Singapore Airlines 2008 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2008 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Singapore Airlines Annual Report 2007-08

142

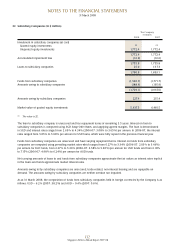

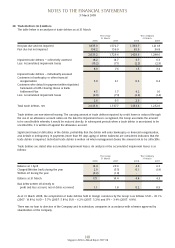

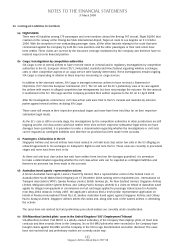

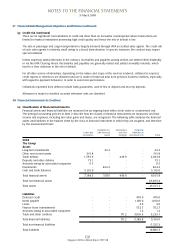

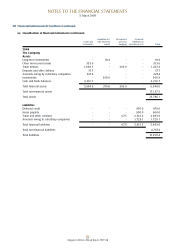

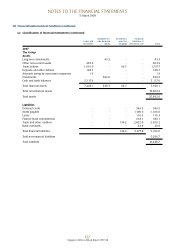

32 Trade and Other Creditors (in $ million)

Trade and other creditors are non-interest bearing. Included in trade and other creditors are provision for warranty claims

of $0.6 million (2007: $1.6 million) for the Group and provision for return costs for aircrafts under sales and leaseback

arrangement of $134.2 million (2007: $101.0 million) and $110.1 million (2007: $90.5 million) for the Group and the

Company respectively.

An analysis of provision for warranty claims is as follows:

The Group

31 March

2008 2007

Balance at 1 April 1.6 3.0

Writeback during the year (0.3) (1.0)

Provision utilised during the year (0.7) (0.4)

Balance at 31 March 0.6 1.6

An analysis of provision for return costs for aircrafts is as follows:

The Group The Company

31 March 31 March

2008 2007 2008 2007

Balance at 1 April 101.0 83.8 90.5 79.8

Provision during the year 49.1 17.6 35.5 11.1

Provision utilised during the year (15.9) (0.4) (15.9) (0.4)

Balance at 31 March 134.2 101.0 110.1 90.5

As at 31 March 2008, 49.5% of trade and other creditors (2007: 19.0%) were held in USD by the Group.

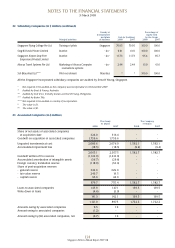

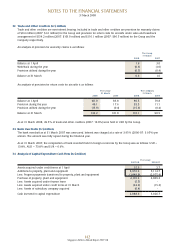

33 Bank Overdrafts (in $ million)

The bank overdraft as at 31 March 2007 was unsecured. Interest was charged at a rate of 3.95% (2006-07: 3.95%) per

annum. The amount was fully repaid during the financial year.

As at 31 March 2007, the composition of bank overdraft held in foreign currencies by the Group was as follows: USD –

13.8%, AUD – 73.8% and EUR – 0.6%.

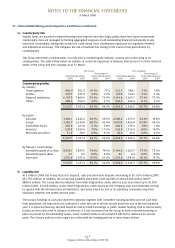

34 Analysis of Capital Expenditure Cash Flow (in $ million)

The Group

2007-08 2006-07

Assets acquired under credit terms at 1 April 15.3 2.7

Additions to property, plant and equipment 3,951.3 5,114.7

Less: Progress payments transferred to property, plant and equipment (1,849.9) (2,075.4)

Purchase of property, plant and equipment 2,101.4 3,039.3

Less: Assets acquired under finance lease (5.5) -

Less: Assets acquired under credit terms at 31 March (22.2) (15.3)

Less: Assets of subsidiary company acquired (0.4) -

Cash invested in capital expenditure 2,088.6 3,026.7

NOTES TO THE FINANCIAL STATEMENTS

31 March 2008