Singapore Airlines 2008 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2008 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Singapore Airlines Annual Report 2007-08

140

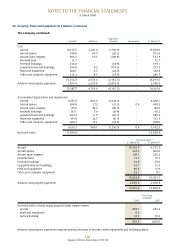

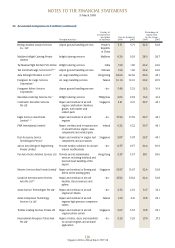

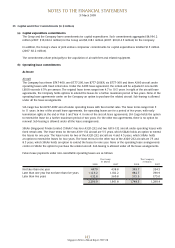

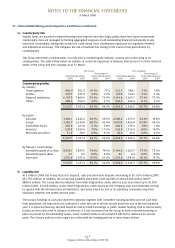

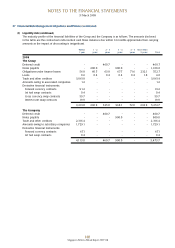

28 Trade Debtors (in $ million)

The table below is an analysis of trade debtors as at 31 March:

The Group The Company

31 March 31 March

2008 2007 2008 2007

Not past due and not impaired 1,835.0 1,572.7 1,363.7 1,211.8

Past due but not impaired 198.2 156.9 65.9 36.8

2,033.2 1,729.6 1,429.6 1,248.6

Impaired trade debtors – collectively assessed 18.2 14.7 3.7 6.3

Less: Accumulated impairment losses (10.2) (7.1) (2.2) (2.9)

8.0 7.6 1.5 3.4

Impaired trade debtors – individually assessed

Customers in bankruptcy or other financial

reorganisation 5.0 6.1 0.3 0.4

Customers who default in payment within stipulated

framework of IATA Clearing House or Bank

Settlement Plan 4.5 1.7 4.2 1.0

Less: Accumulated impairment losses (6.9) (7.3) (2.2) (1.4)

2.6 0.5 2.3 -

Total trade debtors, net 2,043.8 1,737.7 1,433.4 1,252.0

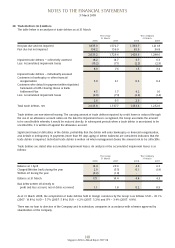

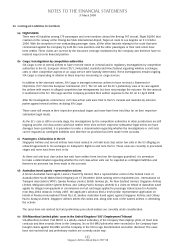

Trade debtors are non-interest bearing. The carrying amount of trade debtors impaired by credit losses is reduced through

the use of an allowance account unless on the date the impairment loss is recognised, the Group ascertains the amount

to be uncollectible whereby it would be reduced directly. In subsequent periods when a trade debtor is ascertained to be

uncollectible, it is written off against the allowance account.

Significant financial difficulties of the debtor, probability that the debtor will enter bankruptcy or financial reorganisation,

and default or delinquency in payments (more than 90 days aging of debtor balances) are considered indicators that the

trade debtor is impaired. Individual trade debtor is written off when management deems the amount not to be collectible.

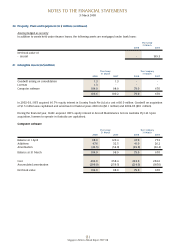

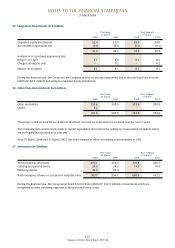

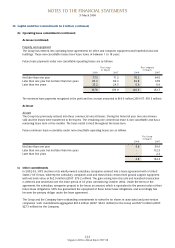

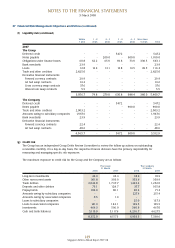

Trade debtors are stated after accumulated impairment losses. An analysis of the accumulated impairment losses is as

follows:

The Group The Company

31 March 31 March

2008 2007 2008 2007

Balance at 1 April 14.4 20.9 4.3 6.2

Charged/(Written back) during the year 2.9 (5.5) 0.1 (1.9)

Written off during the year (0.2) (1.0) - -

Balance at 31 March 17.1 14.4 4.4 4.3

Bad debts written off directly to

profit and loss account, net of debts recovered 1.1 1.8 0.2 0.9

As at 31 March 2008, the composition of trade debtors held in foreign currencies by the Group is as follows: USD – 45.1%

(2007: 19.8%), AUD – 5.7% (2007: 5.8%), EUR – 6.2% (2007: 5.2%) and JPY – 3.4% (2007: 4.9%).

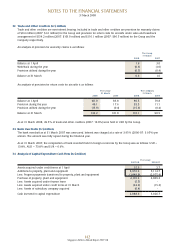

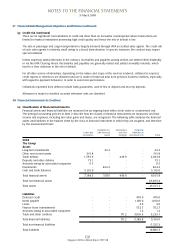

There was no loan to directors of the Company and its subsidiary companies in accordance with schemes approved by

shareholders of the Company.

NOTES TO THE FINANCIAL STATEMENTS

31 March 2008