BMW 2011 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2011 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19 COMBINED GROUP AND COMPANY MANAGEMENT REPORT

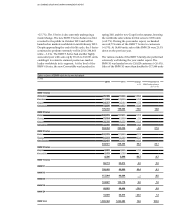

Income tax expense for the year amounted to € 2,476

million (+ 53.8 %), resulting in an effective tax rate

of 33.5 %, marginally up on the previous year’s 33.2 %.

Group net profit was significantly higher than in 2010,

rising by 51.3 % to € 4,907 million.

Sharp increase in dividend

Reflecting the very strong earnings performance, the

Board of Management and the Supervisory Board

will propose to the Annual General Meeting to use

BMW AG’s unappropriated profit of € 1,508 million to

pay a dividend of € 2.30 for each share of common

stock (2010: € 1.30) and a dividend of € 2.32 for each share

of preferred stock (2010: € 1.32), a distribution rate of

30.7 % for 2011 (2010: 26.5 %).

Capital expenditure increased

Capital expenditure on intangible assets and property,

plant and equipment amounted to € 3,692 million in

2011, 13.1 % higher than in the previous year (2010:

€ 3,263 million). The main focus in 2011 was on product

investments for new model start-ups (BMW 1 Series,

3 Series), on infrastructure investments aimed at ex-

panding the production network and on the future pro-

duction of electric cars (BMW i 3 and i8).

The BMW Group invested € 2,720 million in property,

plant and equipment and other intangible assets in

2011 (2010: € 2,312 million; + 17.6 %). Development

expenditure of € 972 million was additionally recog-

nised

as assets (2010: € 951 million; + 2.2 %). The per-

centage of development costs capitalised decreased

to 28.8 %, mainly due to model life cycle factors (2010:

34.3 %).

The capital expenditure ratio for the year was unchanged

at 5.4 % and therefore remained – thanks to the effi-

cient use of capital resources – well within the target

range of below 7 % of Group revenues, despite substan-

tial levels of investment in innovative products and

technologies.

BMW Group strengthens market position in European

fleet business

In July the BMW Group announced the purchase of ING

Car Lease Group (ICL Group). This addition, combined

with the existing Alphabet fleet business, increased

the number of leasing and fleet management contracts

handled by the BMW

Group to approximately 540,000.

Alphabet is now one of the top five fleet service pro-

viders

on the European

market, mainly concentrating

on the growing sector of full-service leasing. The expan-

sion of fleet management business provides the ideal

foundation for developing forward-looking mobility so-

lutions and services.

BMW Group and SGL Group open new carbon fibre

production plant

In September 2011, SGL Automotive Carbon Fibers – a

joint venture of the BMW Group and the SGL Group –

opened a new state-of-the-art carbon fibre manufacturing

plant in Moses Lake, USA. The facility plays a major

strategic role in the manufacture of ultra-lightweight

carbon-fibre reinforced plastics (CFRP), which will be

used extensively in the BMW i vehicles to be launched

by the BMW Group from 2013 onwards.

CFRP is becoming increasingly important in the quest

for lighter materials that minimise vehicle weight and

thereby reduce both fuel consumption and CO2 emis-

sions. With their new production plant in Moses Lake,

the

BMW Group and

the

SGL Group are proving that

targeted

innovations can make a real eco-friendly con-

tribution towards the

future of individual mobility.

Investment in SGL Carbon SE

BMW AG acquired 15.81 % of the share capital of SGL

Carbon SE during the period under report, thus re-

inforcing

our engagement in the area of lightweight

construction and the use of CFRP in carmaking.

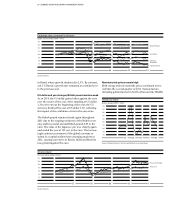

BMW Group Capital expenditure and operating cash flow

in € million

8,000

7,000

6,000

5,000

4,000

3,000

2,000

07 08 09 10 11

Capital

expenditure 4,267 4,204 3,471 3,263 3,692

Operating

cash flow1 6,246 4,471 4,921 8,1492 7,077

1 Cash inflow from operating activities of the Automotive segment

2 Adjusted for effect of change in accounting policy for leased products as described in

note 8