BMW 2011 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2011 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

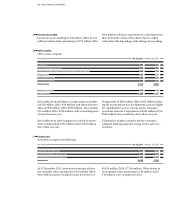

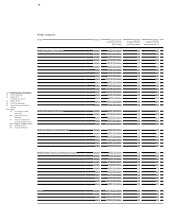

117 GROUP FINANCIAL STATEMENTS

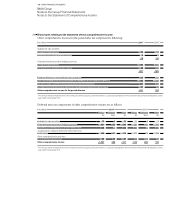

Cash and cash equivalents

Cash and cash equivalents of € 7,776 million (2010: € 7,432 million) comprise cash on hand and at bank, all with an

original term of up to three months.

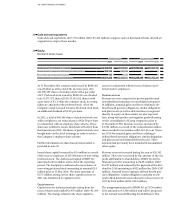

33

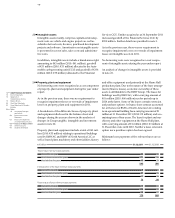

At 31 December 2011 common stock issued by BMW AG

was divided, as at the end of the previous year, into

601,995,196 shares of common stock with a par-value

of € 1. Preferred stock issued by BMW AG was divided

into 53,571,372 shares (2010: 53,163,412 shares) with

a par-value of € 1. Unlike the common stock, no voting

rights are attached to the preferred stock. All of the

Company’s stock is issued to bearer. Preferred stock bears

an additional dividend of € 0.02 per share.

In 2011, a total of 408,140 shares of preferred stock was

sold to employees at a reduced price of € 26.58 per share

in conjunction with an employee share scheme. These

shares are entitled to receive dividends with effect from

the financial year 2012. 180 shares of preferred stock were

bought back via the stock exchange in order to service

the Company’s employee share scheme.

Further information on share-based remuneration is

provided in note 20.

Issued share capital increased by € 0.4 million as a result

of the issue to employees of 407,960 shares of non-voting

preferred stock. The Authorised Capital of BMW AG

amounted to € 3.6 million at the end of the reporting

period. The Company is authorised to issue shares of

non-voting preferred stock amounting to nominal € 5.0

million prior to 13 May 2014. The share premium of

€ 15.5 million arising on the share capital increase in

2011 was transferred to capital reserves.

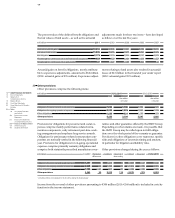

Capital reserves

Capital reserves include premiums arising from the

issue of shares and totalled € 1,955 million (2010: € 1,939

million). The change related to the share capital in-

crease in conjunction with the issue of shares of pre-

ferred stock to employees.

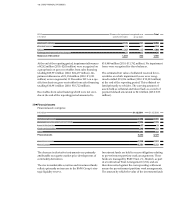

Revenue reserves

Revenue reserves comprise the post-acquisition and

non-distributed earnings of consolidated companies.

In

addition, actuarial gains and losses relating to de-

fined benefit pension obligations, similar obligations

and plan assets (as well as deferred taxes recognised

directly in equity on these items) are also reported

here, along with positive and negative goodwill arising

on the consolidation of Group companies prior to

31 December 1994. Revenue reserves decreased by

€ 1,582 million as a result of the reclassification

adjust-

ment recorded in accordance with IAS 1.96 as at 1 Janu-

ary

2010 for actuarial gains and losses relating to

defined benefit pension obligations, similar obligations

and plan assets (and related deferred taxes). These

amounts had previously been included in accumulated

other equity.

Revenue reserves increased during the year to € 26,102

million. They were increased by the amount of the net

profit attributable to shareholders of BMW AG for the

financial year 2011 amounting to € 4,881 million (2010:

€ 3,227 million) and reduced by the payment of the divi-

dend for 2010 amounting to € 852 million (for 2009:

€ 197

million). Actuarial losses relating to defined benefit

pen-

sion obligations, similar obligations and plan assets

(and related deferred taxes) reduced revenue reserves in

2011 by € 419 million (2010: € 203 million).

The unappropriated profit of BMW AG at 31 December

2011 amounts to € 1,508 million and will be proposed

to the Annual General Meeting for distribution. This

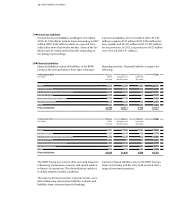

34

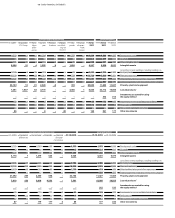

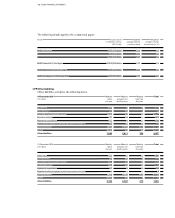

Equity

Number of shares issued

Preferred stock Common stock

2011 2010 2011 2010

Shares issued / in circulation at 1 January 53,163,412 52,665,362 601,995,196 601,995,196

Shares issued in conjunction with employee share scheme 408,140 499,590 – –

less: shares repurchased and re-issued 180 1,540 – –

Shares issued / in circulation at 31 December 53,571,372 53,163,412 601,955,196 601,995,196