BMW 2011 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2011 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

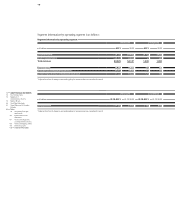

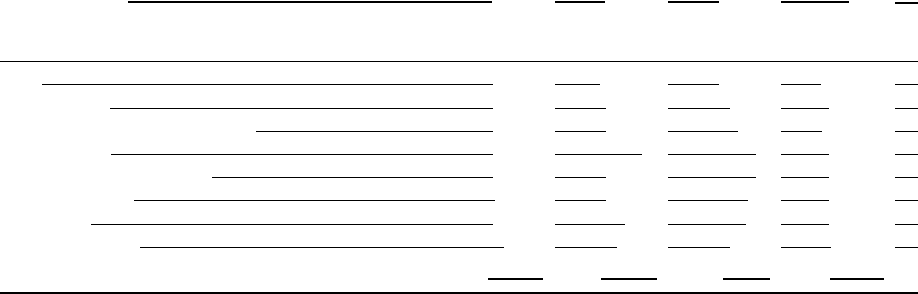

137 GROUP FINANCIAL STATEMENTS

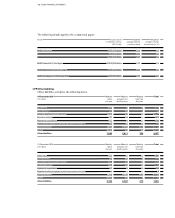

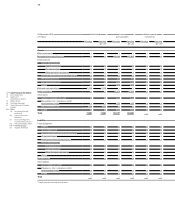

31 December 2011 Maturity Maturity Maturity Total

in € million within between one later than

one year and five years five years

Bonds – 9,100 – 17,430 – 4,509 – 31,039

Liabilities to banks – 3,197 – 5,449 – 268 – 8,914

Liabilities from customer deposits (banking) – 8,968 – 3,254 – 24 – 12,246

Commercial paper – 5,486 – – – 5,486

Asset backed financing transactions – 3,191 – 6,474 – – 9,665

Derivative instruments – 1,410 – 2,218 – 7 – 3,635

Trade payables – 5,295 – 43 – 2 – 5,340

Other financial liabilities – 847 – 483 – 488 – 1,818

– 37,494 – 35,351 – 5,298 –78,143

card business amounts to € 1,031 million (2010: € 1,020

million). The equivalent figure for dealer financing is

€ 16,699 million (2010: € 14,388 million).

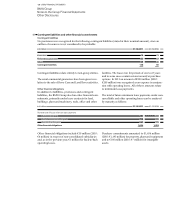

In the case of performance relationships underlying

non-derivative financial instruments, collateral will be

required, information on the credit-standing of the

counterparty obtained or historical data based on the

existing business relationship (i. e. payment patterns to

date) reviewed in order to minimise the credit risk, all

depending on the nature and amount of the exposure

that the BMW Group is proposing to enter into.

Within the financial services business, the financed

items (e. g. vehicles, equipment and property) in the re-

tail customer and dealer lines of business serve as

first-

ranking collateral with a recoverable value. Security is

also put up by customers in the form of collateral asset

pledges, asset assignment and first-ranking mortgages,

supplemented where appropriate by warranties and

guarantees. If an item previously accepted as collateral

is acquired, it undergoes a multi-stage process of re-

possession

and disposal in accordance with the legal

situation prevailing in the relevant market. The assets

involved are generally vehicles which can be converted

into cash at any time via the dealer organisation.

Impairment losses are recorded as soon as credit risks

are identified on individual financial assets, using a

methodology specifically designed by the BMW Group.

More detailed information regarding this methodology

is provided in the section on accounting policies.

Creditworthiness testing is an important aspect of the

BMW Group’s credit risk management. Every borrower’s

creditworthiness is tested for all credit financing and

lease contracts entered into by the BMW Group. In the

case of retail customers, creditworthiness is assessed

using validated scoring systems integrated into the pur-

chasing process. In the area of dealer financing, credit-

worthiness is assessed by means of on going credit moni-

toring and an internal rating system that takes account

not only of the tangible situation of the borrower but

also of qualitative factors such as past reliability in busi-

ness relations.

The credit risk relating to derivative financial instruments

is minimised by the fact that the Group only enters into

such contracts with parties of first-class credit standing.

The general

credit risk on derivative financial instru-

ments utilised by the BMW Group is therefore not con-

sidered

to be significant.

A concentration of credit risk with particular borrowers

or groups of borrowers has not been identified in con-

junction with financial instruments.

Further disclosures relating to credit risk – in particular

with regard to the amounts of impairment losses recog-

nised – are provided in the explanatory notes to the rele-

vant categories of receivables in notes 27, 28 and 32.

Liquidity risk

The following table shows the maturity structure of ex-

pected contractual cash flows (undiscounted) for finan-

cial liabilities: