BMW 2011 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2011 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

tinued to be pursued in line with plan in 2011. The

bank’s expansion will provide greater flexibility in

terms of liquidity management and equity allocation.

BMW Leasing GmbH was successfully merged with

BMW Bank GmbH in August 2011.

Business expanded in new markets

The Financial Services operations set up in China in the

previous year made good progress during the year

under report.

Business also developed well in India in

the first full

year of operations. Moreover, we also con-

tinued our strategy of regional expansion in 2011 and in

August a subsidiary was established for financial services

business in Poland.

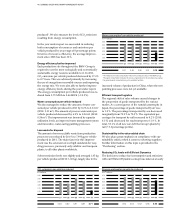

Fleet business strengthened by acquisition

The BMW Group operates its international multi-brand

fleet business under the brand name “Alphabet”. In

September, the European Competition Commission

approved the acquisition of the ICL Group by the BMW

Group. As a result of this move we now have operations

in 15 countries and are meanwhile one of the top five

fleet service providers on the European market. As a

result of the acquisition, the portfolio of fleet business

financing contracts rose sharply by 128.8 % to 474,717

contracts (thereof 252,870 contracts of

the

ICL Group,

excluded the ICL Group: + 6.9 %). The expansion of fleet

management business is in keeping with the BMW

Group’s Strategy Number ONE, namely to be the world’s

leading provider of premium products and premium

services in the field of individual mobility.

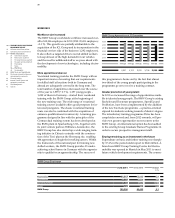

Multi-brand financing well up on previous year

Multi-brand financing business was expanded signifi-

cantly once again in 2011, with new business increasing

by 13.8 % to 139,791 contracts. A portfolio of 370,999

contracts (+ 7.8 %) was in place at 31 December 2011.

Dealer financing expanded

The total volume of dealer financing contracts at the end

of the period under report amounted to € 11,417 mil-

lion, 12.4 % more than one year earlier.

Growth in customer deposit business

Customer deposit business represents an important ele-

ment of the BMW Group’s refinancing strategy. The

volume of customer deposits held at 31 December 2011

totalled € 12,039 million, an increase of 12.6 % compared

to the end of the previous year. This development was

boosted by the attractive deposit terms offered by BMW

Bank in Germany. At 31 December 2011, a total of

24,388

securities custodian accounts were being managed,

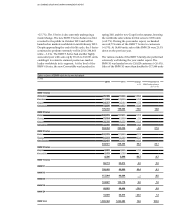

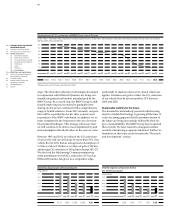

The strong growth of new business had a positive

im-

pact on the overall size of the contract portfolio with

retail customers, increasing it to a total of 3,311,809

contracts (+ 12.8 %) at 31 December 2011. This figure

includes 252,870 contracts of the ICL Group. All regions

reported growth. The portfolios of the Europe / Middle

East region (+ 43.7 %) and of the Asia / Pacific region

(+ 10.4 %) expanded significantly compared to the pre-

vious year. The increase in Europe was primarily

at-

tributable to the acquisition of the ICL Group. The

contract portfolios for the Americas region and the EU-

Bank region climbed by 3.9 % and 2.8 % respectively.

Top spot for quality of service confirmed

The BMW Group’s Financial Services segment again won

numerous awards in 2011. In the annual survey on

quality of service carried out by the well-known market

research institute J. D. Power and Associates, the BMW

Group’s financial services operations in the USA achieved

top spot for the eighth time in succession in the category

“Dealer Financing Satisfaction Study

SM

”. In Canada, the

segment took first place amongst manufacturer-

related

financial service providers in the two categories “Retail

Customer Credit Business” and “Retail Customer Lease

Business”. All of these awards are testimony to the

segment’s rigorous focus on providing customers with

the

best possible service.

BMW Bank on track towards becoming a

Europe-wide bank

The strategy of turning BMW Bank Germany into a

credit institution with operations across Europe con-

18 COMBINED GROUP AND COMPANY

MANAGEMENT REPORT

18 A Review of the Financial Year

20 General Economic Environment

24 Review of Operations

24 Automotive segment

29 Motorcycles segment

31 Financial Services segment

33 Research and development

36 Purchasing

37 Sales

38 Workforce

40 Sustainability

43 BMW Stock and Capital Market

46 Disclosures relevant for takeovers

and explanatory comments

49 Financial Analysis

66 Internal Control System and

explanatory comments

67 Risk Management

73 Outlook

Contract portfolio retail customer financing of

BMW Group Financial Services 2011

as a percentage by region

Americas 31.8 Europe / Middle East / Africa 27.7

EU-Bank 30.9 Asia / Pacific 9.6

EU-Bank

Americas

Asia / Pacific

Europe / Middle

East / Africa