BMW 2011 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2011 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

18 COMBINED GROUP AND COMPANY

MANAGEMENT REPORT

18 A Review of the Financial Year

20 General Economic Environment

24 Review of Operations

43 BMW Stock and Capital Market

46 Disclosures relevant for takeovers

and explanatory comments

49 Financial Analysis

49 Internal Management System

51 Earnings Performance

53 Financial Position

56 Net Assets Position

59 Subsequent Events Report

59 Value Added Statement

61 Key Performance Figures

62 Comments on BMW AG

66 Internal Control System and

explanatory comments

67 Risk Management

73 Outlook

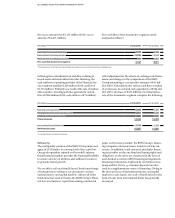

Comments on Financial Statements of BMW AG

The financial statements of BMW AG are drawn up in

accordance with the German Commercial Code (HGB)

and the German Stock Corporation Act (AktG).

BMW AG develops, manufactures and sells cars and

motorcycles manufactured by itself, foreign subsidiaries

and Magna Steyr. Sales activities are carried out

through the Company’s own branches, independent

dealers, subsidiaries and importers. The number of cars

manufactured at German and foreign plants in 2011

rose by 17.3 % to 1,738,160 units. At 31 December 2011,

BMW AG had 71,630 employees, 2,112 more than one

year earlier.

The dynamic performance of the world’s car markets

resulted in strong sales volume growth for BMW AG.

Thanks to this positive development, revenues rose by

20.2 %. The most significant increase was recorded in

Asia. Sales to Group sales companies accounted for

€ 40.0 billion or 72.7 % of total revenues of € 55.0 billion.

The increase in cost of sales was less pronounced than

the increase in revenues, mainly due to changes in

the sales mix and reduced material costs.

As a conse-

quence, gross profit increased by € 3.1 billion

to € 11.7

billion.

The increase in other operating income and expenses

was attributable primarily to income recorded in con-

junction with retrospective changes to transfer prices

and to a higher level of income from reversals of war-

ranty provisions. Estimates used to measure those pro-

visions were refined on the basis of current information.

These income items were partially offset by increased

expenses recognised for pending losses on commodity

and currency hedging contracts.

The financial result deteriorated by € 300 million, mainly

as a result of the impact of fair value measurement on

designated plan assets for pension and other non-current

personnel-related provisions.

The profit from ordinary activities increased from € 2,337

million to € 4,037 million.

Extraordinary items in 2011 relate to the merger gain

arising on the merger of BMW Maschinenfabrik Spandau

GmbH, Munich, into BMW AG, Munich. In 2010, ex-

traordinary items had included the impact of the

first-time application of the German Accounting Law

Modernisation Act (BilMoG).

The tax expense in 2011 comprises current year tax and

adjustments to tax provisions for prior years in con-

nection

with intra-group transfer pricing arrangements.

After deducting the expense for taxes, the Company

reports a net profit of € 1,970 million (2010: € 1,506

million).

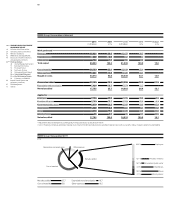

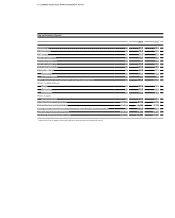

Capital expenditure on intangible assets and property,

plant and equipment amounted to € 2,032 million (2010:

€ 1,582 million), an increase of 28.4 % over the previous

year. The main focus was on product investments for

production start-ups and infrastructure improvements.

Depreciation and amortisation amounted to € 1,578

million.

Investments went up from € 1,875 million to € 2,823 mil-

lion. The carrying amount of investments was increased

on the one hand by €625 million in conjunction with

a transfer to capital reserves made at the level of BMW

Leasing GmbH, Munich, and reduced by the derecogni-

tion of the investment in BMW Vertriebs GmbH & Co.

oHG, Dingolfing, following that entity’s automatic

merger with BMW Leasing GmbH (subsequently merged

into BMW Bank GmbH, Munich). In addition, shares

in SGL Carbon SE, Wiesbaden, were purchased during

the financial year 2011 at an acquisition cost of € 464

million.

Inventories went up from € 3,259 million to € 3,755 mil-

lion due to higher business volumes generally and to

stocking up in conjunction with the introduction of new

models.

Cash and cash equivalents rose by € 1,290 million to

€ 2,864 million, reflecting the BMW Group’s strong

operating performance in the year under report. Finan-

cial receivables from subsidiaries decreased.

Equity rose by € 1,134 million to € 8,222 million, while

the equity ratio improved from 29.1 % to 29.9 %.

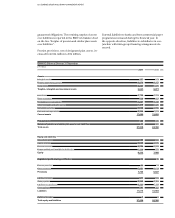

In order to secure obligations resulting from pre-retire-

ment part-time work arrangements and a part of the

Company’s pension obligations, assets were transferred

to BMW Trust e.V., Munich, in conjunction with Con-

tractual Trust Arrangements (CTA), on a trustee basis.

The assets concerned comprise mainly holdings in in-

vestment fund assets and a receivable resulting from a

so-called “Capitalisation Transaction”

(Kapitalisierungs-

geschäft). Fund assets are offset against the related