BMW 2011 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2011 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

18 COMBINED GROUP AND COMPANY

MANAGEMENT REPORT

18 A Review of the Financial Year

20 General Economic Environment

24 Review of Operations

43 BMW Stock and Capital Market

46 Disclosures relevant for takeovers

and explanatory comments

49 Financial Analysis

49 Internal Management System

51 Earnings Performance

53 Financial Position

56 Net Assets Position

59 Subsequent Events Report

59 Value Added Statement

61 Key Performance Figures

62 Comments on BMW AG

66 Internal Control System and

explanatory comments

67 Risk Management

73 Outlook

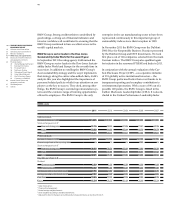

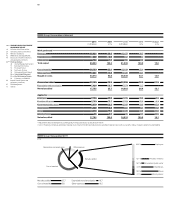

year. The increase in net profit to € 4,907 million in-

creased cash inflows by € 1,664 million. Changes in

working capital reduced cash flows from operating ac-

tivities by € 1,212 million, mainly reflecting the effect

of stocking-up in conjunction with the introduction of

new models. This compared with changes in other

oper-

ating assets and liabilities (up by € 603 million) and

the change in non-cash relevant income and expenses

(up by € 842 million), which resulted in an increase in

the cash inflow from operating activities. The change

in leased assets and in receivables from sales financing

increased cash inflows in 2011 by € 512 million com-

pared to the previous year.

The cash outflow for investing activities amounted to

€ 5,499 million and was therefore € 309 million higher

than in 2010. Capital expenditure on intangible assets

and property, plant and equipment resulted in the cash

outflow for investing activities increasing by € 416 mil-

lion compared to the previous year. Net cash used in

acquiring the ICL Group totalled € 595 million. Cash out-

flows for investments were € 463 million higher than

in the previous year. By contrast, the net change in mar-

ketable securities resulted in a € 1,169 million reduction

in cash outflows for investing activities.

Financing activities generated a cash inflow of € 87

mil-

lion in 2011, € 423 million lower than in the previous year

(2010: cash inflow of € 510 million). Proceeds from the

issue of bonds totalled € 5,899 million (2010: € 4,578 mil-

lion), compared with an outflow of € 5,333 million (2010:

€ 3,406 million) for the repayment of bonds.

The dividend payment in the financial year 2011

amountes to € 852 million (2010: € 197 million). The cash

inflow for other financial liabilities and commercial paper

was € 439 million (2010: cash outflow of € 260 million).

The cash inflow from operating activities exceeded the

cash outflow for investing activities by € 214 million in

the financial year 2011. In the previous year, there was a

shortfall of € 871 million.

The cash flow statement for the Automotive segment

shows that the cash inflow from operating activities ex-

ceeded the cash outflow for investing activities by € 1,352

million (2010: € 2,608 million).

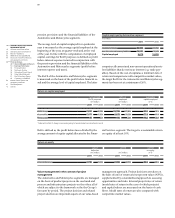

Adjusted for net investments in marketable securities

amounting to € 781 million (2010: € 1,863 million),

mainly in conjunction with strategic liquidity planning,

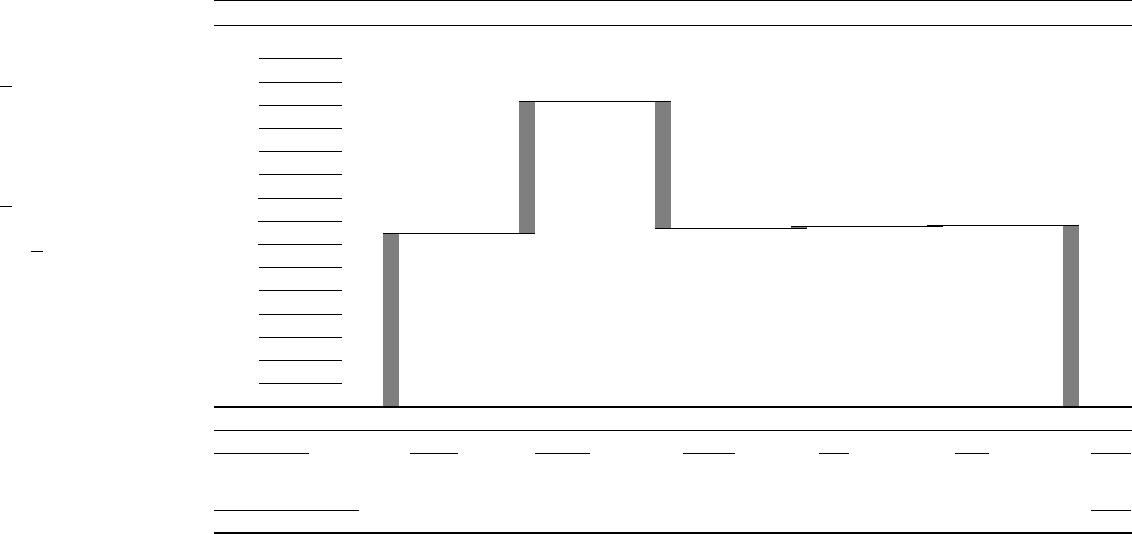

Change in cash and cash equivalents

in € million

15,000

14,000

13,000

12,000

11,000

10,000

9,000

8,000

7,000

6,000

5,000

4,000

3,000

2,000

1,000

Cash and cash Cash inflow Cash outflow Cash inflow Currency trans- Cash and cash

equivalents from operating from investing from financing lation, changes in equivalents

31.12. 2010 activities activities activities Group composition 31.12. 2011

7,432 + 5,713 – 5,499 + 87 + 43 7,776