BMW 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

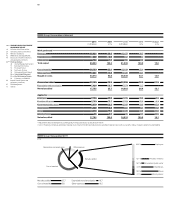

18 COMBINED GROUP AND COMPANY

MANAGEMENT REPORT

18 A Review of the Financial Year

20 General Economic Environment

24 Review of Operations

43 BMW Stock and Capital Market

46 Disclosures relevant for takeovers

and explanatory comments

49 Financial Analysis

49 Internal Management System

51 Earnings Performance

53 Financial Position

56 Net Assets Position

59 Subsequent Events Report

59 Value Added Statement

61 Key Performance Figures

62 Comments on BMW AG

66 Internal Control System and

explanatory comments

67 Risk Management

73 Outlook

to major corporate customers is primarily based on a

standardised method of measuring the value of the

vehicle(s) or other object(s) serving as collateral. The

recoverability of the value of items accepted as collateral

is regularly reviewed, measured and evaluated with

a view to assessing the impact on the level of risk not

covered by collateral.

In order to minimise risk from lending, we employ

standardised instruments such as subsequent security,

additional collateral, retention of vehicle documents or

higher upfront payments. In addition, the levels of au-

thority and responsibility of those involved in the lend-

ing process are clearly defined. The segment’s financial

services entities are managed and monitored by stipu-

lating limits. All process steps, such as the segregation

of duties and the use of techniques to recognise risks

at an early stage, are required to be applied worldwide.

Appropriate testing is carried out to ensure that the

systems are up to date and working properly. Local, re-

gional and centralised credit audits are also regularly

performed by Internal Audit to check compliance with

lending approval and authorisation rules procedures

as well as the processes and IT systems involved.

We continue to develop standardised credit decision

processes for the BMW Group worldwide. The focus here

is on improving the quality of credit applications, the

Group’s rating methodology and procedures used to se-

lect employees within the worldwide credit and coun-

terparty risk network.

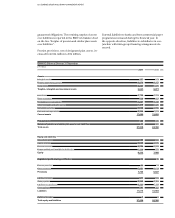

Risk criteria with worldwide applicability, such as debt

arrears, bad debt ratios and the proportion of financing

volumes subject to problems, are calculated and analysed

on a monthly or quarterly basis. This information is used

proactively to manage risks. The calculation of expected

losses serves as the basis for determining the level of risk

provision to be recognised in the balance sheet.

The segment’s portfolio risks are managed using state-of-

the-art techniques based on relevant regulatory

require-

ments such as Basel II. Unexpected losses are measured

using credit-value-at-risk methodologies and are moni-

tored and managed by means of a global limit system. Ap-

propriate control measures are applied as the need arises.

In the case of vehicles which remain with the Financial

Services segment at the end of a contract (leases and

credit financing arrangements with option of return),

there is a risk that the residual value calculated at the

inception of the contract may not be recovered when

the vehicle is sold (residual value risk). Residual values

are calculated uniformly throughout the BMW Group

in accordance with mandatory guidelines. For risk

management purposes, the expected risk-free residual

value of a vehicle is measured on the basis of external

and internal information. These amounts are checked

regularly and adjusted as appropriate. Residual values

of vehicles on used car markets are continuously moni-

tored and reported on. In addition to internal infor-

mation, our assessments also take account of external

market data. The BMW Group strives to effectively re-

duce the impact of declining residual values by actively

managing the life cycles of current models, optimising

reselling processes on international markets and im-

plementing targeted price and volume measures. Poten-

tial losses are measured by comparing forecasted mar-

ket values and contractual residual values by model and

market.

The risk of incurring unexpected losses is measured on

the basis of a value-at-risk approach. The portfolio risk

is also monitored and managed in the case of residual

value risks by a system of limits.

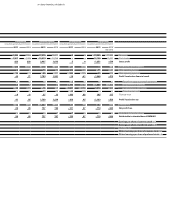

Interest-rate risks relate to potential losses caused by

changes in market interest rates and can arise when

fixed interest-rate periods for assets and liabilities

recognised in the balance sheet do not match. For risk

management purposes, all interest-related asset or

liability exposures are aggregated on a cash flow basis,

taking account of subsequent changes, e.g. in the case

of early termination of a contract. Interest-rate risks

are

managed on the basis of a value-at-risk approach

and a limit system. Limits are set using a benchmark-

oriented approach that focuses on interest-rates arrange-

ments contained in the original contracts. Compliance

with prescribed limits is tested regularly.

Liquidity risks can arise in the form of rising refinanc-

ing costs on the one hand and restricted access to funds

on the other. A matched funding approach is used stra-

tegically

to avoid liquidity risks as far as possible. Using

this approach, the segment endeavours – by regular

measurement and monitoring – to ensure that cash in-

flows and outflows from transactions in varying matu-

rity cycles will offset each other.