Audi 2012 Annual Report Download - page 222

Download and view the complete annual report

Please find page 222 of the 2012 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

225

Consolidated Financial

Statements

202 Income Statement

203 Statement of Recognized

Income and Expense

204 Balance Sheet

205 Cash Flow Statement

206 Statement of Changes in Equity

Notes to the Consolidated

Financial Statements

208 Development of fixed assets

in the 2012 fiscal year

210 Development of fixed assets

in the 2011 fiscal year

212 General information

218 Recognition and

measurement principles

218 Recognition of income

and expenses

218 Intangible assets

219 Property, plant

and equipment

220 Leasing and rental assets

220 Investment property

220 Investments accounted for

using the equity method

220 Impairment tests

221 Financial instruments

224 Other financial assets and

other receivables

224 Deferred tax

224 Inventories

225 Securities, cash and

cash equivalents

225 Provisions for pensions

225 Other provisions

225 Liabilities

226 Government grants

226 Management’s estimates

and assessments

227 Notes to the Income Statement

233 Notes to the Balance Sheet

244 Additional disclosures

266 Events occurring subsequent to

the balance sheet date

267 Statement of Interests

held by the Audi Group

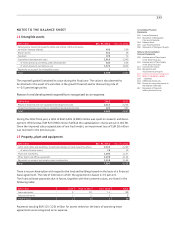

SECURITIES, CASH AND CASH EQUIVALENTS

Securities held as current assets are measured at market value, i.e. at the trading price on the

balance sheet date. Cash and cash equivalents are stated at their nominal value. The cash figures

encompass cash and cash equivalents. Included under cash equivalents are financial resources

that are highly liquid with an insignificant risk of fluctuations in value.

The Audi Group is integrated into the Volkswagen Group’s financial management. As part of

cash pooling arrangements, balances are settled on a daily basis and transformed into amounts

owed to or from Volkswagen AG, Wolfsburg. This promotes the efficiency of both intra-Group

and external transactions and also reduces transaction costs. The cash pool receivables are allo-

cated to cash and cash equivalents on the basis of their character as cash equivalents.

PROVISIONS FOR PENSIONS

Actuarial measurement of provisions for pensions is based on the projected unit credit method

for defined retirement benefit plans as specified in IAS 19 (Employee Benefits). This method

takes account of pensions and entitlements to future pensions known at the balance sheet date

as well as anticipated future pay and pension increases. The actuarial interest rate continues to

be determined on the basis of profits realized on the capital market for top-ranking corporate

bonds. Actuarial gains and losses are reported in a separate line item within equity, with no

effect on income, after taking deferred tax into account.

OTHER PROVISIONS

In accordance with IAS 37, provisions are recognized if an obligation existing toward third parties

is likely to lead to cash outflows and where the amount of the obligation can reliably be estimated.

Pursuant to IAS 37, the other provisions for all discernible risks and uncertain liabilities are

reported at their probable cost and are not offset against recourse entitlements. Provisions

with over one year to maturity are measured at their discounted settlement value as of the

balance sheet date. Market rates are used as the discount rates. A nominal interest rate of

0.7 (1.8) percent was applied domestically. The settlement value also includes the expected

cost increases. The non-current portions of provisions for service anniversary awards and partial

retirement were discounted at 3.2 (4.6) percent. The changes to be applied from 2013 to the

accounting treatment of bonus payment obligations under partial retirement programs are not

expected to lead to any material changes to the net assets, financial position and results of

operations.

LIABILITIES

Non-current liabilities are reported in the Balance Sheet at amortized cost. Any differences be-

tween the historical costs and the repayment value are taken into account using the effective

interest method. Liabilities from financial lease agreements are reported in the Balance Sheet at

the present value of the leasing installments. Current liabilities are recognized at the repayment

value or settlement amounts.