Audi 2012 Annual Report Download - page 211

Download and view the complete annual report

Please find page 211 of the 2012 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285

|

|

214

GROUP OF CONSOLIDATED COMPANIES

In addition to AUDI AG, the Consolidated Financial Statements include all principal companies in

which AUDI AG can directly or indirectly govern the financial and operating policies so as to ob-

tain benefit from the activities of the entities (subsidiaries) in question. Consolidation begins at

that point in time when AUDI AG has control of an entity; it ends when control is lost.

Associated companies are accounted for using the equity method.

Non-consolidated subsidiaries as well as participating interests are always reported at amor-

tized cost because no active market exists for the shares of these companies and no fair value

can reliably be determined with a justifiable amount of effort.

Where there is evidence that the fair value is lower, this fair value is recognized. These subsidiar-

ies are principally companies with only limited business operations. The total equity contributed

by these subsidiaries is 0.9 (1.0) percent of the Group’s equity. The total profit after tax of these

companies amounts to 0.1 (0.1) percent of the Audi Group’s profit after tax.

On July 19, 2012, the Audi Group, through Automobili Lamborghini S.p.A., Sant’Agata Bolognese

(Italy), a subsidiary of AUDI AG, acquired 100 percent of the voting rights in the motorcycle

company DUCATI MOTOR HOLDING S.P.A., Bologna (Italy) in exchange for payment of a purchase

price of EUR 747 million. This acquisition of Ducati – an internationally renowned manufacturer

of motorcycles in the premium segment with huge expertise in high-performance engines and

lightweight construction – marks the Audi Group’s first foray into the growth market of high-end

motorcycles. During the 2011 calendar year, the Ducati Group sold 42,016 motorcycles, generat-

ing revenue amounting to EUR 479 million.

Due to time constraints, it was not possible for the acquired assets and liabilities to be analyzed

in full before publication of the Consolidated Financial Statements. The provisional figure for

goodwill of EUR 290 million includes benefits that cannot be separated out and that are not

based on contractual or other rights, such as the expertise and knowledge of Ducati employees.

Goodwill is not deductible for tax purposes. The transaction-related costs, totaling EUR 1 million

to date, are recognized as an expense.

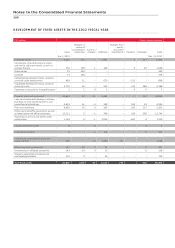

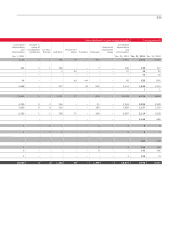

The provisional allocation of the purchase price to the assets and liabilities is shown in the fol-

lowing table:

EUR million

IFRS carrying

amounts at

acquisition date

Purchase price

allocation

Fair values at the

time of acquisition

Brand names 211 193 404

Customer relations 49 131 180

Other intangible assets 78 17 95

Land and buildings 78 3 81

Other non-current assets 25 8 33

Inventories 83 0 83

Cash and cash equivalents 150 – 150

Other current assets 154 – 154

Total assets 828 352 1,180

Non-current liabilities 106 108 214

Current liabilities 510 – 510

Total debts 616 108 724

The gross value of the acquired receivables at the time of acquisition was EUR 153 million, with

a net carrying amount of EUR 142 million (corresponding to the fair value).