Audi 2012 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2012 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

197

Management Report

140 Audi Group

151 Business and underlying

situation

173 Financial performance

indicators

176 Social and ecological aspects

190 Risks, opportunities

and outlook

190 Risk report

197 Report on post-balance sheet

date events

197 Report on expected

developments

201 Disclaimer

REPORT ON POST-BALANCE SHEET DATE EVENTS

There were no reportable events of material significance after December 31, 2012.

REPORT ON EXPECTED DEVELOPMENTS

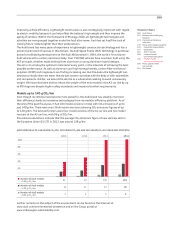

Anticipated development of the economic environment

General economic situation

The Audi Group expects global economic growth to continue in 2013. The emerging economies

in Asia and Latin America should again achieve the highest growth rates, while only a moderate

rise in economic output is expected in the leading industrial nations. We anticipate further ex-

pansion in the global economy in 2014.

Western Europe’s economic development will remain dominated by sovereign debt crises in 2013.

A recessionary pattern is expected in the EU’s southern member states. The situation is only likely

to improve in 2014 if clear progress is made in solving the sovereign debt crises. It is expected

that Germany’s export-driven economy will not remain entirely unscathed by the difficult eco-

nomic conditions in Western Europe, and will achieve only low growth in 2013. However, the

German labor market is likely to remain stable for the time being, thus underpinning domestic

demand. Depending on how the remainder of Western Europe fares, the German economy could

see growth pick up somewhat in 2014.

Most countries of Central and Eastern Europe should again enjoy much higher economic growth

than Western Europe in 2013 and 2014. Nevertheless, their economic fortunes will equally be

influenced by the developments in Western Europe.

The Audi Group anticipates that U.S. economic output in 2013 will grow at a similar rate to last

year. Provided the global economy recovers, 2014 is likely to bring increased growth in the United

States.

The Latin American economy should display increased momentum in 2013 and be able to main-

tain that performance in 2014. In international terms, the region’s growth rate remains above

the average.

Asia’s emerging economies are expected to show an even more dynamic performance. China’s

growth rates in 2013 and 2014 should be on a par with the previous year. On the other hand,

over the next two years the Indian economy is likely to expand at an even faster rate than in

2012. In Japan, economic expansion is likely to abate in 2013 following the country’s recovery

from the consequences of the 2011 natural disaster. The Japanese economy is not expected to

show buoyancy until 2014.

Car market

The Audi Group again expects to see global car markets experience mixed fortunes in 2013. All in

all, we anticipate a slight rise in global demand. We expect the worldwide car market to show

rather more dynamism in 2014.

In Western Europe the Company again expects to see a decline in passenger car sales in 2013.

Due to the continuing sovereign debt crises and the unsettling effect this is having on consumers,

we forecast flat or declining levels of new registrations in virtually all Western European markets.

Nor is the German car market likely to be immune to these developments, with sales of passenger

cars expected to fall slightly in 2013. If the economic environment in Western Europe regains

stability, we expect that demand for cars will improve again in 2014.