Audi 2012 Annual Report Download - page 218

Download and view the complete annual report

Please find page 218 of the 2012 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

221

Consolidated Financial

Statements

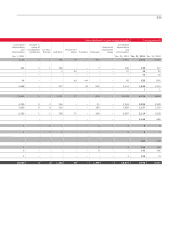

202 Income Statement

203 Statement of Recognized

Income and Expense

204 Balance Sheet

205 Cash Flow Statement

206 Statement of Changes in Equity

Notes to the Consolidated

Financial Statements

208 Development of fixed assets

in the 2012 fiscal year

210 Development of fixed assets

in the 2011 fiscal year

212 General information

218 Recognition and

measurement principles

218 Recognition of income

and expenses

218 Intangible assets

219 Property, plant

and equipment

220 Leasing and rental assets

220 Investment property

220 Investments accounted for

using the equity method

220 Impairment tests

221 Financial instruments

224 Other financial assets and

other receivables

224 Deferred tax

224 Inventories

225 Securities, cash and

cash equivalents

225 Provisions for pensions

225 Other provisions

225 Liabilities

226 Government grants

226 Management’s estimates

and assessments

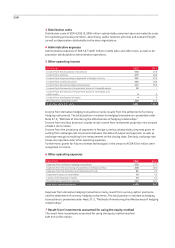

227 Notes to the Income Statement

233 Notes to the Balance Sheet

244 Additional disclosures

266 Events occurring subsequent to

the balance sheet date

267 Statement of Interests

held by the Audi Group

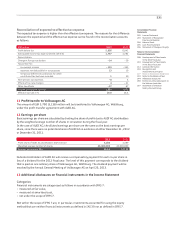

Cash flows are generally calculated on the basis of the expected growth rates in the sales markets

concerned. Estimated cash flow after the end of the planning period is based on a maximum rate

of growth of 1.5 (2.0) percent per year.

Impairment tests are carried out for development activities, acquired property rights, and prop-

erty, plant and equipment on the basis of expected product life cycles, the respective revenue and

cost situation, current market expectations and currency-specific factors. Expected future cash

flows to other intangible assets and fixed tangible assets are discounted with country-specific

discount rates that adequately reflect the risk and amount to 6.6 (6.8) percent before tax.

Impairment losses pursuant to IAS 36 are recognized where the recoverable amount, i.e. the

higher amount from either the use or disposal of the asset in question, has declined below its

carrying amount. If necessary, an impairment loss resulting from this test is recognized.

Sensitivity analyses have shown that even in the case of differing key assumptions within a rea-

listic framework, there is no need to recognize an impairment for goodwill and other intangible

assets with an indefinite useful life.

FINANCIAL INSTRUMENTS

Financial instruments are contracts that create financial assets at one company and, at the same

time, create financial debts or equity instruments at another company.

Financial instruments are recognized and measured in accordance with IAS 39.

According to this, financial instruments are divided into the following categories:

– available-for-sale financial assets,

– loans and receivables,

– held-to-maturity investments,

– financial assets measured at fair value through profit or loss.

The Audi Group does not have any financial assets that fall into the category of “held-to-

maturity investments.”

Financial liabilities are classed as follows:

– financial liabilities measured at fair value through profit or loss,

– financial liabilities measured at amortized cost.

The fair value option, in other words measuring certain assets and liabilities at fair value

through profit or loss, is not applied in the Audi Group.

Assignment to a category depends on the purpose for which the financial instruments were

acquired and is reviewed at the end of each reporting period.

For purchases and sales in the customary manner, recognition takes place using settlement date

accounting (in other words, on the day on which an asset is delivered).

Initial measurement of financial assets and liabilities is carried out at fair value.

Subsequent measurement is dependent on the category assigned in accordance with IAS 39 and

is carried out either at amortized cost or at fair value.

The amortized cost of a financial asset or financial liability, using the effective interest method,

is the amount at which a financial instrument was measured at initial recognition minus any

principal repayments, impairment losses or uncollectible debts.