Audi 2012 Annual Report Download - page 214

Download and view the complete annual report

Please find page 214 of the 2012 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

217

Consolidated Financial

Statements

202 Income Statement

203 Statement of Recognized

Income and Expense

204 Balance Sheet

205 Cash Flow Statement

206 Statement of Changes in Equity

Notes to the Consolidated

Financial Statements

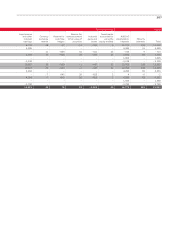

208 Development of fixed assets

in the 2012 fiscal year

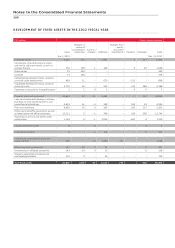

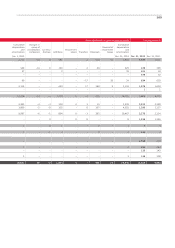

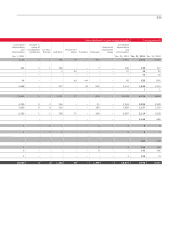

210 Development of fixed assets

in the 2011 fiscal year

212 General information

212 Accounting principles

214 Group of consolidated

companies

216 Consolidation principles

217 Foreign currency translation

218 Recognition and

measurement principles

227 Notes to the Income Statement

233 Notes to the Balance Sheet

244 Additional disclosures

266 Events occurring subsequent to

the balance sheet date

267 Statement of Interests

held by the Audi Group

recognized if necessary. Within the Audi Group, the predecessor method is applied in relation to

common control transactions. Under this method, the assets and liabilities of the acquired com-

pany or business operations are measured at the gross carrying amounts of the previous parent

company. The predecessor method thus means that no adjustment to the fair value of the acquired

assets and liabilities is performed at the time of acquisition; any goodwill arising during initial

consolidation is adjusted against equity, without affecting income. Contingent considerations

are measured at their fair value at the time of acquisition. Subsequent changes to the value of

contingent consideration do not as a rule result in an adjustment of the measurement at the

time of acquisition. Other costs of purchase that are not associated with the procurement of

equity are not counted towards the purchase price but are immediately recognized as an expense.

The Consolidated Financial Statements also include securities funds whose assets are attributable

in substance to the Group.

Receivables and liabilities between consolidated companies are netted, and expenses and income

eliminated. Interim profits and losses are eliminated from Group inventories and fixed assets.

Consolidation processes affecting income are subject to deferrals of income taxes; deferred tax

assets and liabilities are offset where the term and tax creditor are the same.

The same accounting policies for determining the pro rata equity are applied to Audi Group

companies accounted for using the equity method. This is done on the basis of the last set of

audited financial statements of the company in question.

FOREIGN CURRENCY TRANSLATION

The currency of the Audi Group is the euro (EUR). Foreign currency transactions in the individual

financial statements of AUDI AG and the subsidiaries are translated on the basis of the exchange

rates at the time of the transaction in each case. Monetary items in foreign currencies are trans-

lated at the exchange rate applicable on the balance sheet date. Exchange differences are recog-

nized in the current-period income statements of the respective Group companies.

The foreign companies belonging to the Audi Group are independent entities and prepare their

financial statements in their local currency. The only exceptions are AUDI HUNGARIA SERVICES

Zrt., Győr (Hungary), AUDI HUNGARIA MOTOR Kft., Győr (Hungary), and Audi Volkswagen Middle

East FZE, Dubai (United Arab Emirates), which prepare their annual financial statements in euros

and U.S. dollars respectively rather than in local currency. The concept of the “functional currency”

is applied when translating financial statements prepared in foreign currency. Assets and liabili-

ties, with the exception of equity, are translated at the reporting date exchange rate. The effects

of foreign currency translation on equity are reported in the currency exchange reserve with no

effect on income. The items in the Income Statement are translated using weighted average

monthly rates. Currency translation variances arising from the differing exchange rates used in

the Balance Sheet and Income Statement are recognized in equity, without affecting income,

until the disposal of the subsidiary.