BMW 2011 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2011 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

18 COMBINED GROUP AND COMPANY

MANAGEMENT REPORT

18 A Review of the Financial Year

20 General Economic Environment

24 Review of Operations

43 BMW Stock and Capital Market

46 Disclosures relevant for takeovers

and explanatory comments

49 Financial Analysis

49 Internal Management System

51 Earnings Performance

53 Financial Position

56 Net Assets Position

59 Subsequent Events Report

59 Value Added Statement

61 Key Performance Figures

62 Comments on BMW AG

66 Internal Control System and

explanatory comments

67 Risk Management

73 Outlook

East, served to keep the price of crude oil high (between

US dollar 95 and US dollar 105), despite the deteriorating

economic environment. Metal prices fell by about 25 %

in the second half of 2011 compared to the highs regis-

tered

in the second quarter of 2011, but still remained

high when seen in a long-term comparison.

Car markets in 2011

Primarily due to strong demand on emerging markets,

the number of passenger cars and light commercial

vehicles sold worldwide rose from 72.5 million in 2010

to 75.0 million in 2011 (+ 3.4 %). The Chinese car mar-

ket grew by 3.5 % from 17.0 million to 17.6 million units,

while the US market expanded to 12.8 million units

(+ 10.0 %).

The picture in the European Union was inconsistent,

partly reflecting the fact that national stimulus pro-

grammes

expired at different times within the region.

Overall, demand for cars in Europe fell by 3.0 % to 13.0

million units. In Germany, demand grew by 7.0 % to

3.1 million units. By contrast, decreases were registered

in all of the other major markets, namely in Great

Britain (– 5.0 %), France (– 6.0 %), Italy (– 10.0 %) and

Spain (– 16.0 %).

The Japanese car market contracted by 16.0 % to 4.1 mil-

lion units, reflecting the severe impact of production

interruptions in the wake of the natural catastrophe.

Major emerging car markets continued to grow, although

much more slowly than in the past. Demand in India

rose by 7.0 %, setting a new record of 2.9 million units.

The Russian car market expanded by 30.0 % to 2.4 million

units. Brazil’s car market climbed to a total of 3.4 mil-

lion units (+ 3.0 %).

Motorcycle markets in 2011

International motorcycle markets in the 500 cc plus

class continued to be weak in 2011, contracting world-

wide by 3.9 %. The European market shrank overall by

6.9 %, although Germany (+ 3.2 %) and France (+ 3.7 %)

managed to buck the general trend. By contrast, the

motorcycle markets in Spain (– 24.3 %), Great Britain

(– 13.5 %) and Italy (– 12.3 %) all recorded double-digit

decreases. The 500 cc plus segment in the USA also

posted a slight increase on the previous year (+ 1.4 %).

The Japanese market, however, contracted by 6.9 %.

The financial services market in 2011

With economic figures still strong at the beginning of

2011, rising inflation was the main source of concern.

In the final months of the year, however, this was over-

shadowed by uncertainties relating to sovereign debt

levels in both Europe and the USA.

The European Central Bank (ECB) raised interest rates

during the first half of 2011, in the hope of containing

inflation within the euro region. However, during the

final quarter of the year, the sovereign debt crisis caused

the ECB to drop its reference interest rate by a total of

50 basis points, back to the level of the recessionary

year 2009. Other measures taken to stabilise the situation

were the purchase of state bonds issued by crisis-af-

fected countries in southern Europe.

The US Reserve Bank also pursued expansionary mone-

tary policies during the period under report. The re-

serve ratio for commercial banks was reduced in China

for the first time in three years.

High debt levels in a number of euro countries and

gloomier economic prospects caused the rating agencies

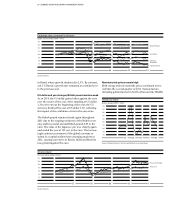

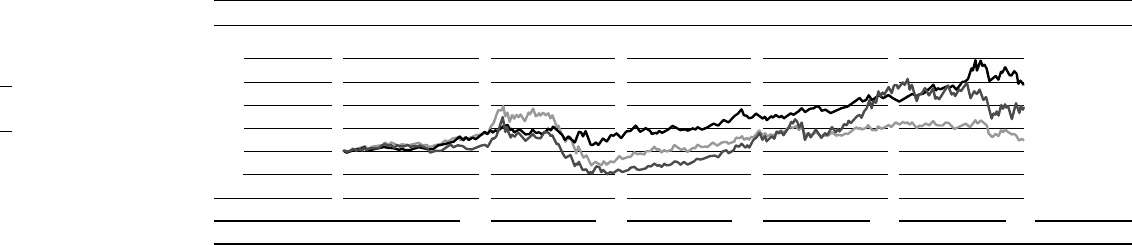

Precious metals price trend

(Index: 29 December 2006 = 100)

300

250

200

150

100

50

07 08 09 10 11

Source: Reuters

Palladium

Gold

Platinum