BMW 2011 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2011 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

18 COMBINED GROUP AND COMPANY

MANAGEMENT REPORT

18 A Review of the Financial Year

20 General Economic Environment

24 Review of Operations

43 BMW Stock and Capital Market

46 Disclosures relevant for takeovers

and explanatory comments

49 Financial Analysis

49 Internal Management System

51 Earnings Performance

53 Financial Position

56 Net Assets Position

59 Subsequent Events Report

59 Value Added Statement

61 Key Performance Figures

62 Comments on BMW AG

66 Internal Control System and

explanatory comments

67 Risk Management

73 Outlook

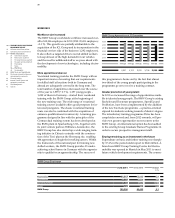

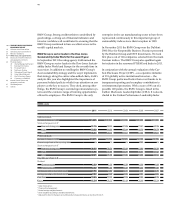

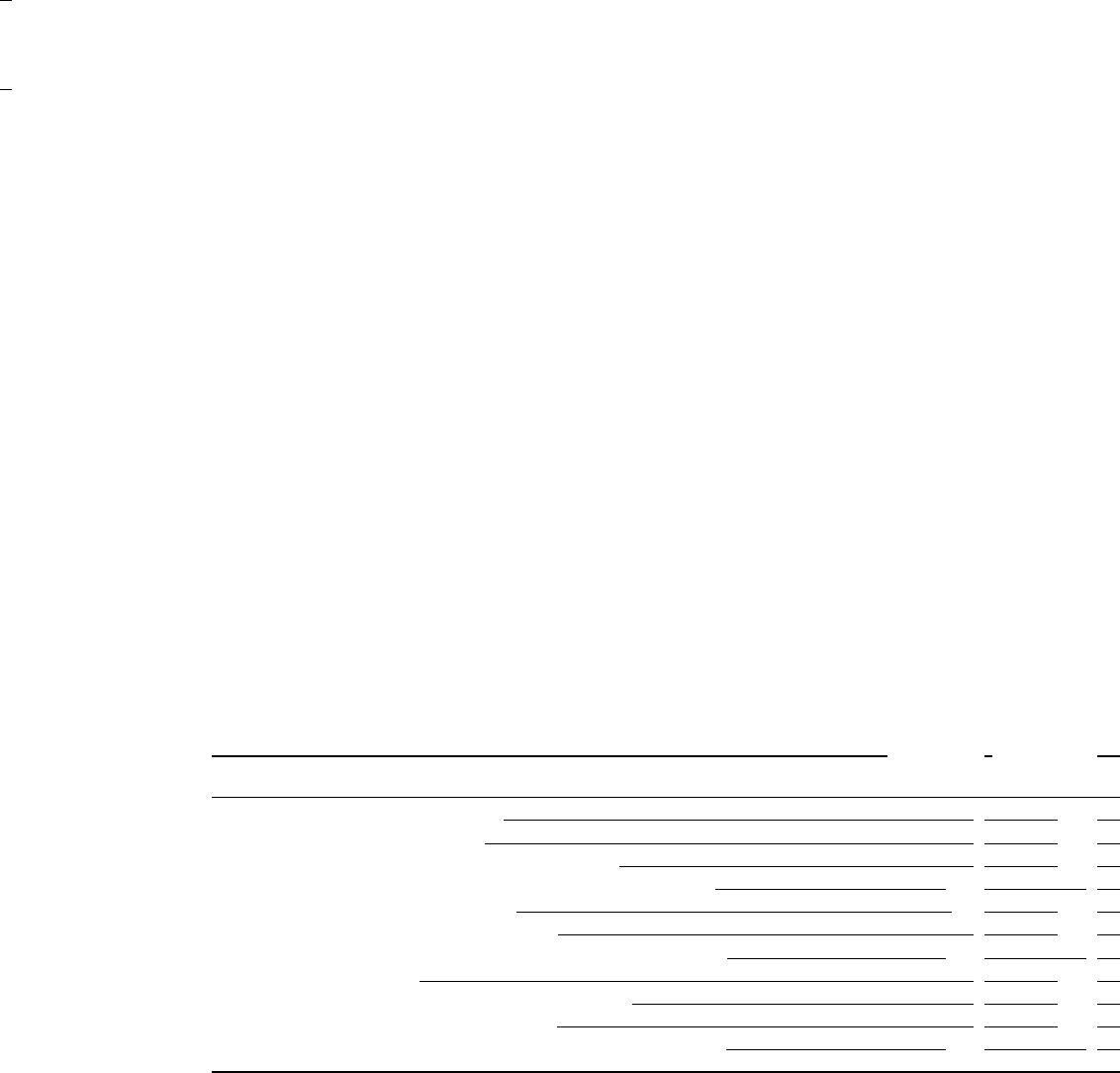

Direct share of

Indirect share of

voting rights (%) voting rights (%)

