Singapore Airlines 2008 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2008 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Singapore Airlines Annual Report 2007-08

97

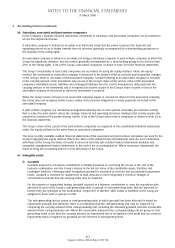

2 Accounting Policies (continued)

(x) Taxation (continued)

(ii) Deferred tax (continued)

• Inrespectofdeductibletemporarydifferencesandcarryforwardofunusedtaxcreditsandunusedtaxlosses,

if it is not probable that taxable profit will be available against which the deductible temporary differences and

carry forward of unused tax credits and unused tax losses can be utilised.

The carrying amount of deferred tax asset is reviewed at each balance sheet date and reduced to the extent that it

is no longer probable that taxable profit will be available to allow all or part of the deferred tax asset to be utilised.

Unrecognised deferred tax assets are reassessed at each balance sheet date and are recognised to the extent that

it has become probable that future taxable profit will allow the deferred tax asset to be utilised.

Deferred tax assets and liabilities are measured at the tax rates that are expected to apply to the year when the

asset is realised or the liability is settled, based on tax rates and tax laws that have been enacted or substantively

enacted at the balance sheet date.

Deferred taxes are recognised in the profit and loss account except that deferred tax relating to items recognised

directly in equity is recognised directly in equity and deferred tax arising from a business combination is adjusted

against goodwill on consolidation.

(y) Revenue

Revenue is recognised to the extent that it is probable that the economic benefits will flow to the Group and the

revenue can be reliably measured. Revenue is measured at the fair value of consideration received or receivable.

Revenue is principally earned from the carriage of passengers, cargo and mail, the rendering of airport terminal

services, engineering services, training of pilots, air charters and tour wholesaling and related activities. Revenue for

the Group excludes dividends from subsidiary companies and intra-group transactions.

Passenger and cargo sales are recognised as operating revenue when the transportation is provided. The value of

unused tickets and air waybills is included in current liabilities as “sales in advance of carriage”. The value of tickets are

recognised as revenue if unused after two years.

Revenue from the provision of airport terminal services is recognised upon rendering of services.

Revenue from repair and maintenance of aircraft, engine and component overhaul is recognised based on the

percentage of completion of the projects. The percentage of completion of the projects is determined based on the

number of man-hours incurred to date against the estimated man-hours needed to complete the projects.

Rental income from lease of aircraft is recognised on a straight-line basis over the lease term.

(z) Income from investments

Dividend income from investments is recognised when the Group’s right to receive the payment is established.

Interest income from investments and fixed deposits is recognised using the effective interest method.

(aa) Employee benefits

(i) Equity compensation plans

Employees of the Group receive remuneration in the form of share options and share awards as consideration for

services rendered.

The Group has in place the Singapore Airlines Limited Employee Share Option Plan, the Singapore Airport Terminal

Services Limited Employee Share Option Plan and the SIA Engineering Company Limited Employee Share Option

Plan for granting of share options to senior executives and all other employees. The exercise price approximates

the market value of the shares at the date of grant.

NOTES TO THE FINANCIAL STATEMENTS

31 March 2008