Audi 2012 Annual Report Download - page 251

Download and view the complete annual report

Please find page 251 of the 2012 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

254

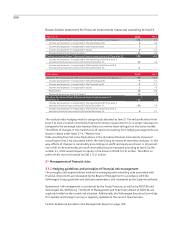

Currency risks

The Audi Group is exposed to exchange rate fluctuations in view of its international business

activities. The measures implemented to hedge against these currency risks are coordinated

regularly between AUDI AG and the Group Treasury of Volkswagen AG, Wolfsburg, in accordance

with Volkswagen’s organizational guideline.

These risks are limited by concluding appropriate hedges for matching amounts and maturities.

The hedging transactions are performed centrally for the Audi Group by Volkswagen AG on the

basis of an agency agreement. The results from hedging transactions are credited or debited

each month by the Group Treasury of Volkswagen AG on the basis of the contract volume allocated

to the Audi Group.

In accordance with the Volkswagen organizational guideline, AUDI AG additionally concludes

hedging transactions of its own to a limited extent, where this helps to simplify current opera-

tions.

Marketable derivative financial instruments (foreign exchange contracts, currency option trans-

actions and currency swaps) are used for this purpose. Contracts are concluded exclusively with

first-rate national and international banks whose creditworthiness is regularly examined by

leading rating agencies and Central Risk Management at Volkswagen AG.

For the purpose of managing currency risks, exchange rate hedging in the 2012 fiscal year focused

on the U.S. dollar, the British pound, the Japanese yen and the Chinese renminbi.

Currency risks pursuant to IFRS 7 arise as a result of financial instruments that are denominated

in a currency other than the functional currency and are of a monetary nature. Exchange rate

variances from the translation of financial statements into the Group currency (translation risk)

are disregarded. Within the Audi Group, the principal non-derivative monetary financial instru-

ments (liquid assets, receivables, securities held and borrowed capital instruments held, inter-

est-bearing liabilities, interest-free liabilities) are either denominated directly in the functional

currency or substantially transferred to the functional currency through the use of derivatives.

Above all, the generally short maturity of the instruments also means that potential exchange

rate movements have only a very minor impact on profit or equity.

Currency risks are measured using sensitivity analyses, during which the impact on profit after

tax and equity of hypothetical changes to relevant risk variables is assessed. All non-functional

currencies in which the Audi Group enters into financial instruments are fundamentally treated

as relevant risk variables.

The periodic effects are determined by applying the hypothetical changes in the risk variables

to the inventory of financial instruments on the reporting date. It is assumed for this purpose

that the inventory on the reporting date is representative of the entire year. Movements in the

exchange rates of the underlying currencies for the hedged transactions affect the cash flow

hedge reserve in equity and the fair value of these hedging transactions.

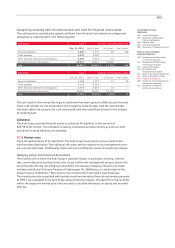

Fund price risks

The securities funds created using surplus liquidity are exposed, in particular, to an equity and

bond price risk that may arise from fluctuations in stock market prices and indices, and market

interest rates. Changes in bond prices resulting from a change in market interest rates, and the

measurement of currency risks and other interest rate risks from the securities funds, are quan-

tified separately in the corresponding notes on “Currency risks” and “Interest rate risks.”

Risks from securities funds are generally countered by maintaining a broad mix of products,

issuers and regional markets when making investments, as stipulated in the investment guide-

lines. Where necessitated by the market situation, currency hedges in the form of futures con-

tracts are also used.

Such measures are coordinated by AUDI AG in agreement with the Group Treasury of

Volkswagen AG, Wolfsburg, and implemented at operational level by the securities funds’ risk

management teams.