Stefan Quandt, Bad Homburg v. d. Höhe, Germany 17.4

AQTON SE, Bad Homburg v. d. Höhe, Germany 17.4

Stefan Quandt Verwaltungs GmbH, Bad Homburg v. d. Höhe, Germany 17.4

Stefan Quandt GmbH & Co. KG für Automobilwerte, Bad Homburg v. d. Höhe, Germany 17.4

Johanna Quandt, Bad Homburg v. d. Höhe, Germany 0.4 16.3

Johanna Quandt GmbH, Bad Homburg v. d. Höhe, Germany 16.3

Johanna Quandt GmbH & Co. KG für Automobilwerte, Bad Homburg v. d. Höhe, Germany 16.3

Susanne Klatten, Munich, Germany 12.6

Susanne Klatten Beteiligungs GmbH, Bad Homburg v. d. Höhe, Germany 12.6

Susanne Klatten GmbH, Bad Homburg v. d. Höhe, Germany 12.6

Susanne Klatten GmbH & Co. KG für Automobilwerte, Bad Homburg v. d. Höhe, Germany 12.6

2 Based on voluntary balance notifications provided by the listed shareholders at 31 December 2008

Composition of subscribed capital

The subscribed capital (share capital) of BMW AG

amounted to € 655,566,568 at 31 December 2011 (2010:

€ 655,158,608) and, in accordance with Article 4 (1)

of the Articles of Incorporation, is subdivided into

601,995,196 shares of common stock (91.83 %) (2010:

601,995,196; 91.89 %) and 53,571,372 shares of non-voting

preferred stock (8.17 %) (2010: 53,163,412; 8.11 %), each

with a par value of € 1. The Company’s shares are issued

to bearer. The rights and duties of shareholders derive

from the German Stock Corporation Act (AktG) in con-

junction with the Company’s Articles of Incorporation,

the full text of which is available at www.bmwgroup.com.

The right of shareholders to have their shares evidenced

in writing is excluded in accordance with the Articles

of Incorporation. The voting power attached to each

share corresponds to its par value. Each € 1 of par value

of share capital represented in a vote is entitled to one

vote (Article 18 (1) of the Articles of Incorporation). The

Company’s shares of preferred stock are non-voting

within the meaning of §

139 et seq. AktG, i. e. they only

confer voting rights in exceptional cases stipulated by

law, in particular when the preference amount has not

been paid or has not been fully paid in one year and the

arrears are not paid in the subsequent year alongside

the full preference amount due for that year. With the

exception of voting rights, holders of shares of preferred

stock are entitled to the same rights as holders of shares

of common stock. Article 24 of the Articles of Incorpora-

tion confers preferential treatment to the non-voting

shares of preferred stock with regard to the appropriation

of the Company’s unappropriated profit. Accordingly,

the unappropriated profit is required to be appropriated

in the following order:

(a) subsequent payment of any arrears on dividends on

non-voting preferred shares in the order of accruement,

(b)

payment of an additional dividend of € 0.02 per € 1

par

value on non-voting preferred shares and

(c) uniform payment of any other dividends on shares

of common and preferred stock, provided the share-

holders

do not resolve otherwise at the Annual

General Meeting.

Restrictions affecting voting rights or the transfer

of shares

As well as shares of common stock, the Company has

also issued non-voting shares of preferred stock. Further

information relating to this can be found above in the

section “Composition of subscribed capital”.

When the Company issues non-voting shares of preferred

stock to employees in conjunction with its employee

share scheme, these shares are subject to a company-im-

posed vesting period of four years, measured from the

beginning of the calendar year in which the shares are is-

sued. During this time the shares may not be sold.

Contractual holding period arrangements also apply

to shares of common stock required to be acquired

by Board of Management members in conjunction

with the share-based remuneration scheme (see also

note 47 for further information).

Direct or indirect investments in capital exceeding

10 % of voting rights

Based on the information available to the Company, the

following direct or indirect holdings exceeding 10 % of

the voting rights at the end of the reporting period were

held at the date stated:2

Disclosures relevant for takeovers1 and explanatory comments

1 Disclosures pursuant to § 289 (4) HGB and § 315 (4) HGB