BMW 2011 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2011 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282

|

|

55 COMBINED GROUP AND COMPANY MANAGEMENT REPORT

the excess amount was € 2,133 million (2010: excess

amount of € 4,471 million).

Refinancing

The net liquidity position of the BMW Group improved

again in 2011 thanks to a strong level of free cash flow.

Our good reputation enjoyed on the world’s interna-

tional financial markets provides the financial flexibility

to ensure solvency at all times and sufficient resources

to generate future growth.

We are able to call on a broadly based, finely tuned

range

of instruments to refinance our operations via inter-

national money and capital markets. Almost all of the

funds raised are used to finance the BMW Group’s Finan-

cial

Services business. Apart from issuing commercial

Following the reclassification of cash flows relating to

leased assets and receivables from sales financing, the

cash outflow for operating activities of the Financial Ser-

vices segment totalled € 2,308 million (2010: outflow of

€ 3,773 million). Primarily as a result of the sale of market-

able securities, investing activities generated a cash in-

flow of € 204 million (2010: cash outflow of € 71 million).

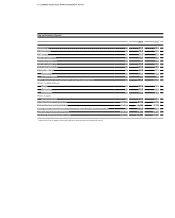

Free cash flow of the Automotive segment can be

analysed as follows:

paper on the money market, the BMW Group’s financ-

ing companies also issue bearer bonds in various cur-

rencies. In addition, retail customer and dealer financ-

ing receivables on the one hand and leasing rights and

obligations on the other are securitised in the form of

asset-backed securities (ABS) financing arrangements.

Financing instruments employed by our banks in Ger-

many and the USA (e. g. customer deposits) are also

used as a supplementary source of financing. Owing to

the increased use of international money and capital

markets to raise funds, the scale of funds raised in the

form of loans from international banks has generally

decreased.

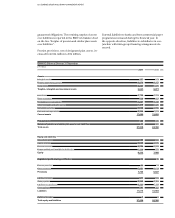

After adjustment for the effects of exchange-rate fluctu-

ations and changes in the composition of the BMW

Group amounting to a net positive amount of € 43 mil-

lion (2010: € 26 million), the various cash flows resulted

in an increase in cash and cash equivalents of € 344 mil-

lion (2010: decrease of € 335 million). Net financial as-

sets of the Automotive segment comprise the following:

in € million 31. 12. 2011 31. 12. 2010

Cash inflow from operating activities 7,077 8,149*

Cash outflow for investing activities – 5,725 – 5,541*

Net investment in marketable securities 781 1,863

Free cash flow Automotive segment 2,133 4,471

* The adjustments result from the reclassification described in note 43 of the Group Financial Statements.

in € million 31. 12. 2011 31. 12. 2010

Cash and cash equivalents 5,829 5,585

Marketable securities and investment funds 1,801 1,134

Intragroup net financial receivables 6,404 5,690

Financial assets 14,034 12,409

Less: external financial liabilities* – 1,747 – 1,123

Net financial assets 12,287 11,286

* Excluding derivative financial instruments