BMW 2011 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2011 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

Purchasing and Supplier Network developed further

Throughout 2011 we continued the process of globalis-

ing

our supplier network. Alongside the issue of

secur-

ing supplies, we also focused on parts quality. Having

organisational structures in place that effectively bundle

responsibility for purchasing, logistics and parts quality

enables us to successfully secure supplies for produc-

tion with greater efficiency, even when working at full

capacity. Tight networking with our suppliers is seen as

a key issue, particularly regarding access to innova-

tions.

With this in mind, in autumn 2011 we created the

Supplier Innovation Award to honour outstanding

in-

novation in our vehicles. The award is intended to em-

phasise

the fact that innovative strength is a key factor

in the continued success of the BMW Group.

Numerous model start-ups during the reporting year

2011 again saw a large number of model start-ups.

We continued to internationalise our supply chain,

particularly with the new BMW 6 Series Coupé, the

ActiveHybrid 5, the M5 and the 1 Series M Coupé. In

this endeavour we were again successful in improving

our cost base and the quality of supplies. An important

step in the direction of electromobility and BMW i was

taken with the production start of the BMW ActiveE

test fleet.

Making use of international procurement markets

Our purchasing activities in Asia, and particularly in

China, have been expanded prior to the opening of the

new production plant in Tiexi*, China. To this end we

set up our own organisational unit in China with re-

sponsibility for purchasing, logistics and quality. Simul-

taneously we broadened our purchasing activities for

future vehicle projects in Europe and the NAFTA region.

In doing so, we always give particular consideration to

local partners present in the various production markets.

This approach is seen as an important way of hedging

currency risk. Multi-currency ordering enables us to pay

for the various elements in the value-added chain in the

relevant foreign currencies.

* Joint Venture BMW Brilliance

Productivity and technological edge in manufacturing

Production processes at the BMW Landshut plant were

further optimised in 2011 and value streams designed

to achieve even greater efficiency. In recognition of the

improvements achieved, the Landshut plant was pre-

sented with the Lean Production Award 2011 for the best

value-added chain.

PURCHASING

Production capacities for CFRP components at the Leip-

zig and Landshut plants were additionally expanded in

preparation for the vehicle projects relating to the BMW i

sub-brand. We also raised production capacities at the

BMW Leipzig plant for plastic outer skin components.

With both of these moves we are creating integrated

production structures that deliver high levels of added

value for the sites involved.

Sustainability in the value-added chains

Adherence to the BMW Group’s high ecological and

social standards was again a key criterion in selecting

suppliers in 2011. The main focus was on monitoring

the production locations of our suppliers worldwide.

The high standards that we apply were recognised again

in 2011 by inclusion in the Dow Jones Sustainability

Index, in which the BMW Group is one of the top three

in the Supply Chain category.

18 COMBINED GROUP AND COMPANY

MANAGEMENT REPORT

18 A Review of the Financial Year

20 General Economic Environment

24 Review of Operations

24 Automotive segment

29 Motorcycles segment

31 Financial Services segment

33 Research and development

36 Purchasing

37 Sales

38 Workforce

40 Sustainability

43 BMW Stock and Capital Market

46 Disclosures relevant for takeovers

and explanatory comments

49 Financial Analysis

66 Internal Control System and

explanatory comments

67 Risk Management

73 Outlook

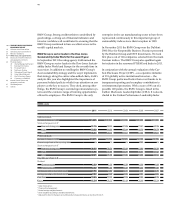

Regional mix of BMW Group purchase volumes 2011

in %, basis: production material

Germany 51

Central and Eastern Europe

11

Rest of Western Europe 18 Asia / Australia 4

NAFTA 13 Africa 3

Germany

Central and Eastern Europe

Rest of Western Europe

NAFTA

Asia / Australia Africa