BMW 2011 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2011 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282

|

|

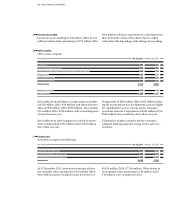

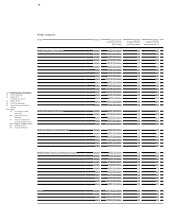

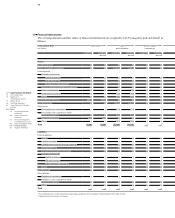

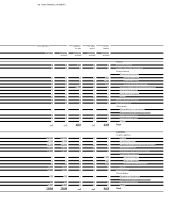

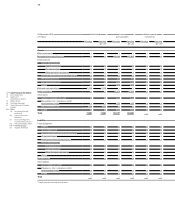

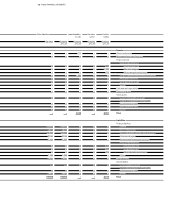

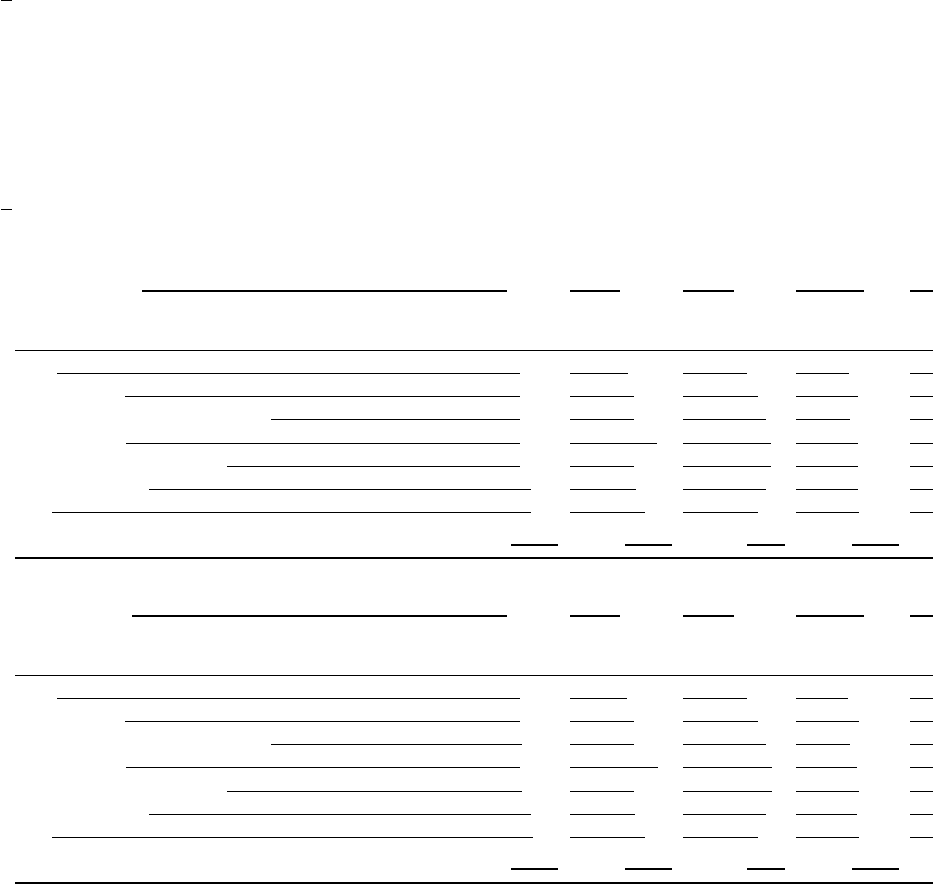

125 GROUP FINANCIAL STATEMENTS

31 December 2011 Maturity Maturity Maturity Total

in € million within between one later than

one year and five years five years

Bonds 8,009 16,069 4,495 28,573

Liabilities to banks 2,983 5,166 249 8,398

Liabilities from customer deposits (banking) 8,928 3,090 23 12,041

Commercial paper 5,478 – – 5,478

Asset backed financing transactions 3,152 6,233 – 9,385

Derivative instruments 999 1,456 24 2,479

Other 831 397 395 1,623

Financial liabilities 30,380 32,411 5,186 67,977

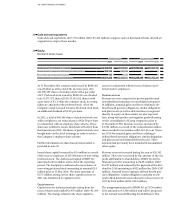

31 December 2010 Maturity Maturity Maturity Total

in € million within between one later than

one year and five years five years

Bonds 6,681 17,883 3,004 27,568

Liabilities to banks 3,514 3,676 550 7,740

Liabilities from customer deposits (banking) 7,590 3,076 23 10,689

Commercial paper 5,242 – – 5,242

Asset backed financing transactions 1,793 5,713 – 7,506

Derivative instruments 944 1,033 33 2,010

Other 756 454 388 1,598

Financial liabilities 26,520 31,835 3,998 62,353

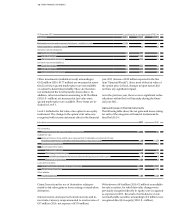

37

38

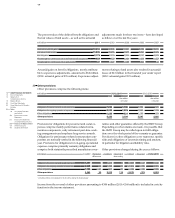

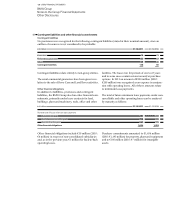

Income tax liabilities

Current income tax liabilities totalling € 1,363 million

(2010: € 1,198 million) include claims amounting to € 807

million (2010: € 549 million) which are expected to be

settled after more than twelve months. Some of the lia-

bilities may be settled earlier than this depending on

the timing of proceedings.

Current tax liabilities of € 1,363 million (2010: € 1,198

million) comprise € 122 million (2010: € 189 million) for

taxes payable and € 1,241 million (2010: € 1,009 million)

for tax provisions. In 2011, tax provisions of € 27 million

were reversed (2010: € – million).

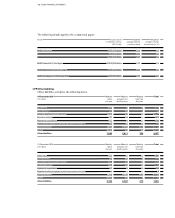

Financial liabilities

Financial liabilities include all liabilities of the BMW

Group at the relevant balance sheet dates relating to

The BMW Group uses various short-term and long-term

refinancing instruments on money and capital markets

to finance its operations. This diversification enables it

to obtain attractive market conditions.

The main instruments used are corporate bonds, asset-

backed financing transactions, liabilities to banks and

liabilities from customer deposits (banking).

financing activities. Financial liabilities comprise the

following:

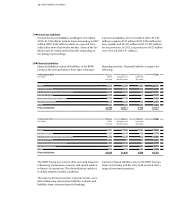

Customer deposit liabilities arise in the BMW Group’s

banks in Germany and the USA, both of which offer a

range of investment products.