Singapore Airlines 2008 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2008 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178

|

|

Singapore Airlines Annual Report 2007-08

123

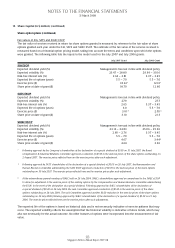

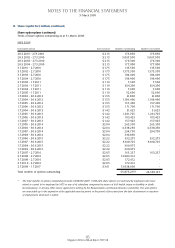

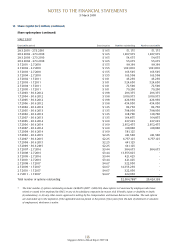

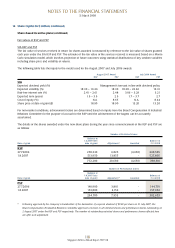

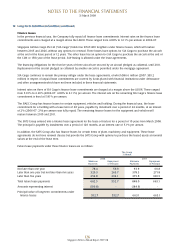

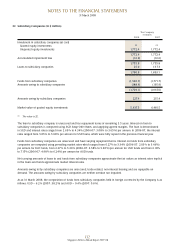

16 Other Reserves (in $ million) (continued)

(d) Fair value reserve (continued)

Fair value changes of derivative financial instruments designated as hedging instruments in cash flow hedges:

The Group The Company

31 March 31 March

2008 2007 2008 2007

Balance at 1 April (73.3) 154.5 (40.0) 30.6

Net gain/(loss) on fair value changes 515.8 (227.8) 239.0 (70.6)

Balance at 31 March 442.5 (73.3) 199.0 (40.0)

Net gain/(loss) on fair value changes 408.0 (232.4) 326.9 (180.6)

Share of associated companies’ net gain/

(loss) on fair value reserve 224.2 (134.5) - -

Recognised in the carrying value of non-financial

assets on occurrence of capital expenditure

commitments 11.2 - 11.2 -

Recognised in the profit and loss account on

occurrence of:

Disposal of joint venture company recognised in

“Exceptional items” - (2.8) - -

Fuel hedging contracts recognised in “Fuel costs” (232.2) 118.9 (183.3) 94.0

Foreign currency contracts recognised in

“Other operating expenses” 106.1 15.7 84.2 13.4

Interest rate swap contracts recognised in

“Finance charges” (1.5) 7.3 - 2.6

515.8 (227.8) 239.0 (70.6)

Total fair value reserve 443.4 (45.5) 198.6 (18.1)

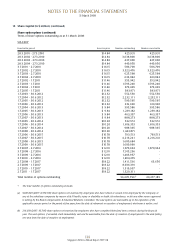

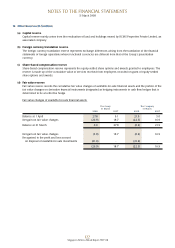

17 Deferred Account (in $ million)

The Group The Company

31 March 31 March

2008 2007 2008 2007

Deferred gain on sale and leaseback transactions

- operating leases 272.2 374.8 190.0 261.3

- finance leases 45.1 49.3 - -

317.3 424.1 190.0 261.3

Deferred credit 470.0 549.5 470.0 549.5

787.3 973.6 660.0 810.8

NOTES TO THE FINANCIAL STATEMENTS

31 March 2008