM

and our own See’s Candy meet that double-barreled test. Certain other companies – think of our

regulated utilities, for example – fail it because inflation places heavy capital requirements on them. To

earn more, their owners must invest more. Even so, these investments will remain superior to

nonproductive or currency-based assets.

Whether the currency a century from now is based on gold, seashells, shark teeth, or a piece of paper

(as today), people will be willing to exchange a couple of minutes of their daily labor for a Coca-Cola

or some See’s peanut brittle. In the future the U.S. population will move more goods, consume more

food, and require more living space than it does now. People will forever exchange what they produce

for what others produce.

Our country’s businesses will continue to efficiently deliver goods and services wanted by our citizens.

Metaphorically, these commercial “cows” will live for centuries and give ever greater quantities of “milk”

to boot. Their value will be determined not by the medium of exchange but rather by their capacity to

deliver milk. Proceeds from the sale of the milk will compound for the owners of the cows, just as they

did during the 20th century when the Dow increased from 66 to 11,497 (and paid loads of dividends as

well). Berkshire’s goal will be to increase its ownership of first-class businesses. Our first choice will be

to own them in their entirety – but we will also be owners by way of holding sizable amounts of

marketable stocks. I believe that over any extended period of time this category of investing will prove to

be the runaway winner among the three we’ve examined. More important, it will be by far the safest.

19