BMW 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

18 COMBINED GROUP AND COMPANY

MANAGEMENT REPORT

18 A Review of the Financial Year

20 General Economic Environment

24 Review of Operations

43 BMW Stock and Capital Market

46 Disclosures relevant for takeovers

and explanatory comments

49 Financial Analysis

49 Internal Management System

51 Earnings Performance

53 Financial Position

56 Net Assets Position

59 Subsequent Events Report

59 Value Added Statement

61 Key Performance Figures

62 Comments on BMW AG

66 Internal Control System and

explanatory comments

67 Risk Management

73 Outlook

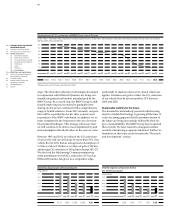

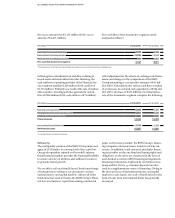

Revenues generated by the BMW Group in the Africa,

Asia and Oceania regions increased by 25.4 %. Strong

eco-

nomic growth in China gave a 37.3 % boost to revenues.

In the Rest of Europe region (i.e. excluding Germany)

and the Americas region revenues grew by 12.8 % and

0.8 % respectively. In Germany, where revenues had

fallen in the previous year, they rose by 14.7 %.

Group cost of sales increased by 9.5 % to € 54,276 million

(2010: € 49,545 million), rising therefore at a slower rate

than revenues. The main factors here were slower in-

creases in manufacturing costs and lower refinancing

costs. Gross profit increased as a result by 33.0 % to

€ 14,545 million, giving a gross profit

margin

of 21.1 %

(2010: 18.1 %).

The gross profit margin recorded by the Automotive

segment was 20.7 % (2010: 17.4 %) and that of the

Motor-

cycles segment was 15.9 % (2010: 16.0 %). The Financial

Services segment’s gross profit margin improved by

3.4 percentage points to 14.3 %.

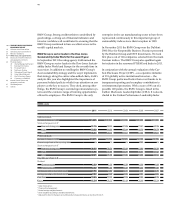

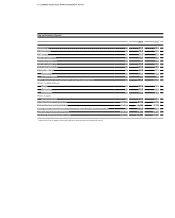

Research and development costs increased by 17.1 % to

€ 3,610 million, in part due to activities related to the

electrification of the future product range. As a percent-

age of revenues, the research and development cost ra-

tio went up by 0.1 percentage point to 5.2 %. Research

and development costs include amortisation of capi-

talised development costs amounting to € 1,209 million

(2010: € 1,260 million). Total research and develop-

ment expenditure amounted to € 3,373 million (2010:

€ 2,773 million). This figure comprises research costs,

non-capitalised development costs, capitalised develop-

ment costs and the systematic amortisation expense

relating to capitalised development costs. The research

and development expenditure ratio for 2011 was 4.9 %

(2010: 4.6 %). The proportion of development costs

recognised as assets in 2011 was 28.8 % (2010: 34.3 %).

Sales costs went up due to increased volumes, while ad-

ministrative costs rose as a result of the higher profit

share paid to employees. Overall, costs were up 11.7 %

compared to the previous year. As a percentage of

revenues, the sales and administrative cost ratio fell by

0.1 percentage points to 9.0 %.

Depreciation and amortisation on property, plant and

equipment and intangible assets recorded in cost of

sales and in sales and administrative costs amounted to

€ 3,646 million (2010: € 3,682 million).

The net expense reported for other operating income

and other operating expenses increased by € 58 million

to € 350 million, mainly as a result of higher allocations

to provisions.

As a result of the positive factors referred to above, the

profit before financial result amounted to € 8,018 million

(2010: € 5,111 million).

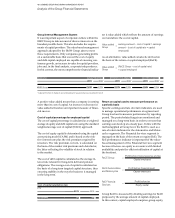

The financial result was a net expense of € 635 million,

which represented a deterioration of € 377 million against

the previous year (2010: net expense of € 258

million).

This development mainly reflected fair value losses in-

curred on commodity derivatives and on stand-alone in-

terest rate derivatives which caused sundry other finan-

cial

result to deteriorate by € 706 million. The result

from investments improved by € 164 million, reducing

the net expense for the year to € 7 million. The previous

year’s net expense of € 171 million was negatively im-

pacted by impairment losses recognised on investments

in affiliated companies. Overall, other financial result

deteriorated by € 542 million to a net expense of € 617

million. The result from equity accounted investments

improved by € 64 million to € 162 million. In addition

to the Group’s share of results from its equity accounted

investments in BMW Brilliance Automotive Ltd., Shen-

yang, and the Cirquent Group, this also includes for

the first time the Group’s share of results from joint

ventures with the SGL Carbon Group, from the two new

DriveNow entities and from the newly founded joint

venture with Peugeot SA. Within the financial result, the

net interest result improved by € 101 million.

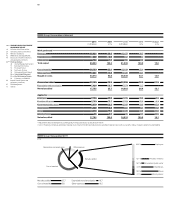

Taking all these factors into consideration, the profit be-

fore tax improved to € 7,383 million (2010: € 4,853 mil-

lion). The pre-tax return on sales was 10.7 % (2010: 8.0 %).

Income tax expense amounted to € 2,476 million (2010:

€ 1,610 million), resulting in an effective tax rate of

33.5 % (2010: 33.2 %).

Overall, the BMW Group recorded a net profit of € 4,907

million (2010: € 3,243 million) for the financial year 2011.

The post-tax return on sales was 7.1 % (2010: 5.4 %).

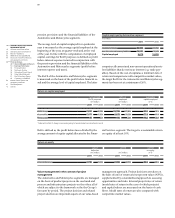

Revenues of the Automotive segment rose by 16.8 %,

while segment profit before tax jumped to

€ 6,823 mil-

lion (2010: € 3,887 million). Sales volume was 14.2 % up

on the previous year.

In the Motorcycles segment, the number of BMW brand

motorcycles handed over to customers increased by

6.4 %. Sales of Husqvarna brand motorcycles fell by 23.0 %

compared to the previous year. Segment revenues rose

by 10.1 %. The segment profit before tax fell by € 24 mil-