BMW 2011 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2011 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

136

76 GROUP FINANCIAL STATEMENTS

76 Income Statements

76 Statement of

Comprehensive Income

78 Balance Sheets

80 Cash Flow Statements

82 Group Statement of Changes

in Equity

84 Notes

84 Accounting Principles

and Policies

100 Notes to the Income

Statement

107 Notes to the Statement

of Comprehensive Income

108

Notes to the Balance Sheet

129 Other Disclosures

145 Segment Information

Fair value gains and losses recognised on derivatives

and recorded initially in accumulated other equity are

reclassified to cost of sales when the derivatives ma-

ture.

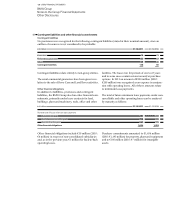

Losses amounting to € 2 million (2010: € 24 million) at-

tributable to forecasting errors (and the resulting over-

hedging of currency exposures) were recognised as an

expense within the line item “Financial Result” in the

financial year 2011. These forecasting errors, which all

related to the year under report, arise primarily as a

result of changes in sales forecasts in foreign currencies.

In addition, an expense of € 52 million (2010: income

of € 3 million) was recognised in conjunction with the

ineffective portion of cash flow hedges relating to raw

materials. These amounts were also reported in “Finan-

cial Result”.

At 31 December 2011 the BMW Group held derivative

instruments with terms of up to 54 months (2010: 60

months) to hedge currency risks attached to forecasted

transactions. It is expected that € 279 million of net losses,

recognised in equity at the end of the reporting period,

will be recognised in the income statement in 2012.

The difference between the gains / losses on hedging

instruments and the result recognised on hedged items

represents the ineffective portion of fair value hedges.

Fair value hedges are mainly used to hedge the market

prices of bonds, other financial liabilities and receivables

from sales financing.

At 31 December 2011 the BMW Group held derivative

instruments with terms of up to 60 months (2010: 72

months) to hedge interest rate risks. It is expected that

€ 10 million of net losses, recognised in equity at the

end of the reporting period, will be recognised in the

income statement in 2012.

At 31 December 2011 the BMW Group held derivative

instruments with terms of up to 55 months (2010: 35

months) to hedge raw material price risks attached to

future transactions. It is expected that € 18 million of

net g

ains, recognised in equity at the end of the re-

porting

period, will be recognised in the income state-

ment in 2012.

Cash flow hedges are generally used to hedge cash

flows arising in conjunction with the supply of vehicles

to subsidiaries and to hedge raw material price fluc-

tuations.

