Berkshire Hathaway 2011 Annual Report Download - page 20

Download and view the complete annual report

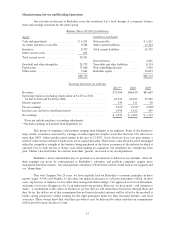

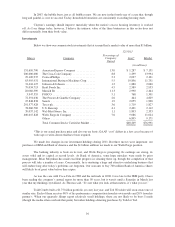

Please find page 20 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.For tax-paying investors like you and me, the picture has been far worse. During the same 47-year

period, continuous rolling of U.S. Treasury bills produced 5.7% annually. That sounds satisfactory. But

if an individual investor paid personal income taxes at a rate averaging 25%, this 5.7% return would

have yielded nothing in the way of real income. This investor’s visible income tax would have stripped

him of 1.4 points of the stated yield, and the invisible inflation tax would have devoured the remaining

4.3 points. It’s noteworthy that the implicit inflation “tax” was more than triple the explicit income tax

that our investor probably thought of as his main burden. “In God We Trust” may be imprinted on our

currency, but the hand that activates our government’s printing press has been all too human.

High interest rates, of course, can compensate purchasers for the inflation risk they face with currency-based

investments – and indeed, rates in the early 1980s did that job nicely. Current rates, however, do not come

close to offsetting the purchasing-power risk that investors assume. Right now bonds should come with a

warning label.

Under today’s conditions, therefore, I do not like currency-based investments. Even so, Berkshire holds

significant amounts of them, primarily of the short-term variety. At Berkshire the need for ample

liquidity occupies center stage and will never be slighted, however inadequate rates may be.

Accommodating this need, we primarily hold U.S. Treasury bills, the only investment that can be

counted on for liquidity under the most chaotic of economic conditions. Our working level for liquidity

is $20 billion; $10 billion is our absolute minimum.

Beyond the requirements that liquidity and regulators impose on us, we will purchase currency-related

securities only if they offer the possibility of unusual gain – either because a particular credit is

mispriced, as can occur in periodic junk-bond debacles, or because rates rise to a level that offers the

possibility of realizing substantial capital gains on high-grade bonds when rates fall. Though we’ve

exploited both opportunities in the past – and may do so again – we are now 180 degrees removed from

such prospects. Today, a wry comment that Wall Streeter Shelby Cullom Davis made long ago seems

apt: “Bonds promoted as offering risk-free returns are now priced to deliver return-free risk.”

• The second major category of investments involves assets that will never produce anything, but that are

purchased in the buyer’s hope that someone else – who also knows that the assets will be forever

unproductive – will pay more for them in the future. Tulips, of all things, briefly became a favorite of

such buyers in the 17th century.

This type of investment requires an expanding pool of buyers, who, in turn, are enticed because they

believe the buying pool will expand still further. Owners are not inspired by what the asset itself can

produce – it will remain lifeless forever – but rather by the belief that others will desire it even more

avidly in the future.

The major asset in this category is gold, currently a huge favorite of investors who fear almost all other

assets, especially paper money (of whose value, as noted, they are right to be fearful). Gold, however,

has two significant shortcomings, being neither of much use nor procreative. True, gold has some

industrial and decorative utility, but the demand for these purposes is both limited and incapable of

soaking up new production. Meanwhile, if you own one ounce of gold for an eternity, you will still

own one ounce at its end.

What motivates most gold purchasers is their belief that the ranks of the fearful will grow. During the

past decade that belief has proved correct. Beyond that, the rising price has on its own generated

additional buying enthusiasm, attracting purchasers who see the rise as validating an investment thesis.

As “bandwagon” investors join any party, they create their own truth – for a while.

Over the past 15 years, both Internet stocks and houses have demonstrated the extraordinary excesses

that can be created by combining an initially sensible thesis with well-publicized rising prices. In these

bubbles, an army of originally skeptical investors succumbed to the “proof” delivered by the market,

and the pool of buyers – for a time – expanded sufficiently to keep the bandwagon rolling. But bubbles

blown large enough inevitably pop. And then the old proverb is confirmed once again: “What the wise

man does in the beginning, the fool does in the end.”

18