BMW 2011 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2011 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

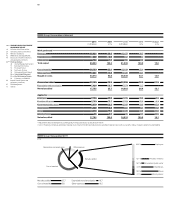

18 COMBINED GROUP AND COMPANY

MANAGEMENT REPORT

18 A Review of the Financial Year

20 General Economic Environment

24 Review of Operations

43 BMW Stock and Capital Market

46 Disclosures relevant for takeovers

and explanatory comments

49 Financial Analysis

49 Internal Management System

51 Earnings Performance

53 Financial Position

56 Net Assets Position

59 Subsequent Events Report

59 Value Added Statement

61 Key Performance Figures

62 Comments on BMW AG

66 Internal Control System and

explanatory comments

67 Risk Management

73 Outlook

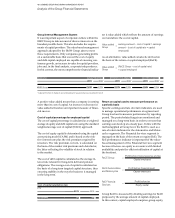

pension provisions and the financial liabilities of the

Automotive and Motorcycles segments.

The average level of capital employed for a particular

year is measured as the average capital employed at the

beginning of the year, at quarter-ends and at the end

of the year. In line with the computation of employed

capital, earnings for RoCE purposes is defined as profit

before interest expense incurred in conjunction with

the pension provision and the financial liabilities of the

Automotive and Motorcycles segments (profit before

interest expense and taxes).

The RoCE of the Automotive and Motorcycles segments

is measured on the basis of the profit before financial re-

sult and the average level of capital employed. The latter

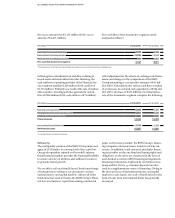

RoE is defined as the profit before taxes divided by the

average amount of equity capital allocated to the Finan-

Value management in the context of project

management

The Automotive and Motorcycles segments are managed

on the basis of product projects on the one hand and

process and infrastructure projects on the other, all of

which are subject to the framework set by the Group’s

forecasts by period. The project decision and related

project selection are important aspects of our value-based

cial Services segment. The target is a sustainable return

on equity of at least 18 %.

management approach. Project decisions are taken on

the basis of rates of return and net present values (NPVs),

supplemented by a standardised approach to assessing

opportunities and risks. Internal project rates of return

(model rates of return in the case of vehicle projects)

and capital values are measured on the basis of cash

flows.

Model rates of return are also compared with

competitive market values.

comprises all current and non-current operational assets

less liabilities that do not incur interest (e. g. trade pay-

ables). Based on the cost of capital as a minimum rate of

return and comparisons with competitive market values,

the target RoCE for the Automotive and Motorcycles seg-

ments has been set at a minimum of 26 %.

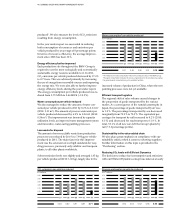

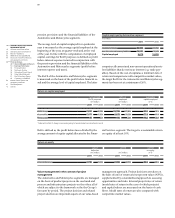

Capital employed by Automotive segment

in € million

2011 2010

Operational assets 29,323 27,787

less: Non-interest-bearing liabilities 19,651 16,948

Capital employed 9,672 10,839

Return on equity

Profit Equity Return

before tax on equity

in € million in € million in %

2011 2010 2011 2010 2011 2010

Financial Services 1,790 1,214 6,084 4,654 29.4 26.1

Return on capital employed

Earnings for Capital Return on

RoCE purposes employed capital employed

in € million in € million in %

2011 2010* 2011 2010* 2011 2010*

BMW Group 7,637 5,220 29,788 27,381 25.6 19.1

Automobiles 7,477 4,355 9,672 10,839 77.3 40.2

Motorcycles 45 71 442 394 10.2 18.0

* Adjusted for effect of change in accounting policy for leased products as described in note 8