BMW 2011 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2011 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

18 COMBINED GROUP AND COMPANY

MANAGEMENT REPORT

18 A Review of the Financial Year

20 General Economic Environment

24 Review of Operations

43 BMW Stock and Capital Market

46 Disclosures relevant for takeovers

and explanatory comments

49 Financial Analysis

49 Internal Management System

51 Earnings Performance

53 Financial Position

56 Net Assets Position

59 Subsequent Events Report

59 Value Added Statement

61 Key Performance Figures

62 Comments on BMW AG

66 Internal Control System and

explanatory comments

67 Risk Management

73 Outlook

The situation on international money and capital mar-

kets was again dominated in 2011 by the European debt

crisis, resulting in major swings on the world’s financial

markets, particularly in the second half of the year.

The debt crisis did not have any impact on the BMW

Group’s financing activities. Thanks to its good ratings,

the BMW Group was again able to refinance opera-

tions

at an attractive level in 2011. In addition to the issue

of bonds and loan notes on the one hand and private

placements on the other, we were also able to issue com-

mercial

paper at good conditions. Additional funds were

also raised via new securitised transactions and by ex-

tending existing transactions. As in previous years, all

issues were highly sought after by both institutional and

private investors.

During the year, the BMW Group issued two benchmark

bonds with a total issue volume of € 2.25 billion on

Euro-

pean capital markets. Bonds were also issued in Canadian

and Australian dollars, Norwegian krone, Swiss francs

and other currencies for a total amount of € 4.5 billion.

Issues of public ABS bonds raised 2.25 billion US dollar in

the USA and 2 billion rand in South Africa. In addition,

securitised private ABS transactions were used to raise

€ 200 million in Germany, 20 billion yen in Japan, 700

million Canadian dollars in Canada, 1.5 billion Australian

dollars in Australia and 1 billion US dollars in the USA.

Funds were also raised at attractive conditions on the

loan note market. Alongside various euro transactions

with a total volume of € 500 million, a number of smaller

issues were made on niche markets.

The regular issue of commercial paper at attractive con-

ditions further strengthened our broad refinancing basis.

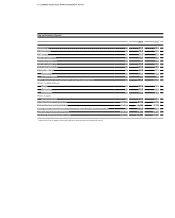

The following table provides an overview of existing

money and capital market programmes of the BMW

Group at 31 December 2011:

good conditions. A consortium of 39 international banks

is involved in the credit facility. Despite the volatile market

situation, syndication of the facility was oversubscribed

to a considerable extent. A commitment fee is paid an-

nually in line with normal market practice. The duration

of the credit agreement is determined when the facility

is drawn down. The previous credit facility for 8 billion

US dollar, due to expire in November 2012, was there-

fore replaced early.

Standard & Poor’s raised its outlook for BMW AG during

the year under report from stable to positive. Moody’s

raised BMW AG’s long-term and short-term ratings by

one level in each case from A3/P-2 to A2/P-1 and con-

firmed the stable outlook. BMW AG therefore currently

enjoys the best ratings of all European car manufacturers.

Further information regarding financial liabilities is

pro-

vided in the notes to the Group Financial Statements

(note 34 and note 38).

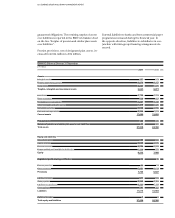

Net assets position*

The Group balance sheet total increased by € 13,265

mil-

lion (+ 12.0 %) to stand at € 123,429 million at 31 December

2011. Adjusted for changes in exchange rates, the balance

sheet total would have increased by 10.8 %.

The main factors behind the increase on the assets side

of the balance sheet were receivables from sales financ-

ing (+ 8.8 %), inventories (+ 24.1 %), leased products

(+21.1 %) and trade receivables (+ 41.1 %). By contrast,

decreases were recorded for non-current financial assets

(– 8.8 %) and non-current other assets (– 17.9 %).

On the equity and liabilities side of the balance sheet,

the increase was due to the rise in equity (+ 13.3 %),

pension provisions (+ 39.7 %), trade payables (+ 22.7 %)

and financial liabilities (+ 9.0 %). Deferred tax liabilities

decreased slightly (– 3.7 %).

At € 5,238 million, the carrying amount of intangible

assets was € 207 million higher than at the end of the

previous year. Within intangible assets, capitalised

development costs decreased by € 237 million to € 4,388

million. Development costs recognised as assets during

the year under report amounted to € 972 million (+ 2.2 %).

The proportion of development costs recognised as

assets was 28.8 % (2010: 34.3 %). Additions to capitalised

development costs in 2011 were therefore slightly above

Programme Amount utilised

Euro Medium Term Notes € 25.3 billion

Commercial paper € 5.2 billion

In October 2011 the BMW Group concluded a new syn-

dicated credit facility totalling € 6 billion with a term of

five years and with two one-year extension options at

* Adjusted for effect of change in accounting policy for leased products as described

in note 8