BMW 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.69 COMBINED GROUP AND COMPANY MANAGEMENT REPORT

The need to optimise consumption and reduce emis-

sions

is an integral part of the Group’s product inno-

vation process. The Efficient Dynamics concept, initially

developed several years ago, comprises the whole set

of

measures now incorporated throughout the entire

vehicle fleet relating to highly efficient engines, improved

aerodynamics, lightweight construction and energy

management.

In the medium term we will achieve greater fuel econ-

omy by electrifying the drive train and developing com-

prehensive hybrid systems. We are also working on

solutions for sustainable mobility in densely populated

areas. For example, large-scale field trials have been

carried out with the MINI E in Great Britain, Germany,

France, the USA, China and Japan. A test fleet of

BMW ActiveE electric cars based on the BMW 1 Series

Coupé

has been on the roads since 2011. The extensive

knowledge gained from these trials will be incor-

porated in the series development of electric vehicles

within the BMW Group. The BMW i 3 is due to come

onto the market in 2013 as the BMW Group’s first series

production electric car for use in the world's major metro-

politan

regions.

Operating risks

The flexible nature of our worldwide production network

and working time models generally helps to reduce op-

erating risks. In addition, risks arising from business

interruptions and loss of production are also insured up

to economically reasonable levels with insurance com-

panies of good credit standing.

Close cooperation between manufacturers and suppliers

is usual in the automotive sector, and although this

form of networking provides economic benefits, it also

creates a certain degree of mutual dependence. As part

of a policy of preventative risk management imple-

mented

within the purchasing function, suppliers are

assessed for technical competence on the one hand and

financial strength on the other, during both the develop-

ment

and production phases of our vehicles. We are

also increasingly taking steps to deal with suppliers’

risks at a local level. A Supplier Relationship Manage-

ment system, which also takes account of social and

ecological aspects, helps to reduce risks connected

with

purchasing activities.

The risk of individual suppliers suffering capacity bottle-

necks increased during the period under report, mainly

reflecting the huge rise in volumes that needed to be

mastered in 2011. Material supplies were fully assured

at all times by means of appropriate early-intervention

measures.

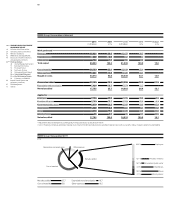

Risks relating to Financial Services business

A set of strategic principles and rules derived from regu-

latory requirements serves as the basis for risk manage-

ment within the Financial Services segment. At the

heart of the risk management process is a clear division

into front- and back-office activities and a comprehen-

sive internal control system (ICS).

In order to ensure that the segment is capable of bear-

ing the risks to which it is exposed (i. e. its “risk-bearing

capacity”), we monitor the segment’s total exposure to

major risks. This involves measuring unexpected losses

using a variety of value-at-risk techniques, aggregating

those losses (after factoring in correlation effects) and

comparing the aggregated result with resources avail-

able to cover risks (i. e. equity). The segment’s risk-bear-

ing capacity is monitored continuously with the aid of

an integrated limit system. The segment’s total risk

exposure was covered at all times during the past year

by the available risk-coverage volumes.

The main categories of risk for the Financial Services

segment are: credit and counterparty default risk, re-

sidual value risk, interest rate risk, liquidity risk and

operational risks. In order to evaluate and manage

these risks, a variety of internal methods have been de-

veloped based on regulatory environment requirements

(such as Basel II) and which comply with national and

international standards.

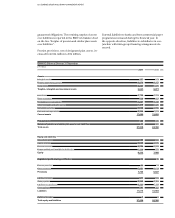

Credit risks arise in conjunction with lending to retail

customers and major corporate customers, the latter

relating primarily to the dealer, fleet and importer

financing / leasing lines of business. Counterparty de-

fault risk, by contrast, refers to the risk that banks or

financial institutions with which financial instruments

have been transacted in conjunction with refinancing

and risk hedging are unable to meet their payment

obligations.

Lending to retail customers is largely based on automated

scoring techniques. In the case of major corporate

customers, creditworthiness is checked using internal

rating models, which take account of financial state-

ment data and supplementary qualitative evaluations.

Customer creditworthiness is tested at least once a

year

and revised accordingly. The approval for lending