Berkshire Hathaway 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

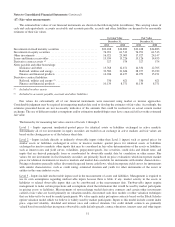

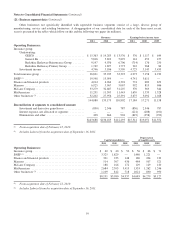

(19) Pension plans (Continued)

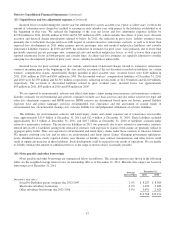

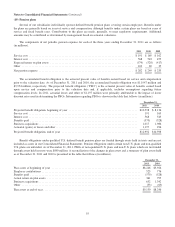

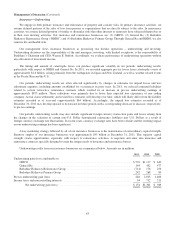

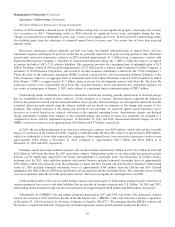

A reconciliation of amounts included in accumulated other comprehensive income (“AOCI”) related to defined benefit

pension plans for each of the two years ending December 31, 2011 follows (in millions). We estimate that $177 million of the

balance in AOCI at December 31, 2011 will be included in pension expense in 2012.

2011 2010

Accumulated other comprehensive income (loss), beginning of year ................................ $(1,395) $(1,368)

Amount included in net periodic pension expense ........................................... 76 53

Gains (losses) current period and other ................................................... (1,202) (80)

Accumulated other comprehensive income (loss), end of year ..................................... $(2,521) $(1,395)

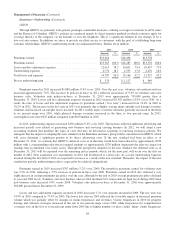

Weighted average interest rate assumptions used in determining projected benefit obligations and net periodic pension

expense were as follows.

2011 2010

Applicable to pension benefit obligations:

Discount rate .............................................................................. 4.6% 5.4%

Expected long-term rate of return on plan assets .................................................. 6.9 7.1

Rate of compensation increase ................................................................ 3.7 3.7

Discount rate applicable to pension expense ......................................................... 5.3 5.8

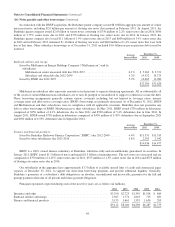

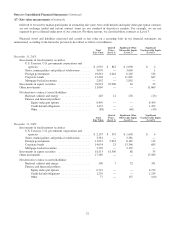

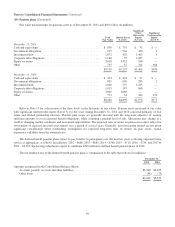

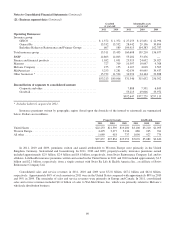

Several of our subsidiaries also sponsor defined contribution retirement plans, such as 401(k) or profit sharing plans.

Employee contributions to the plans are subject to regulatory limitations and the specific plan provisions. Several of the plans

provide that the subsidiary match these contributions up to levels specified in the plans and provide for additional discretionary

contributions as determined by management. Employer contributions expensed with respect to these plans were $572 million,

$567 million and $540 million for the years ending December 31, 2011, 2010 and 2009, respectively.

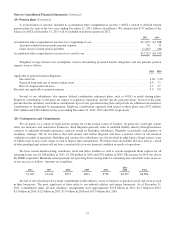

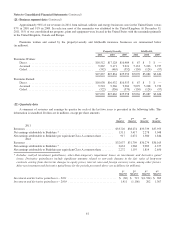

(20) Contingencies and Commitments

We are parties in a variety of legal actions arising out of the normal course of business. In particular, such legal actions

affect our insurance and reinsurance businesses. Such litigation generally seeks to establish liability directly through insurance

contracts or indirectly through reinsurance contracts issued by Berkshire subsidiaries. Plaintiffs occasionally seek punitive or

exemplary damages. We do not believe that such normal and routine litigation will have a material effect on our financial

condition or results of operations. Berkshire and certain of its subsidiaries are also involved in other kinds of legal actions, some

of which assert or may assert claims or seek to impose fines and penalties. We believe that any liability that may arise as a result

of other pending legal actions will not have a material effect on our financial condition or results of operations.

We lease certain manufacturing, warehouse, retail and office facilities as well as certain equipment. Rent expense for all

operating leases was $1,288 million in 2011, $1,204 million in 2010 and $701 million in 2009. The increase in 2010 was due to

the BNSF acquisition. Minimum rental payments for operating leases having initial or remaining non-cancelable terms in excess

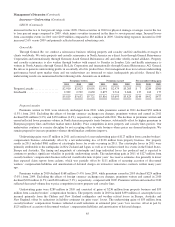

of one year are as follows. Amounts are in millions.

2012 2013 2014 2015 2016

After

2016 Total

$1,169 $1,044 $915 $813 $738 $4,209 $8,888

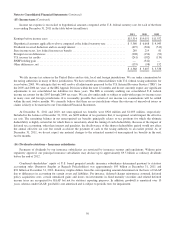

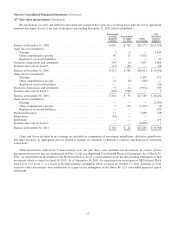

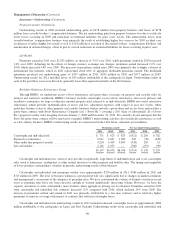

Several of our subsidiaries have made commitments in the ordinary course of business to purchase goods and services used

in their businesses. The most significant of these relate to our railroad, utilities and energy businesses. As of December 31,

2011, commitments under all such subsidiary arrangements were approximately $10.8 billion in 2012, $4.3 billion in 2013,

$3.3 billion in 2014, $3.2 billion in 2015, $1.9 billion in 2016 and $10.3 billion after 2016.

57