Audi 2012 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2012 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285

|

|

198

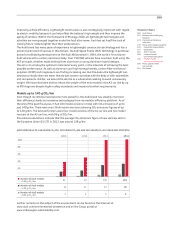

Sales of automobiles in Central and Eastern European countries should initially remain on a par

with the previous year in 2013, before the markets expand more dynamically in 2014.

The Audi Group expects the United States to maintain its upward trend in new registrations of

cars and light commercial vehicles in 2013. Demand will probably benefit from consistently high

replacement demand and the continuing availability of favorable credit terms. The U.S. automo-

bile market’s solid performance should continue in 2014 as well. In Latin American car markets,

we expect demand to be on a par with the previous year in 2013. Sales of new vehicles are then

expected to pick up somewhat in 2014.

We expect demand for cars in the Asia-Pacific region to show a mixed performance in 2013 and

2014. The growth trend in new registrations in China should hold up, with slightly less momen-

tum. In India, too, the high pace of growth is likely to calm somewhat in 2013 before returning

to higher growth rates in 2014. In Japan, we anticipate a decline in general demand for cars

following the withdrawal of state aid and the meeting of replacement demand after the natural

disaster; the market should then stabilize again in 2014.

Motorcycle market

For 2013 and 2014 we expect to see a slight rise in demand for motorcycles in the displacement

segment above 500 cc in the markets that are relevant for the Ducati brand. Growth is likely to

be vigorous in emerging economies, but generally more moderate in established markets. In

Southern European motorcycle markets, we forecast demand for motorcycles to be rather subdued

because of the protracted sovereign debt crises, which have unsettled consumers there.

Anticipated development of the Audi Group

Continuing high uncertainty about the further direction of the economy – especially in light of the

sovereign debt crises in many countries – remains a major challenge for the automotive industry

and consequently also for the Audi Group. The situation is exacerbated by increasingly intensive

competition and the ongoing technological revolution brought on by the development of alter-

native mobility and drive concepts.

Among its strategic objectives, the Audi Group practices value-oriented corporate management.

It is steadily defining and implementing measures designed to protect and boost its interna-

tional competitiveness. The Audi Group thus believes it is well-equipped to adhere to its course

of qualitative growth over the coming years.

Anticipated development of deliveries

For the 2013 and 2014 fiscal years, the Audi Group expects to be able to increase deliveries of

its core brand Audi. Thus, the 2015 target to deliver 1.5 million automobiles of the brand with

the four rings could be achieved sooner. The Company is aiming to increase its market shares in

a large number of sales markets thanks to its attractive product range, thus further improving

its already strong competitive position in the premium car segment.

Deliveries of the Audi brand in the key high-volume markets of Western Europe should thus remain

at the high level of previous years despite the anticipated difficult environment and falling over-

all market demand.

In the Central and Eastern Europe region – and especially Russia – the Company is targeting a

dynamic increase in deliveries to customers.