Singapore Airlines 2008 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2008 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

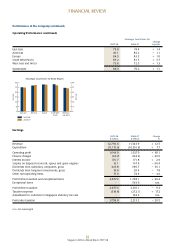

PerCent

Cents

ReturnonTurnover(%)

ReturnonAverageEquityHolders'Funds(%)

ReturnonAverageTo talAssets(%)

BasicEarningsPerShare(¢)

0

5

10

15

20

25

0

30

60

90

120

150

180

2007-082006-072005-062004-052003-04

Group Profitability Ratios

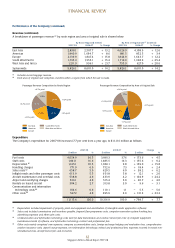

$Million

Dollars

EquityHolders'Funds($Million)

TotalAssets($Million)

NAVPerShare($)

0

5,000

10,000

15,000

20,000

25,000

30,000

0

2

4

6

8

10

12

14

20082007200620052004

Group Equity Holders’ Funds, To tal Assets

and Net Asset Value (NAV) Per Share

31March

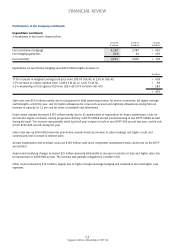

$Million

$Million

NetLiquidAssets

NetDebt

-500

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

-500

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

20082007200620052004

Group Net Liquid Assets and Net Debt

31March

Singapore Airlines Annual Report 2007-08

55

FINANCIAL REVIEW

Performance of the Group (continued)

Group Earnings (continued)

ProtabilityratiosoftheGroupareasfollows:

2007-08 2006-07 Change

% % % points

Returnonturnover 13.4 15.2 – 1.8

Returnonaveragetotalassets 8.1 8.9 – 0.8

Returnonaverageequityholders’funds 13.6 14.9 – 1.3

Financial Position of the Group

TheGroup’stotalassetsstoodat$26,515millionasat31March2008,up2.0percentfromayearago.Netassetvalueper

shareimproved5.5percentto$12.77.

Equityholders’fundsincreased0.2percentto$15,125millionasat31March2008,mainlyattributabletoprotforthe

nancialyear,partiallyoffsetbypaymentofdividendsandcapitalreductionduringthenancialyear.Dividendspaidincluded

specialdividendof50centspershareandnaldividendof35centspershareinrespectofnancialyear2006-07andinterim

dividendof20centspershareinrespectofnancialyear2007-08.Pursuanttoacapitalreductionexercise84,309,846shares

werecancelledatthepriceof$18.46pershare,while1,093,530shareswereissuedunderatop-upofferofnewsharesatthe

priceof$18.46persharetoenableshareholderstorounduptheirholdingofsharesafterthecapitalreductiontothenearest

multipleof200shares.

TheGroupimproveditsnetliquidassetsR1positionfrom$3,810millionayearagoto$3,927millionasat31March2008.This

strongerliquidityposition(+$117million)wasaresultofstrongercashgeneratedfromoperations.Totaldebttoequityratio

improvedmarginallyby0.01timesto0.11times.

R1 Net liquid assets is defined as the sum of cash and bank balances (net of bank overdrafts), investments, loans to third parties, and net of

finance lease commitments, loans and fixed rate notes issued.