BMW 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49 COMBINED GROUP AND COMPANY MANAGEMENT REPORT

Analysis of the Group Financial Statements

Group Internal Management System

It is an important aspect of corporate culture within the

BMW Group to take account of diverse interests on the

broadest possible basis. This also includes the

require-

ments of capital providers. The value-based management

approach adopted by the BMW Group aims to meet

those requirements. Only companies generating profits

on a sustainable basis that exceed the cost of equity

and debt capital employed are capable of ensuring

con-

tinuous growth, an increase in value for capital providers,

jobs and, in the final analysis, corporate independence.

In this context, the most comprehensive financial indica-

A positive value added means that a company is earning

more than its cost of capital. An increase or decrease in

value added is therefore an important measure of finan-

cial success.

Cost of capital percentage for employed capital

The cost of capital percentage is calculated as a weighted

average of equity and debt capital costs using the standard

weighted average cost of capital (WACC) approach.

The cost of equity capital is determined using the capital

asset pricing model (CAPM) and is based on the

risk-

free interest rate plus the risk premium required by

investors. The risk premium, in turn, is calculated on

the basis of the market risk premium and a beta factor,

the latter reflecting the volatility of stock in relation

to the market.

The cost of debt capital is calculated as the average in-

terest rate relevant for long-term debt and pension

obliga tions. The average cost of capital is calculated on

the basis of a long-term targeted capital structure, thus

ensuring stability in the way the business is managed

in the long term.

tor is value added which reflects the amount of earnings

over and above the cost of capital.

Value added = earnings amount – cost of capital = earnings

Group amount – (cost of capital rate × capital

employed)

As an alternative, value added can also be derived on

the basis of the return on capital employed (RoCE).

Value added = (RoCE Group – cost of capital rate)

Group × capital employed

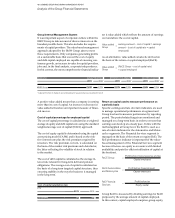

Return on capital used to measure performance on

a periodic basis

Specific earnings and rate of return indicators are used

to manage operational performance at segment and

Group level and to measure performance by reporting

period. The period-related targets are monitored and

managed on a long-term basis in order to ensure that

earnings can develop at a steady pace. In line with the

method applied at Group level, the RoCE is used as a

rate of return indicator for the Automotive and

Motor-

cycles segments. The Financial Services segment is

managed on the basis of the return on equity (RoE). The

RoE performance indicator is important for the

value-

based management of the Financial Services segment

because it focuses on equity as a resource with limited

availability and puts the efficient utilisation of capital at

the forefront.

Profit before interest expense and tax

RoCE Group = Capital employed

RoCE Automobiles Profit before financial result

and Motorcycles = Capital employed

RoE Financial Profit before tax

Services = Equity capital

Group RoCE is measured by dividing earnings for RoCE

purposes by the average amount of capital employed.

In this context, capital employed comprises group equity,

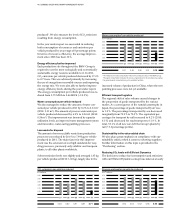

Cost of capital rate (before tax)

in %

2011 2010

BMW Group 12 12

in € million Earnings amount Cost of capital (EC + DC) Value added Group

2011 2010* 2011 2010* 2011 2010*

BMW Group 7,637 5,220 3,575 3,286 4,062 1,934

* Adjusted for effect of change in accounting policy for leased products as described in note 8