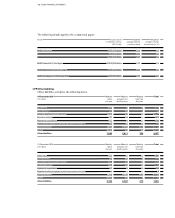

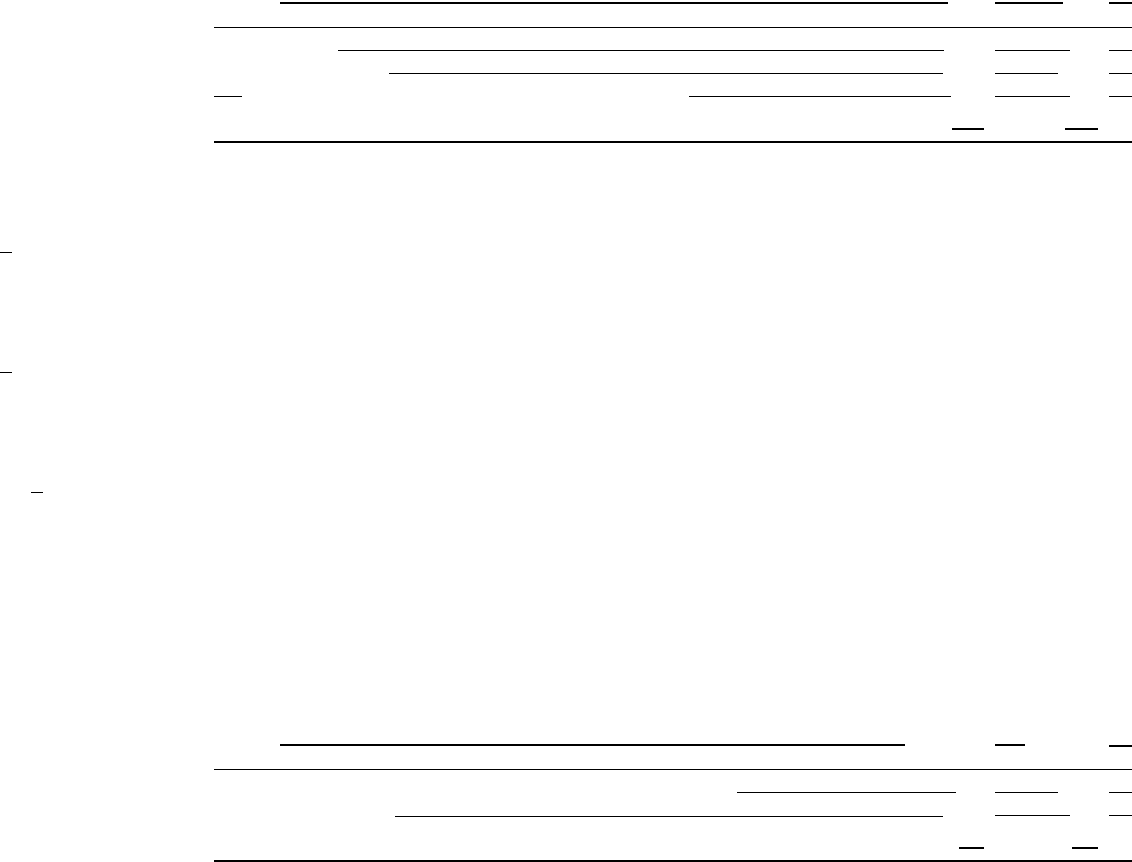

Fair value hedges

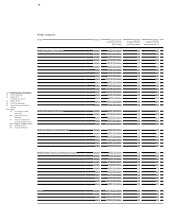

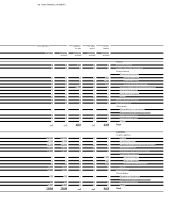

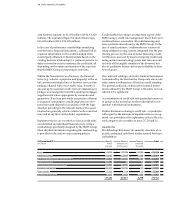

The following table shows gains and losses on hedging

instruments and hedged items which are deemed to be

part of a fair value hedge relationship:

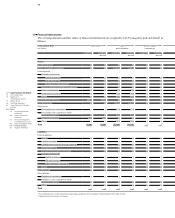

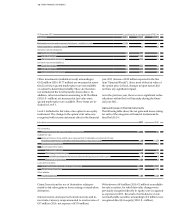

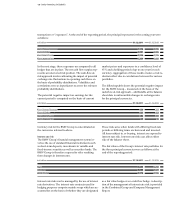

Credit risk

Notwithstanding the existence of collateral accepted,

the carrying amounts of financial assets generally take

account of the maximum credit risk arising from the

possibility that the counterparties will not be able to

fulfil their contractual obligations. The maximum credit

risk for irrevocable credit commitments relating to

credit

in € million 31. 12. 2011 31. 12. 2010*

Gains / losses on hedging instruments designated as part of a fair value hedge relationship 213 – 239

Gains / loss from hedged items – 225 253

–12 14

* Prior year figures restated

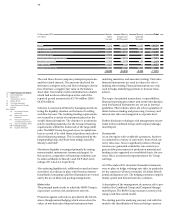

in € million 2011 2010

Balance at 1 January – 127 209

Total changes during the year – 623 – 336

of which recognised in the income statement during the period under report – 68 274

Balance at 31 December –750 –127

The disclosure of interest income resulting from the un-

winding of interest on future expected receipts would

normally only be relevant for the BMW Group where

assets have been discounted as part of the process of de-

termining impairment losses. However, as a result of

the assumption that most of the income that is subse-

quently recovered is received within one year and the

fact that the impact is not material, the BMW Group

does not discount assets for the purposes of determining

impairment losses.

Cash flow hedges

The effect of cash flow hedges on accumulated other

equity was as follows: