BMW 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

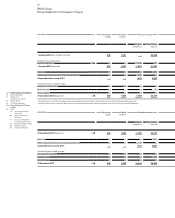

18 COMBINED GROUP AND COMPANY

MANAGEMENT REPORT

18 A Review of the Financial Year

20 General Economic Environment

24 Review of Operations

43 BMW Stock and Capital Market

46 Disclosures relevant for takeovers

and explanatory comments

49 Financial Analysis

49 Internal Management System

51 Earnings Performance

53 Financial Position

56 Net Assets Position

59 Subsequent Events Report

59 Value Added Statement

61 Key Performance Figures

62 Comments on BMW AG

66 Internal Control System and

explanatory comments

67 Risk Management

73 Outlook

currently at a high levels. The credit risk situation is also

expected to remain tense in these countries in 2012.

The consolidation process in the various dealer organi-

sations

will continue in some markets in 2012. As a

consequence, this trend could possibly have a negative

impact on credit risk expense within the industry. Sell-

ing

cars in European countries affected by the debt

crisis is likely to be more difficult than ever.

Outlook for the BMW Group in 2012

The past year was a highly successful one for the BMW

Group. In the Automotive segment we surpassed the

sales volume target of more than 1.6 million units that

we had set ourselves, thus strengthening our position

as the world’s leading premium car manufacturer. The

Financial Services segment recorded dynamic growth

and continued to make a key contribution to the BMW

Group’s performance. The Motorcycles segment also

showed that it is in good shape compared to its com-

petitors.

There are, however, indications that the high pace of

eco-

nomic growth seen in the past year will not continue in

2012. Shadows are also being cast by general concerns

regarding the stability of the financial system and fears

of adverse developments in the sovereign debt crisis.

Under these circumstances, the reliability of forecasts is

somewhat impaired.

Despite these concerns, the situation looks promising

for the BMW Group. We laid the foundation for our

current success with our Strategy Number ONE. We

enter

2012 with a very young, attractive model range.

Global demand for our vehicles remains strong. The

BMW X family and the BMW 1, 5, 6 and 7 Series in par-

ticular

are all enjoying an extremely high degree of

popularity. Building on this solid base and with a clear

strategy in mind, we will add

numerous new and revised

models to our product range

in 2012.

The latest BMW 3 Series Sedan was launched in February

2012. Now in its sixth generation, this much-loved model

is still setting standards in its class. The new BMW 3 Series

won broad international acclaim upon making its world

debut in October 2011. The Sports Sedan is the best-sell-

ing premium model and will provide the sales volume

performance of the BMW Group with additional drive.

The BMW 6 Series Gran Coupé, the first four-door Coupé

in the brand’s history, will appear in June and be fol-

lowed

by the model revision of the BMW 7 Series in July.

In March, MINI is adding a new sixth member to its

family of models, the MINI Roadster, following the

launching of the MINI Coupé in October 2011.

We attach great importance to our strategy of continuing

to achieve a reasonable balance of growth in all regions.

By investing substantial amounts in our international

production network we are building the basis for sus-

tainable profitable growth in the future. In this context,

we are currently expanding local production capacities

in China. Including the new Tiexi* plant, the plan is to

h

ave the capability to produce up to 300,000 vehicles p. a.

at the Shenyang site in future. In the medium to long

term we also plan to produce up to around 350,000 vehi-

cles p. a. at the US Spartanburg plant. Furthermore, ca-

pacities are also being raised in South Africa, India and

Russia. Some € 2 billion are being invested in production

sites in Germany during the years 2011 and 2012.

The BMW Group is a profitable business, built on a

strong financial base. We therefore possess the neces-

sary scope to maintain our strong competitive position,

even in a highly volatile environment, and simultane-

ously shape the future of the BMW Group.

Investing in innovative technologies is the key to achiev-

ing steady growth. Our Efficient Dynamics technology

embodies a ground-breaking strategy and, with it, we

have succeeded in substantially reducing levels of fuel

consumption and emissions across our entire fleet.

It is

helping us maintain our leading position in efforts

to reduce CO2 emissions in the premium segment.

Con-

nected Drive – which aims to connect vehicles with

the surrounding environment – has become the second

major focus of our development activities. These inno-

vations increase road safety levels, offer greater con-

venience and create new options for receiving both in-

formation and entertainment while on the move.

In September 2011 we presented the two concept vehi-

cles BMW i 3 and i8 to the global public and provided

an insight into how mobility will function in the future.

The BMW i 3 is due to come onto the market in 2013 as

the BMW Group’s first series-built electric car for city

use. It will be followed shortly afterwards by the BMW i 8

featuring a plug-in hybrid engine set to combine the

dynamic flair of a sports car with the consumption of a

compact model. One common feature of these two vehi-

cles, apart from the new drive train technologies, is the

extensive use of CFRP. Both of these innovative vehicles

* Joint Venture BMW Brilliance