BMW 2011 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2011 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

140

76 GROUP FINANCIAL STATEMENTS

76 Income Statements

76 Statement of

Comprehensive Income

78 Balance Sheets

80 Cash Flow Statements

82 Group Statement of Changes

in Equity

84 Notes

84 Accounting Principles

and Policies

100 Notes to the Income

Statement

107 Notes to the Statement

of Comprehensive Income

108

Notes to the Balance Sheet

129 Other Disclosures

145 Segment Information

43

Explanatory notes to the cash flow statements

The cash flow statements show how the cash and cash

equivalents of the BMW Group and of the Automotive

and Financial Services segments have changed in the

course of the year as a result of cash inflows and cash

outflows. In accordance with IAS 7 (Statement of Cash

Flows), cash flows are classified into cash flows from

operating, investing and financing activities.

Cash and cash equivalents included in the cash flow

statement comprise cash in hand, cheques, and cash

at bank, to the extent that they are available within

three months from the end of the reporting period and

are subject to an insignificant risk of changes in value.

The cash flows from investing and financing activities

are based on actual payments and receipts. By con-

trast,

the cash flow from operating activities is derived

Other risks

The BMW Group is exposed to raw material price risks.

A description of the management of these risks is pro-

vided in the Combined Group and Company Manage-

ment Report. In order to reduce these risks, derivative

financial instruments are used that serve to hedge pur-

chase price fluctuations agreed with suppliers with re-

spect to the raw material content of purchases. Changes

in the fair values of these derivatives, which generally

track the quoted market prices of the raw material being

hedged, gives rise to market price risks for the Group.

If the market prices of hedged raw materials had been

10 % higher (lower) at 31 December 2011, the Group

As stated there, the BMW Group applies a value-at-

risk approach for internal reporting purposes and to

manage interest rate risks. This is based on a variance-

covariance method, in which the potential future fair

value losses of the interest rate portfolios are compared

across the Group with expected amounts measured on

the basis of a holding period of ten days and a confi-

dence level of 99 %. Aggregation of these results creates

a risk reduction effect due to correlations between the

various portfolios.

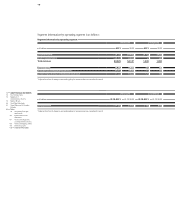

In the following table the potential volume of fair value

fluctuations – measured on the basis of the value-at-risk

approach – are compared with the expected value for

the interest rate relevant positions of the BMW Group

for the three principal currencies:

indirectly from the net profit for the year. Under this

method, changes in assets and liabilities relating to op-

erating activities are adjusted for currency translation

effects and changes in the composition of the Group.

The changes in balance sheet positions shown in the

cash flow statement do not therefore agree directly with

the amounts shown in the Group and segment balance

sheets.

Cash inflows and outflows relating to operating leases,

where the BMW Group is lessor, are required by

IAS 7.14 to be presented within cash flows from operat-

ing activities. In previous financial statements, they

were presented within cash flows from investing activi-

ties. The change in presentation in the BMW Group’s

Cash Flow Statements has been made with effect from

the end of the financial year 2011. Prior year figures

have been adjusted in accordance with IAS 8.42. Cash

profit before tax would have been € 95 million higher

(€ 95 million lower) and accumulated other equity relat-

ing to cash flow hedges would have been € 190 million

higher (€ 190 million lower).

A further exposure relates to the residual value risk on

vehicles returned to the Group at the end of lease con-

tracts. The risks from financial instruments used in this

context were not material to the Group in the past and / or

at the end of the reporting period. A description of the

management of this risk is provided in the Combined

Group and Company Management Report. Information

regarding the residual value risk from operating leases is

provided in the section on accounting policies in note 6.

in € million 31. 12. 2011 31. 12. 2010

Euro 38 11

US Dollar 24 27

British Pound 3 4