BMW 2011 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2011 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

18 COMBINED GROUP AND COMPANY

MANAGEMENT REPORT

18 A Review of the Financial Year

20 General Economic Environment

24 Review of Operations

43 BMW Stock and Capital Market

46 Disclosures relevant for takeovers

and explanatory comments

49 Financial Analysis

49 Internal Management System

51 Earnings Performance

53 Financial Position

56 Net Assets Position

59 Subsequent Events Report

59 Value Added Statement

61 Key Performance Figures

62 Comments on BMW AG

66 Internal Control System and

explanatory comments

67 Risk Management

73 Outlook

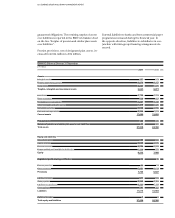

Interest-rate risks are managed by raising refinancing

funds with matching maturities and by employing

derivative financial instruments. Interest-rate risks are

measured and limited on the basis of a value-at-risk

approach. Risk-bearing

capacity and targets are taken

into consideration for

the purposes of measuring and

limiting interest rate

risks. In addition, the risk-return ra-

tio is tested regularly

using simulated computations in

conjunction with a

present-value-based interest rate

management system. Sensitivity

analyses, which contain

stress scenarios and show the

potential impact of inter-

est-rate changes on earnings,

are also used as tools to

manage interest-rate risks.

Access to liquid funds across the Group is ensured by a

broad diversification of refinancing sources. Knowledge

gained from the financial crisis has been incorporated

in a so-called “Target Liquidity Concept”. The liquidity

position is monitored continuously at a separate entity

level and managed by means of a cash flow requirements

and sourcing forecast system in place throughout the

Group.

Most of the Financial Services segment’s credit financ-

ing and lease business is refinanced on capital mar-

kets. The BMW Group has good access to financial

markets thanks to its excellent creditworthiness and,

as in pre vious years, was able to raise funds at good

conditions in 2011, reflecting a diversified refinancing

strategy on the one hand and a solid liquidity base

on the other. Internationally recognised rating agen-

cies have confirmed the BMW Group’s strong credit-

worthiness.

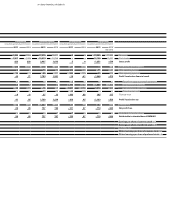

Changes on the world's international commodities

mar-

kets can also have an impact on the BMW Group’s

busi

ness. In order to safeguard the supply of production

materials and minimise cost risks, all relevant com-

modities markets are closely monitored. The year 2011

was characterised by a high degree of volatility in raw

materials prices. Prices fell sharply as from the beginning

of the second half of the year, after rising previously in

response to favourable economic developments. Deriva-

tive instruments had been put in place before the start

of the year to hedge the prices of precious metals (such

as platinum, palladium and rhodium) and of non-

ferrous metals (such as aluminium, copper and lead)

re-

quired in 2011 and subsequent years. Changes in the

price of crude oil, which is an important basic material

in the manufacture of components, have an indirect im-

pact on our production costs. The price of crude oil also

directly influences the purchasing behaviour of our cus-

tomers when fuel prices change.

An escalation of political tensions and terrorist activi-

ties, natural catastrophes or possible pandemics could

cause raw material shortages on the one hand and,

if mate rials and parts fail to be delivered, could result

directly in lost production. Such factors could, however,

also impact business performance indirectly if they af-

fect the economy and the international capital markets.

Sector risks

The automotive industry is increasingly under pressure

worldwide to reduce both fuel consumption and emis-

sion levels. We are meeting these challenges with our

Efficient Dynamics technology, a strategy with which

we have had tangible success since it was introduced.

Medium- to long-term requirements have already been

put in place in Europe, North America, Japan, China

and other countries with respect to the reduction of ve-

hicle fuel consumption and CO2 emissions. Europe has

set a target of achieving an average of 130 g / km for all

new vehicles by 2015. EU regulations set targets for CO2

emissions that take account of vehicle weight. Based on

the new rules, a target of below 140 g / km has been de-

rived for the BMW Group. A uniform consumption and

CO2 regulation applies in the USA for model years up

to 2016. Consumption targets through to 2025 are cur-

rently being determined. Starting with a step-by-step re-

duction in model year 2012, the new vehicle fleets of all

manufacturers are expected to come down to an average

value of 250 g of CO2 per mile in model year 2016. The

Japanese government has also set ambitious targets to

reduce consumption, including statutory regulations for

2010 and 2015 and is currently working on targets for

2020. Discussions are currently taking place in China

with respect to legislation for the years 2012 to 2015

which

go beyond the existing regulations for individual

car fuel consumption.

The BMW Group meets legal requirements with its

Efficient Dynamics technology. A risk could arise,

however, if legal requirements were to be made more

stringent.

The automotive industry is also gearing up to master

the challenges associated with bringing models with al-

ternative drive systems onto the market. At the same

time we also see this as an opportunity to put our

tech-

nological expertise and innovative strengths to use.