Singapore Airlines 2008 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2008 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Singapore Airlines Annual Report 2007-08

111

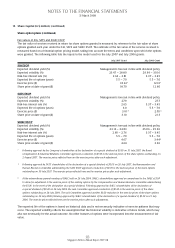

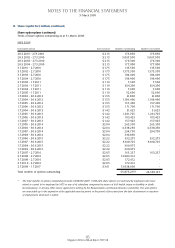

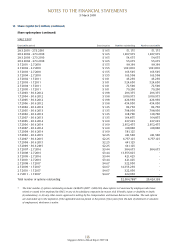

14 Share Capital (in $ million) (continued)

Share option plans

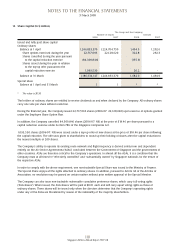

The Singapore Airlines Limited Employee Share Option Plan (“SIA ESOP”), the Singapore Airport Terminal Services Limited

Employee Share Option Plan (“SATS ESOP”) and the SIA Engineering Company Limited Employee Share Option Plan (“SIAEC

ESOP”), which comprise the Senior Executive Share Option Scheme and the Employee Share Option Scheme for senior

executives and all other employees respectively, were approved by shareholders on 8 March 2000, 20 March 2000 and

9 February 2000 respectively.

Options are granted for a term no longer than 10 years from the date of grant. The exercise price of the options will be

the average of the closing prices of the respective companies’ ordinary shares on the SGX-ST for the five market days

immediately preceding the date of grant.

Under the Employee Share Option Schemes, options will vest two years after the date of grant.

Under the Senior Executive Share Option Schemes, options will vest:

(a) one year after the date of grant for 25% of the ordinary shares subject to the options;

(b) two years after the date of grant for an additional 25% of the ordinary shares subject to the options;

(c) three years after the date of grant for an additional 25% of the ordinary shares subject to the options; and

(d) four years after the date of grant for the remaining 25% of the ordinary shares subject to the options.

There are no cash settlement alternatives.

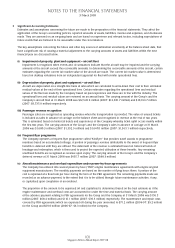

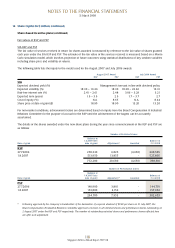

Information with respect to the number of options granted under the respective Employee Share Option Plans is as follows:

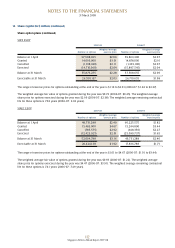

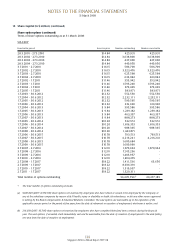

SIA ESOP

2007-08 2006-07

Weighted average Weighted average

Number of options exercise price Number of options exercise price

Balance at 1 April 68,338,907 $12.96 79,196,566 $12.76

Granted 12,324,345 $18.22 12,777,119 $12.60

Cancelled (1,275,363) $13.95 (1,506,158) $13.58

Exercised (22,717,093) $13.25 (22,128,620) $12.00

Balance at 31 March 56,670,796 $13.53 68,338,907 $12.96

Exercisable at 31 March 29,277,185 $12.59 40,163,661 $13.80

The range of exercise prices for options outstanding at the end of the year is $9.84 to $18.22 (2006-07: $10.34 to $16.65).

The weighted average fair value of options granted during the year was $4.56 (2006-07: $3.13). The weighted average

share price for options exercised during the year was $17.85 (2006-07: $12.90). The weighted average remaining

contractual life for these options is 6.38 years (2006-07: 6.12 years).

NOTES TO THE FINANCIAL STATEMENTS

31 March 2008