Singapore Airlines 2008 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2008 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Singapore Airlines Annual Report 2007-08

89

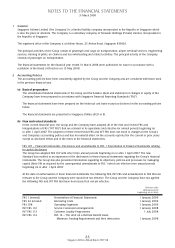

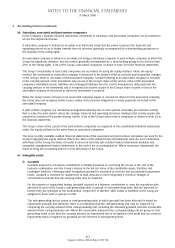

2 Accounting Policies (continued)

(b) New and revised standards (continued)

The directors expect that the adoption of the above pronouncements will have no material impact to the financial

statements in the period of initial application except for the following:

FRS 1 (revised): Presentation of Financial Statements

Revisions to FRS 1 are aimed at improving users’ ability to analyse and compare the information given in financial

statements. The changes require information in financial statements to be aggregated on the basis of shared

characteristics and to introduce a statement of comprehensive income. This will enable separate analysis of the

changes in equity resulting from transactions with owners (such as dividends and share repurchases) and with non-

owners (such as transactions with third parties).

This is a disclosure standard with no impact on the financial position or financial performance of the Group and

Company.

FRS 108: Operating Segments

FRS 108 requires the disclosure of segment information based on the information reviewed by the entity’s chief

operating decision maker. The impact of this standard on the other segment disclosures has yet been determined. As

this is a disclosure standard, there will be no impact on the financial position or financial performance of the Group

and Company.

INT FRS 113: Customer Loyalty Programmes

The interpretation addresses accounting for loyalty award credits granted to customers who buy other goods or

services, and the accounting for the entity’s obligations to provide free or discounted goods or services to customers

when the award credits are redeemed.

Loyalty awards should be viewed as separately identifiable goods or services for which customers are implicitly paying

and measured based on the allocated proceeds which represent the value of the award credits. The proceeds allocated

to the award credits are deferred until the entity fulfils its obligations by supplying the free or discounted goods or

services upon the redemption of the award credits.

The adoption of this interpretation should not result in a change in accounting policy of the Company as the current

accounting treatment of the Company’s award credits granted under the frequent flyer programme (“KrisFlyer”) is

closely aligned with the treatment as set out in the interpretation.

(c) Basis of consolidation

The consolidated financial statements comprise the separate financial statements of the Company and its subsidiaries

as at the balance sheet date. The financial statements of the subsidiaries used in the preparation of the consolidated

financial statements are prepared for the same reporting date as the Company. Consistent accounting policies are

applied for like transactions and events in similar circumstances. A list of the Group’s subsidiary companies is shown in

Note 22 to the financial statements.

All intra-group balances, transactions, income and expenses and profits and losses resulting from intra-group

transactions are eliminated in full.

Acquisitions of subsidiaries are accounted for using the purchase method. Identifiable assets acquired and liabilities

and contingent liabilities assumed in a business combination are measured initially at their fair values at the

acquisition date. Adjustments to those fair values relating to previously held interests are treated as a revaluation and

recognised in equity. Any excess of the cost of the business combination over the Group’s share in the net fair value of

the acquired subsidiary’s identifiable assets, liabilities and contingent liabilities is recorded as goodwill on the balance

sheet. The accounting policy for goodwill is set out in Note 2(e)(i). Any excess of the Group’s share in the net fair

value of the acquired subsidiary’s identifiable assets, liabilities and contingent liabilities over the cost of the business

combination is recognised in the profit and loss account on the date of acquisition.

Subsidiaries are consolidated from the date of acquisition, being the date on which the Group obtains control, and

continue to be consolidated until the date that such control ceases.

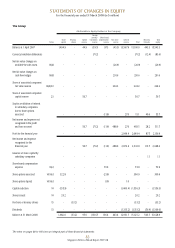

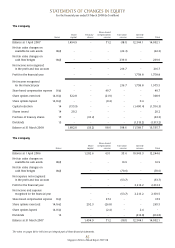

Minority interests represent the portion of profit or loss and net assets in subsidiaries not held by the Group and are

presented separately in the consolidated profit and loss account and within equity in the consolidated balance sheet,

separately from equity attributable to equity holders of the Company.

NOTES TO THE FINANCIAL STATEMENTS

31 March 2008