BMW 2011 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2011 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

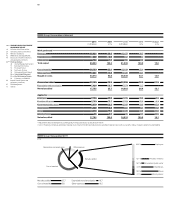

53 COMBINED GROUP AND COMPANY MANAGEMENT REPORT

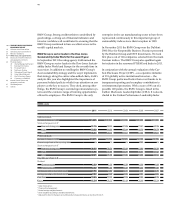

Revenues by segment

in € million

2011 2010

Automotive 63,229 54,137

Motorcycles 1,436 1,304

Financial Services 17,510 16,617

Other Entities 5 4

Eliminations – 13,359 – 11,585

Group 68,821 60,477

Profit / loss before tax by segment

in € million

2011 2010*

Automotive 6,823 3,887

Motorcycles 41 65

Financial Services 1,790 1,214

Other Entities – 168 45

Eliminations – 1,103 – 358

Group 7,383 4,853

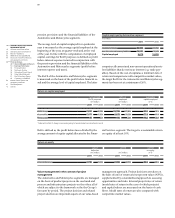

lion to € 41 million as a result of the loss recorded by the

Husqvarna Group.

Financial Services segment revenues grew by 5.4 % to

€ 17,510 million. Segment profit before tax improved to

€ 1,790 million (2010: € 1,214 million), influenced mainly

by lower expense for risk provision in the areas of

credit

financing and residual values on the one hand

and lower refinancing costs on the other. The result also

includes the positive effect of exceptional income re-

sulting from the reduction in risk provision for residual

value and bad debt risks.

The Other Entities segment recorded a pre-tax loss of

€ 168 million (2010: pre-tax profit of € 45 million).

The result from inter-segment eliminations was a net

expense of € 1,103 million, up from a net expense of

€ 358 million one year earlier, mainly reflecting the higher

volume of new leasing business and lower Group pro-

duction costs.

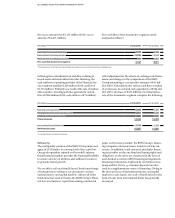

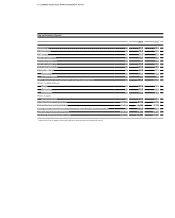

Financial position*

The cash flow statements of the BMW Group and the

Automotive and Financial Services segments show the

sources and applications of cash flows for the financial

years 2010 and 2011, classified into cash flows from

operating, investing and financing activities. Cash and

cash equivalents in the cash flow statements correspond

to the amount disclosed in the balance sheet.

Cash flows from operating activities are determined

indirectly, starting with Group and segment net profit.

By contrast, cash flows from investing and financing

activities are based on actual payments and receipts.

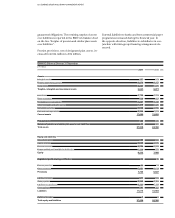

Cash inflows and outflows relating to operating leases,

where the BMW Group is lessor, are required by IAS 7.14

to be presented within cash flows from operating activi-

ties. In previous financial statements, they were pre-

sented within cash flows from investing activities. The

change in presentation in the Group’s Cash Flow State-

ments has been made with effect from the end of the

financial year 2011. Prior year figures have been adjusted

accordingly. Cash inflow from operating activities de-

creased by € 4,476 million as a result of this reclassifica-

tion. Cash outflows for investing activities decreased

by the same amount. Cash flows relating to operating

leases, where the BMW Group is the lessee, continue

to be reported within operating activities. As a result

of

the change in presentation, changes in leased

prod-

ucts are now reported on a net basis within operating

activities.

The presentation of receivables from sales financing

within the cash flow statement has also been changed

in the Group Financial Statements for the year ended

31 December 2011 to ensure that lease and financing

transactions are treated consistently. Previously, changes

in receivables from sales financing – including finance

leases, where the BMW Group is the lessor – were

presented within investing activities. They are now pre-

sented within operating activities. The previous year’s

figures were restated in the interest of comparability.

As a result of the change, cash flows from operating

activities were € 4,856 million lower than reported in the

financial

year 2010. Cash outflows for investing activi-

ties decreased

by the same amount. In situations where

the BMW Group is the lessee in a finance lease, the

relevant components of changes continue to be reported

within operating activities and investing activities. As

with leased products, changes in receivables from sales

financing are now reported on a net basis within oper-

ating activities.

Operating activities of the BMW Group generated a

positive cash flow of € 5,713 million in 2011, an increase

o

f € 1,394 million or 32.3 % compared to the previous

* Adjusted for effect of change in accounting policy for leased products as described

in note 8