Audi 2012 Annual Report Download - page 224

Download and view the complete annual report

Please find page 224 of the 2012 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

227

Consolidated Financial

Statements

202 Income Statement

203 Statement of Recognized

Income and Expense

204 Balance Sheet

205 Cash Flow Statement

206 Statement of Changes in Equity

Notes to the Consolidated

Financial Statements

208 Development of fixed assets

in the 2012 fiscal year

210 Development of fixed assets

in the 2011 fiscal year

212 General information

218 Recognition and

measurement principles

218 Recognition of income

and expenses

218 Intangible assets

219 Property, plant

and equipment

220 Leasing and rental assets

220 Investment property

220 Investments accounted for

using the equity method

220 Impairment tests

221 Financial instruments

224 Other financial assets and

other receivables

224 Deferred tax

224 Inventories

225 Securities, cash and

cash equivalents

225 Provisions for pensions

225 Other provisions

225 Liabilities

226 Government grants

226 Management’s estimates

and assessments

227 Notes to the Income Statement

233 Notes to the Balance Sheet

244 Additional disclosures

266 Events occurring subsequent to

the balance sheet date

267 Statement of Interests

held by the Audi Group

Developments in this environment that deviate from assumptions and are beyond the manage-

ment’s sphere of influence may cause the actual amounts to differ from the estimates originally

anticipated. If the actual development varies from the anticipated development, the premises

and, if necessary, the carrying amounts for the assets and liabilities in question are adjusted

accordingly.

The global economy grew less dynamically in 2012. As far as 2013 is concerned, momentum for

growth is expected to be greater in the emerging markets of Asia and Latin America, whilst only

a moderate increase in economic performance can be expected in the leading industrialized

nations. Overall, as things currently stand, no major adjustment is expected in the carrying

amounts of assets and liabilities in the Consolidated Balance Sheet in the coming fiscal year.

Management’s estimates and assumptions were based in particular on assumptions regarding

the development of the economy as a whole, the development of automotive and motorcycle

markets, and the development of the basic legal parameters. These aspects, as well as further

assumptions, are described in detail in the report on expected developments.

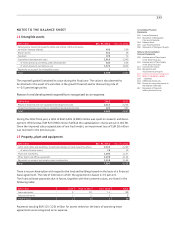

NOTES TO THE INCOME STATEMENT

1 Revenue

The composition of the revenue of the Group, by brand, is as follows:

EUR million 2012 2011

Audi brand 35,851 34,456

Lamborghini brand 421 268

Other Volkswagen Group brands 2,725 3,444

Other automotive business 9,565 5,928

Automotive segment 48,562 44,096

Ducati brand 148 –

Other motorcycles business 61 –

Motorcycles segment 209 –

Revenue 48,771 44,096

As well as sales generated by the Audi and Lamborghini brands, the Automotive segment also

includes revenue from the other brands in the Volkswagen Group. Revenue from other automo-

tive business primarily includes proceeds from the sale of engines and genuine parts. Due to the

increasing degree of localization, the revenue from deliveries of parts sets to China has been

reported under other automotive business since 2012. In the previous year, EUR 2,492 million

from the CKD business were included in the revenue of the Audi brand.

Ducati motorcycles are sold in the Motorcycles segment.

2 Cost of sales

Amounting to EUR 39,046 (36,000) million, cost of sales comprises the costs incurred in gener-

ating revenue and purchase prices in trading transactions. This item also includes expenses result-

ing from the formation of provisions for warranty costs, for development costs that cannot be

capitalized, for depreciation and impairment losses of capitalized development costs, and for

property, plant and equipment for manufacturing purposes. Cost of sales includes unscheduled

impairment losses on intangible assets and property, plant and equipment amounting to

EUR 3 (93) million.