Audi 2012 Annual Report Download - page 254

Download and view the complete annual report

Please find page 254 of the 2012 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

257

Consolidated Financial

Statements

202 Income Statement

203 Statement of Recognized

Income and Expense

204 Balance Sheet

205 Cash Flow Statement

206 Statement of Changes in Equity

Notes to the Consolidated

Financial Statements

208 Development of fixed assets

in the 2012 fiscal year

210 Development of fixed assets

in the 2011 fiscal year

212 General information

218 Recognition and

measurement principles

227 Notes to the Income Statement

233 Notes to the Balance Sheet

244 Additional disclosures

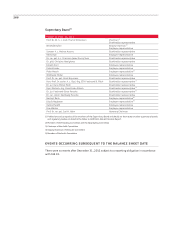

266 Events occurring subsequent to

the balance sheet date

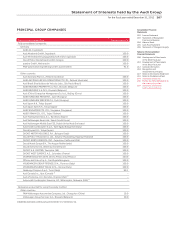

267 Statement of Interests

held by the Audi Group

In the case of regression analysis, the performance of the underlying transaction is viewed as an

independent variable, while that of the hedging transaction is regarded as a dependent variable.

The transaction is classed as effective hedging if the coefficients of determination and escalation

factors are appropriate. All of the hedging relationships verified using this statistical method

proved to be effective as of the year-end date. There was ineffectiveness in 2012 resulting from

cash flow hedges that led to a EUR 2 million decrease in the financial result. In 2011, there was

ineffectiveness amounting to EUR 3 million that led to an improvement of the financial result.

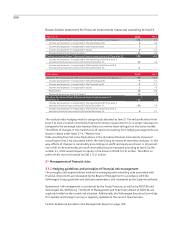

Nominal volume of derivative financial instruments

The nominal volumes of the presented cash flow hedges for hedging currency risks and com-

modity price risks represent the total of all buying and selling prices on which the transactions

are based.

EUR million Nominal volumes

Dec. 31, 2012

Residual time

to maturity

up to 1 year

Residual time

to maturity

up to 5 years Dec. 31, 2011

Cash flow hedges 26,144 10,611 15,534 27,961

Foreign exchange contracts 25,876 10,527 15,349 27,156

Currency option transactions –– – 454

Commodity futures 269 84 185 351

Other derivatives 1,318 773 545 1,964

Foreign exchange contracts 698 426 272 1,021

Commodity futures 620 347 272 942

The derivative financial instruments used exhibit a maximum hedging term of five years.

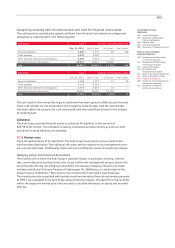

38 Cash Flow Statement

The Cash Flow Statement details the payment streams for both the 2012 fiscal year and the pre-

vious year, categorized according to cash used and received for operating, investing and finan-

cing activities. The effects of changes in foreign exchange rates on cash flows are presented sepa-

rately.

Cash flow from operating activities includes all payment streams in connection with ordinary

activities and is presented using the indirect calculation method. Starting from the profit before

profit transfer and tax, all income and expenses with no impact on cash flow (mainly write-downs)

are excluded.

Cash flow from operating activities in 2012 included payments for interest received amounting

to EUR 154 (180) million and for interest paid amounting to EUR 53 (45) million. In 2012 , the

Audi Group received dividends and profit transfers totaling EUR 290 (211) million. The income

tax payments item substantially comprises payments made to Volkswagen AG, Wolfsburg, on

the basis of the single-entity relationship for tax purposes in Germany, as well as payments to

foreign tax authorities.

Cash flow from investing activities includes capitalized development costs as well as additions

to other intangible assets, property, plant and equipment, long-term investments and non-

current loans. The proceeds from the disposal of assets, the proceeds from the sale of shares,

and the change in securities and fixed deposits are similarly reported in cash flow from investing

activities.

The acquisition and first-time consolidation of subsidiaries resulted in a total outflow of

EUR 591 (37) million. This figure also includes changes to cash flows resulting from first-time

consolidations and capital increases in the case of non-consolidated subsidiaries. The acquisition

of investments in other participating interests resulted in an outflow of EUR 3,020 (27) million.

Cash flow from financing activities includes cash used for the transfer of profit, as well as

changes in financial liabilities.