Berkshire Hathaway 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

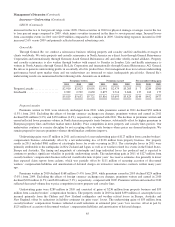

Notes to Consolidated Financial Statements (Continued)

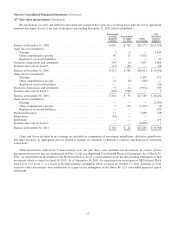

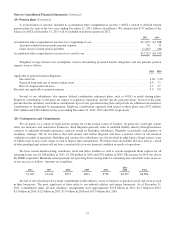

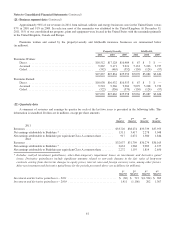

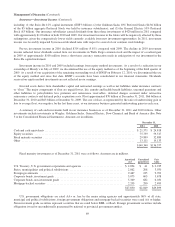

(21) Business segment data (Continued)

Other businesses not specifically identified with reportable business segments consist of a large, diverse group of

manufacturing, service and retailing businesses. A disaggregation of our consolidated data for each of the three most recent

years is presented in the tables which follow on this and the following two pages (in millions).

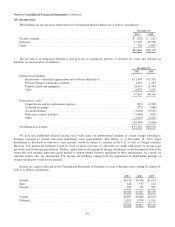

Revenues Earnings before income taxes

2011 2010 2009 2011 2010 2009

Operating Businesses:

Insurance group:

Underwriting:

GEICO ................................... $ 15,363 $ 14,283 $ 13,576 $ 576 $ 1,117 $ 649

General Re ................................ 5,816 5,693 5,829 144 452 477

Berkshire Hathaway Reinsurance Group ........ 9,147 9,076 6,706 (714) 176 250

Berkshire Hathaway Primary Group ............ 1,749 1,697 1,773 242 268 84

Investment income ............................. 4,746 5,186 5,509 4,725 5,145 5,459

Total insurance group ............................... 36,821 35,935 33,393 4,973 7,158 6,919

BNSF (1) .......................................... 19,548 15,059 — 4,741 3,611 —

Finance and financial products ........................ 4,014 4,264 4,301 774 689 653

Marmon .......................................... 6,925 5,967 5,067 992 813 686

McLane Company .................................. 33,279 32,687 31,207 370 369 344

MidAmerican ..................................... 11,291 11,305 11,443 1,659 1,539 1,528

Other businesses (2) ................................. 32,202 27,956 25,391 3,675 3,092 1,028

144,080 133,173 110,802 17,184 17,271 11,158

Reconciliation of segments to consolidated amount:

Investment and derivative gains/losses .............. (830) 2,346 787 (830) 2,346 787

Interest expense, not allocated to segments .......... — — — (221) (208) (101)

Eliminations and other .......................... 438 666 904 (819) (358) (292)

$143,688 $136,185 $112,493 $15,314 $19,051 $11,552

(1) From acquisition date of February 12, 2010.

(2) Includes Lubrizol from the acquisition date of September 16, 2011.

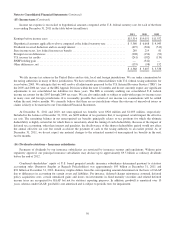

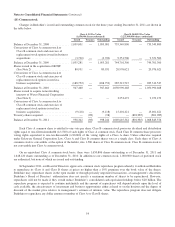

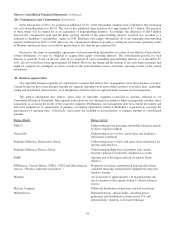

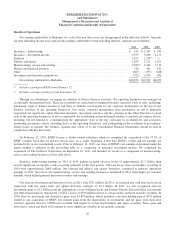

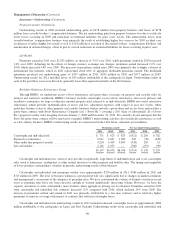

Capital expenditures

Depreciation

of tangible assets

2011 2010 2009 2011 2010 2009

Operating Businesses:

Insurance group ............................................. $ 40 $ 40 $ 50 $ 56 $ 66 $ 71

BNSF (1) ................................................... 3,325 1,829 — 1,480 1,221 —

Finance and financial products ................................. 331 233 148 180 204 219

Marmon ................................................... 514 307 436 484 507 521

McLane Company ........................................... 188 166 172 129 129 120

MidAmerican .............................................. 2,684 2,593 3,413 1,333 1,262 1,246

Other businesses (2) .......................................... 1,109 812 718 1,021 890 950

$8,191 $5,980 $4,937 $4,683 $4,279 $3,127

(1) From acquisition date of February 12, 2010.

(2) Includes Lubrizol from the acquisition date of September 16, 2011.

59