Singapore Airlines 2008 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2008 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Singapore Airlines Annual Report 2007-08

57

FINANCIAL REVIEW

Performance of the Group (continued)

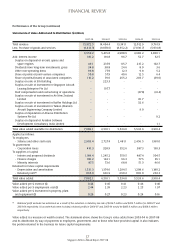

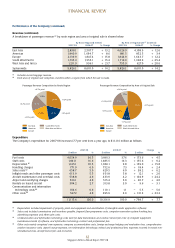

Statements of Value Added and its Distribution ($ million)

2007-08 2006-07 2005-06 2004-05 2003-04

Totalrevenue 15,972.5 14,494.4 13,341.1 12,012.9 9,761.9

Less:Purchaseofgoodsandservices (9,413.3) (9,078.6) (8,352.2) (7,030.7) (5,931.8)

6,559.2 5,415.8 4,988.9 4,982.2 3,830.1

Add:Interestincome 181.2 181.8 96.7 52.7 32.5

Surplusondisposalofaircraft,sparesand

spareengines 49.1 237.9 115.7 215.2 102.7

Dividendsfromlong-terminvestments,gross 34.8 38.8 24.6 8.0 3.6

Othernon-operatingitems 96.8 77.9 12.3 9.8 5.2

Shareofprotsofjointventurecompanies 50.8 57.9 40.6 12.5 6.4

Shareofprots/(losses)ofassociatedcompanies 110.2 79.0 255.2 203.7 (39.0)

SurplusonsaleofSIABuilding - 223.3 - - -

SurplusonsaleofinvestmentinSingaporeAircraft

LeasingEnterprisePteLtd - 197.7 - - -

Staffcompensationandrestructuringofoperations - - - (37.8) (41.4)

SurplusonsaleofinvestmentinAirNewZealand

Limited - - - 45.7 -

SurplusonsaleofinvestmentinRafesHoldingsLtd - - - 32.6 -

SurplusonsaleofinvestmentinTaikoo(Xiamen)

AircraftEngineeringCompanyLimited - - - 9.0 -

SurplusonliquidationofAbacusDistribution

SystemsPteLtd - - - - 9.2

SurplusondisposalofAviationSoftware

DevelopmentConsultancyIndiaLimited - - - - 1.1

Totalvalueaddedavailablefordistribution 7,082.1 6,510.1 5,534.0 5,533.6 3,910.4

Appliedasfollows:

Toemployees

- Salariesandotherstaffcosts 2,903.4 2,727.4 2,481.1 2,456.5 1,981.0

Togovernment

- Corporationtaxes 410.3 328.9 352.6 387.3 130.3

Tosuppliersofcapital

- Interimandproposeddividends 1,184.4 1,245.2 550.5 487.4 304.5

- Financecharges 100.2 124.1 96.3 77.5 65.1

- Minorityinterests 87.5 73.6 68.8 51.3 46.0

Retainedforfuturecapitalrequirements

- Depreciationandamortisation 1,531.3 1,374.0 1,294.5 1,208.6 1,180.2

- RetainedprotR1 865.0 636.9 690.2 865.0 203.3

Totalvalueadded 7,082.1 6,510.1 5,534.0 5,533.6 3,910.4

Valueaddedper$revenue($) 0.44 0.45 0.41 0.46 0.40

Valueaddedper$employmentcost($) 2.44 2.39 2.23 2.25 1.97

Valueaddedper$investmentinproperty,plant

andequipment($) 0.29 0.27 0.23 0.24 0.16

R1 Retained profit excludes tax write-back as a result of the reduction in statutory tax rate of $246.7 million and $204.7 million for 2006-07 and

2003-04 respectively. If tax write-back were included, retained profit for 2006-07 and 2003-04 would be $883.6 million and $408.0 million

respectively.

Valueaddedisameasureofwealthcreated.ThestatementaboveshowstheGroup’svalueaddedfrom2003-04to2007-08

anditsdistributionbywayofpaymentstoemployees,government,andtothosewhohaveprovidedcapital.Italsoindicates

theportionretainedinthebusinessforfuturecapitalrequirements.