Singapore Airlines 2008 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2008 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Singapore Airlines Annual Report 2007-08

156

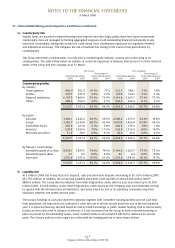

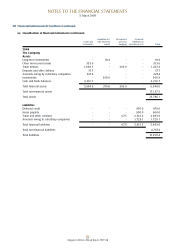

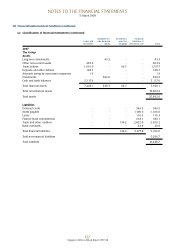

38 Financial Instruments (in $ million) (continued)

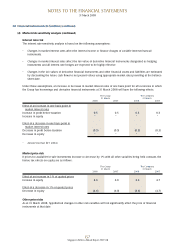

(d) Market risk sensitivity analysis

The Group has used a sensitivity analysis technique that measures the estimated change to the profit and loss and

equity of either an instantaneous increase or decrease of 0.01% (1 basis point) in market interest rates or a 1%

strengthening or weakening in SGD against all other currencies, from the rates applicable at 31 March 2008, for each

class of financial instrument with all other variables remaining constant. This analysis is for illustrative purposes only,

as in practice market rates rarely change in isolation. The sensitivity analysis is based on the following assumptions:

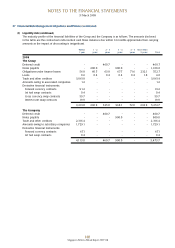

Jet fuel price risk

The jet fuel price risk sensitivity analysis is based on the assumption that all other factors, such as fuel surcharge and

uplifted fuel volume, remain constant. Under this assumption, and excluding the effects of hedging, an increase in

price of one US cent per American gallon of jet fuel affects the Group’s and Company’s annual fuel costs by $20.8

million and $17.0 million (2006-07: $23.1 million and $18.3 million) respectively.

The fuel hedging sensitivity analysis is based on contracts that are still open as at balance sheet date and assumes that

all jet fuel, gasoil and regrade hedges are highly effective. Under these assumptions, with an increase or decrease in

both jet fuel and gasoil prices, each by one US dollar per barrel, the before tax effects on equity are as follows:

The Group The Company

31 March 31 March

2008 2007 2008 2007

Effect of an increase in one USD per barrel

Increase in equity 18.5 16.0 15.1 12.7

Effect of a decrease in one USD per barrel

Decrease in equity (18.5) (16.0) (15.1) (12.7)

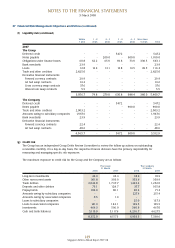

Foreign currency risk

The foreign currency risk sensitivity analysis is based on the assumption that all cash flow hedges are highly effective;

hence there will be no impact on profit before taxation.

Under this assumption, with a 1% strengthening or weakening of SGD against all other currencies, the before tax

effects on profit before taxation and equity are as follows:

The Group The Company

31 March 31 March

2008 2007 2008 2007

Effect of strengthening of SGD

Decrease in profit before taxation (25.2) (31.7) (12.3) (13.1)

Decrease in equity (18.1) (12.4) (13.8) (9.0)

Effect of weakening of SGD

Increase in profit before taxation 25.2 31.7 12.3 13.1

Increase in equity 18.1 12.4 13.8 9.0

NOTES TO THE FINANCIAL STATEMENTS

31 March 2008